Details of the House Tax Cuts and Jobs Act

The House Tax Cuts and Jobs act would fundamentally reform the U.S. tax code for the first time in over 30 years. Here are all the important details.

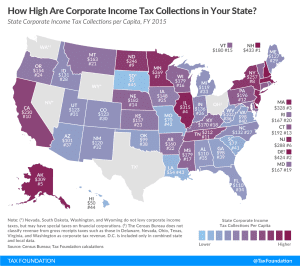

4 min readAcademic studies show that higher corporate tax rates depress worker wages and lead to fewer jobs. An Organisation for Co-operation and Development (OECD) study has found that the corporate tax is the least efficient and most harmful way for governments to raise revenue.

The House Tax Cuts and Jobs act would fundamentally reform the U.S. tax code for the first time in over 30 years. Here are all the important details.

4 min read

Hampered by high marginal tax rates and complex business tax rules, the United States again ranks towards the bottom of the pack on our 2017 International Tax Competitiveness Index, placing 30 out of 35 OECD countries.

11 min read

Corporate tax reform done right is key to growing the economy, boosting real family incomes, and making the U.S. a better place in which to do business.

5 min read

When taking a closer look at the UK’s recent corporate tax reform experiment, it becomes clear that there was significantly more at work than just a simple rate cut. Increasing the effective marginal tax rate on new investments could have had a negative effect on wages, potentially offsetting the positive effects from the corporate rate cut.

4 min read

Recent empirical evidence shows that workers bear upwards of 70 percent of the corporate income tax burden, much more than popular tax models claim, which make errors in how they account for super-normal returns and the openness of our economy.

50 min read

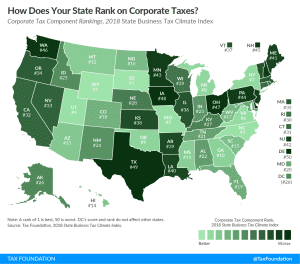

For 15 years, our State Business Tax Climate Index has been the standard for legislators and taxpayers to understand how their state’s tax code compares and how it can be improved. Now, for the first time ever, you can explore our Index’s 100+ variables in an easy to use, interactive format.

16 min read

If lawmakers are looking to maximize the positive economic effects from a tax bill, then improving tax depreciation for structures should probably be part of the conversation. Here are a few options.

10 min read

Tax reform should aim to get the tax code out of the way of entrepreneurship by making it simpler, less burdensome, and eliminating its anti-growth biases.

Republican leadership in the House, Senate, and White House released a framework for a tax proposal that would lower taxes on businesses and individuals and simplify a number of aspects of the federal tax code. Here are the details we know right now.

3 min read

The Ohio Commercial Activity Tax, a 0.26 percent tax on business gross receipts above $1 million, is a throwback to an earlier era of taxation, bringing back a tax type that had been in steady retreat for nearly a century.

34 min read

The most important thing that Congress and the administration can do to boost economic growth, lift workers’ wages, create jobs, and make the U.S. economy more competitive globally, is reform our business tax system.

The last time the U.S. reduced its federal corporate income tax rate was in 1986. Since then, countries throughout the world have significantly reduced their rates, leaving the U.S. with the fourth highest statutory corporate tax rate in the world and an overall uncompetitive tax system.

11 min read