All Related Articles

2018 International Tax Competitiveness Index

The structure of a country’s tax code is an important determinant of its economic performance. Our 2018 international tax rankings provide a road map for each of the 35 OECD countries to improve the structure of their tax codes and achieve a more neutral, more competitive tax system.

11 min read

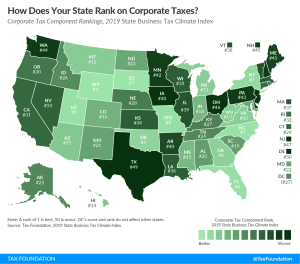

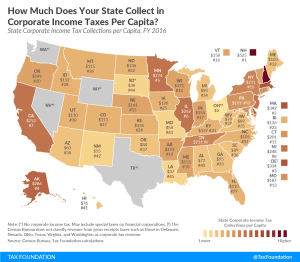

2019 State Business Tax Climate Index

Our 2019 State Business Tax Climate Index compares each state on over 100 variables including corporate, individual, property, and sales taxes. How does your state rank?

17 min read

The Economics of Stock Buybacks

Stock buybacks are readily visible, and unfortunately some have misunderstood stock buybacks to be taking place at the expense of long-term investments.

17 min read

Testimony: The Positive Economic Growth Effects of the Tax Cuts and Jobs Act

Tax Foundation President, Scott Hodge, provides written testimony before the United States Joint Economic Committee on the economic growth effects of TCJA.

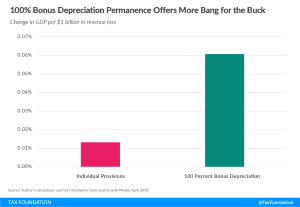

Permanence for 100 Percent Bonus Depreciation Provides More Cost-Effective Growth than Permanence for Individual Provisions

In the long run, permanent full expensing produces about 4.5 times more GDP growth per dollar of revenue than making individual TCJA provisions permanent.

2 min read

The TCJA’s Expensing Provision Alleviates the Tax Code’s Bias Against Certain Investments

The Tax Cuts and Jobs Act made significant progress in improving businesses’ ability to recover the cost of making investments in the United States by enacting 100 percent bonus depreciation.

11 min read

Pennsylvania: A 21st Century Tax Code for the Commonwealth

Policymakers from across the spectrum recognize that Pennsylvania’s tax code has not kept up with a 21st century economy. Here are comprehensive solutions for how Pennsylvania can achieve a more competitive tax code.

13 min read

Proposed Corporate Rate Hike Would Damage Economic Output

Raising the corporate tax rate would reduce economic growth and lead to a smaller capital stock, lower wage growth, and reduced employment.

2 min read