All Related Articles

State Tax Changes as of July 1, 2019

15 min read

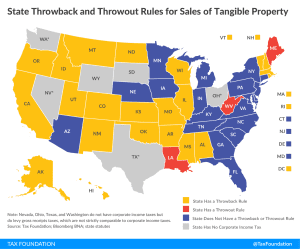

State Throwback and Throwout Rules: A Primer

38 min read

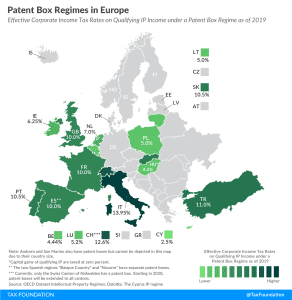

How Patent Boxes Impact Business Decisions

As with every change in tax policy, there are trade-offs. The Modified Nexus Approach adds an additional layer of complexity to the already complex issue of taxing IP income. Linking tax breaks for IP income to its associated R&D activity has changed the game and will likely result in some businesses restructuring and relocating their IP assets and R&D activity. Effective tax rates on IP income will likely play an important role in determining optimal locations, giving measures such as R&D credits more importance. Whether this new approach to IP taxation will impact profit shifting and which countries will be the winners and losers is yet to be seen.

6 min read

Patent Box Regimes in Europe, 2019

4 min read

Switzerland Referendum Approves Tax Reform

15 min read

Business in America

Who are the workers, consumers, and shareholders who interact with businesses in the U.S.? What forms do these businesses take? How do business taxes impact people’s lives? It is essential we answer these questions in order to design a business tax system that is simple, efficient, and enables economic progress.

5 min read

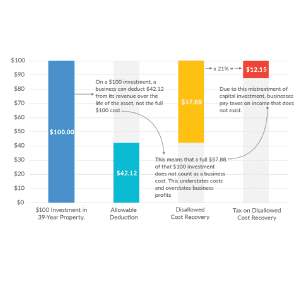

Depreciation Requires Businesses to Pay Tax on Income That Doesn’t Exist

While tax rates matter to businesses, so too does the measure of income to which those tax rates apply. The corporate income tax is a tax on profits, normally defined as revenue minus costs. However, under the current tax code, businesses are unable to deduct the full cost of certain expenses—their capital investments—meaning the tax code is not neutral and actually increases the cost of investment.

3 min read

Taxes on Capital Income Are More Than Just the Corporate Income Tax

The United States’ statutory corporate income tax rate is now more aligned with the rates of other nations . However, taxes on capital income, or corporate investment, are more than just the corporate income tax. Shareholder-level taxes, such as those on dividends and capital gains, also affect incentives to save and invest.

3 min read

New Details on the Austrian Tax Reform Plan

14 min read

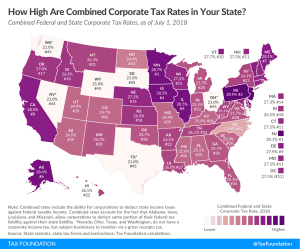

State Corporate Income Taxes Increase Tax Burden on Corporate Profits

The Tax Cuts and Jobs Act (TCJA) reduced the U.S. federal corporate income tax rate from 35 percent to 21 percent. However, most U.S. states also tax corporate income. These state-level taxes mean the average statutory corporate income tax rate in the U.S., which combines the average of state corporate income tax rates with the federal corporate income tax rate, is 25.8 percent in 2019.

2 min read

Taxable Income vs. Book Income: Why Some Corporations Pay No Income Tax

Why do some companies appear to be profitable but pay little or no federal income taxes? It’s largely due to differences between book and taxable income.

4 min read

The Lowered Corporate Income Tax Rate Makes the U.S. More Competitive Abroad

One of the most significant provisions in the Tax Cuts and Jobs Act was the reduction of the U.S. corporate income tax rate from 35 percent to 21 percent. Over time, the lower corporate rate will encourage new investment and lead to additional economic growth. It will make the U.S. more attractive for companies by increasing after-tax returns on investments and will discourage companies from shifting profits to low-tax jurisdictions.

2 min read

Anti-Base Erosion Provisions and Territorial Tax Systems in OECD Countries

The U.S. decision to adopt a territorial tax system is certainly an improvement over having a worldwide system. However, in moving to a territorial system some of the new features created with the TCJA increased the complexity of the system.

38 min read

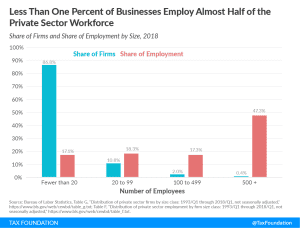

Firm Variation by Employment and Taxes

Less than one percent of businesses employ almost half of the private sector workforce. Large companies pay 89% of corporate income taxes in the United States.

2 min read