All Related Articles

Carbon Tax and Revenue Recycling: Revenue, Economic, and Distributional Implications

In our new report, we explore the design implications of a carbon tax and provide estimates for revenue, economic, and distributional effects of three potential carbon tax and revenue recycling proposals. Each proposal faces different trade-offs and achieves different policy goals.

23 min read

Reviewing Elizabeth Warren’s Tax Proposals to Fund Medicare for All

Elizabeth Warren released a detailed plan on how she would fund Medicare For All, proposing a wealth tax, financial transactions tax, mark-to-market taxation of capital gains income, and a country-by-county minimum tax, among other reforms.

5 min read

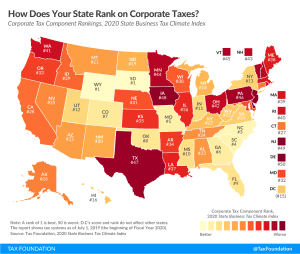

2020 State Business Tax Climate Index

Connecticut, California, New York, and New Jersey rank lowest in our 2020 State Business Tax Climate Index, which compares states on more than 120 tax policy variables to show how well they structure their tax systems and to provide a road map for improvement.

20 min read

UK Taxes: Potential for Growth

3 min read

Better than the Rest

2 min read

Legislation Introduced to Cancel R&D Amortization

Canceling the amortization of research and development costs would reduce federal revenue, but policymakers have a variety of options to offset the costs.

3 min read

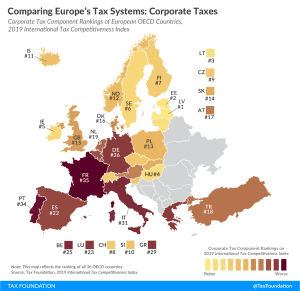

International Tax Competitiveness Index 2019

Our International Index compares OECD countries on over 40 variables that measure how well each country’s tax system promotes sustainable economic growth and investment.

11 min read