Movers and Shakers in the International Tax Competitiveness Index

The 2023 version of the International Tax Competitiveness Index is the 10th edition of the report. Let’s take a look back and see how country ranks have changed over time.

5 min readAcademic studies show that higher corporate tax rates depress worker wages and lead to fewer jobs. An Organisation for Co-operation and Development (OECD) study has found that the corporate tax is the least efficient and most harmful way for governments to raise revenue.

The 2023 version of the International Tax Competitiveness Index is the 10th edition of the report. Let’s take a look back and see how country ranks have changed over time.

5 min read

Lawmakers should simplify the tax code so that taxpayers can understand the laws and the IRS can administer them with minimum cost and frustration.

Lawmakers will have to weigh the economic, revenue, and distributional trade-offs of extending or making permanent the various provisions of the TCJA as they decide how to approach the upcoming expirations. A commitment to growth, opportunity, and fiscal responsibility should guide the approach.

18 min read

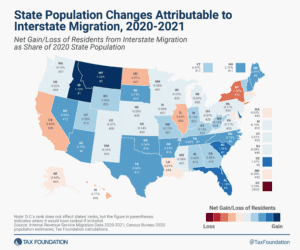

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

8 min read

The 2017 Tax Cuts and Jobs Act (TCJA) was the largest corporate tax reform in a generation, lowering the corporate tax rate from 35 percent to 21 percent, temporarily allowing full expensing for short-lived assets (referred to as bonus depreciation), and overhauling the international tax code.

6 min read

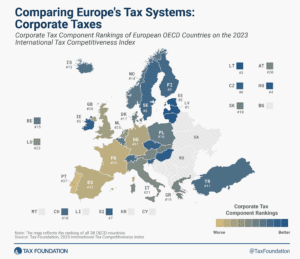

According to the corporate tax component of the 2023 International Tax Competitiveness Index, Latvia and Estonia have the best corporate tax systems in the OECD.

3 min read

The variety of approaches to taxation among European countries creates a need to evaluate these systems relative to each other. For that purpose, we have developed the European Tax Policy Scorecard—a relative comparison of European countries’ tax systems.

52 min read

In recognition of the fact that there are better and worse ways to raise revenue, our Index focuses on how state tax revenue is raised, not how much. The rankings, therefore, reflect how well states structure their tax systems.

111 min read

Indiana’s tax code is structured in a relatively sound and economically efficient manner overall, but additional improvements should be considered to make the state even more economically competitive.

If the EU is going to harmonize its tax base, it should do so in a way that increases the efficiency and competitiveness of tax policy for the EU as a whole, and not just seek out the lowest common denominator.

5 min read

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

88 min read

The OECD recently released a trove of new documents on a draft multilateral tax treaty. The U.S. Treasury has opened a 60-day consultation period for the proposal and is requesting public review and input.

7 min read

Pillar Two implementation is underway in many jurisdictions, and many governments are aiming to get their proposals approved before the end of 2023. However, estimating Pillar Two’s impact on government revenue is proving difficult. As a result, only a few countries have publicly presented their findings.

7 min read

Simplicity in the tax code means taxes should be easy for taxpayers to pay and easy for governments to administer and collect.

In recent years, European countries have undertaken a series of tax reforms designed to maintain tax revenue levels while protecting households and businesses from high inflation.

8 min read

As increased political attention focuses on the state of the American worker, expect to see a resurgence of the argument that the labor share of income is in decline.

5 min read

On 12 September, the European Commission released a proposal called “Business in Europe: Framework for Income Taxation” (BEFIT) and two associated proposals on transfer pricing and a Head of Office tax system.

6 min read

Given enough time, everything old is new again—including tax ideas best consigned to history. But worldwide combined reporting, which a few states flirted with in the 1980s, is rearing its head again.

6 min read

Congress should recognize that Pillar Two has significant U.S.-specific downsides, but also that it cannot unilaterally stop Pillar Two from taking effect. Instead, it should carefully consider a policy response for the next Congress, when a variety of forces are likely to compel it to act.

7 min read