Two Roads Diverge in the OECD’s Impact Assessment

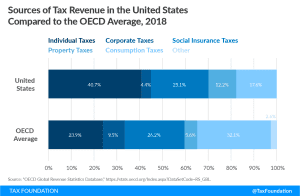

The difference that the OECD presents between the potential impact in the context of agreement compared to a harmful tax and trade war should show policymakers the value of continuing multilateral discussions.

6 min read