All Related Articles

The Distributional Impact of the Tax Cuts and Jobs Act over the Next Decade

Taxpayers in every income level will receive a tax cut in 2018 and for most of the next decade. See how the size of that tax cut will vary for each income group over the next decade with our new, long-term distributional analysis.

33 min read

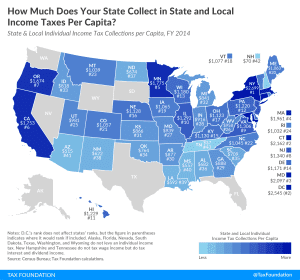

State and Local Individual Income Tax Collections Per Capita

On average, state and local governments collected $1,144 per person from individual income taxes, but collections varied widely from state to state.

2 min read

Indiana Passes Conformity Bill in One-Day Special Session

Indiana recently passed tax conformity legislation linking the state’s individual and corporate tax code to the new federal law.

2 min read

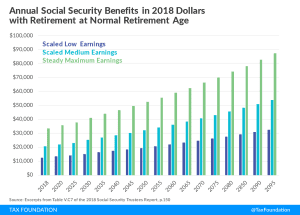

The Complicated Taxation of America’s Retirement Accounts

Changes to the way we tax long-term savings could remove the excess tax burden on saving and investment, helping individuals to better provide for their financial future.

15 min read

Is Every Tax Cut Kansas?

6 min read

States Can’t Just Hit Pause on Implications of Federal Tax Reform

The new federal tax law left states with some important decisions to make. If they delay, their residents could face confusion come filing time.

4 min read

What’s in the Iowa Tax Reform Package

Iowa Gov. Kim Reynolds is on the verge of signing tax reform legislation that would greatly improve the state’s needlessly complex tax code.

6 min read

Minnesota’s Tax Plans Make Modest Improvements

In response to the new federal tax law, the governor and lawmakers in both houses have proposed plans for updating Minnesota’s tax code.

2 min read

Reforming Arkansas’s Income Taxes

1 min read

Seattle Proposes a New Tax on Jobs

3 min read

Kentucky Legislature Overrides Governor’s Veto to Pass Tax Reform Package

By broadening bases while lowering rates, policymakers in Kentucky took a responsible approach to comprehensive tax reform.

2 min read