All Related Articles

Unequal Tax Treatment Is Contributing to Rising Debt Levels for Entrepreneurs

A recent paper discusses two main trends related to U.S. entrepreneurs: the decrease in the number of entrepreneurs and the increase in their borrowing. Entrepreneurs have increased their debt holdings relative to their assets over the past three decades.

3 min read

Updated Proposal for Year-End Tax Bill

2 min read

South Carolina: A Road Map For Tax Reform

South Carolina is by no means a high tax state, though it can feel that way for certain taxpayers. The problems with South Carolina’s tax code come down to poor tax structure. Explore our new comprehensive guide to see how South Carolina can achieve meaningful tax reform.

16 min read

2019 Tax Brackets

The IRS recently released its 2019 individual income tax brackets and rates. Check out the new standard deduction, child tax credit, earned income tax credit, rates and brackets, and more.

5 min read

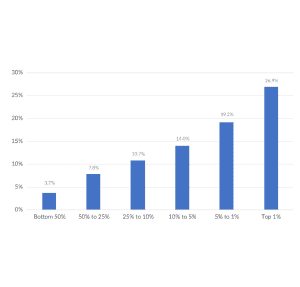

Summary of the Latest Federal Income Tax Data, 2018 Update

The top 50 percent of all taxpayers pay 97 percent of all individual income taxes, while the bottom 50 percent paid the remaining 3 percent.

21 min read

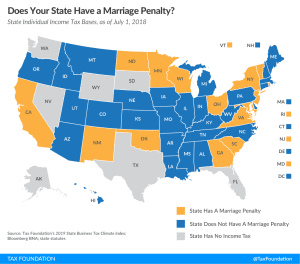

Does Your State Have a Marriage Penalty?

1 min read

Results of 2018 State and Local Tax Ballot Initiatives

Ballot initiatives are often an afterthought on Election Day, but in many states, voters went to the polls to weigh in on significant tax policy questions. Here are the most recent results we’ve compiled for tax-related ballot measures.

5 min read

Top State Tax Ballot Initiatives to Watch in 2018

Explore our list of the top state tax ballot measures to watch for throughout the country.

11 min read