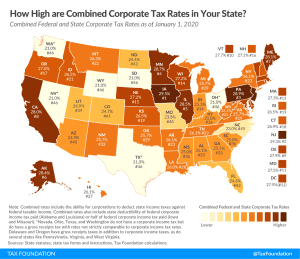

Analysis of Democratic Presidential Candidates Corporate Income Tax Proposals

2020 Democratic presidential candidates have proposed various changes to the corporate income tax, which includes increasing the rate, ranging from 25 percent to 35 percent, imposing a corporate surtax or a minimum tax, and lengthening depreciation schedules.

17 min read