Where Does Kamala Harris Stand on Tax Policy?

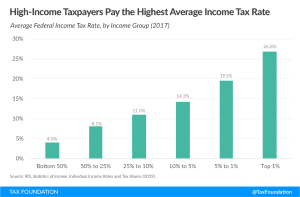

What tax policy ideas did Harris propose along the campaign trail, and how do they differ from Biden’s plan?

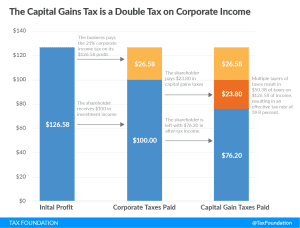

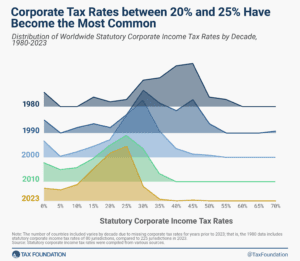

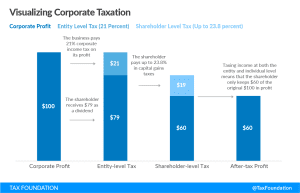

4 min readAcademic studies show that higher corporate tax rates depress worker wages and lead to fewer jobs. An Organisation for Co-operation and Development (OECD) study has found that the corporate tax is the least efficient and most harmful way for governments to raise revenue.

What tax policy ideas did Harris propose along the campaign trail, and how do they differ from Biden’s plan?

4 min read

First, the introduction of the wealth tax would significantly impact international capital flows and cause large economic dislocations in the short term. Second, provinces that are looking at raising their corporate tax rates might hinder capital attraction, growth, and economic recovery.

4 min read

Today marked the release of second-quarter GDP data and provides a new glimpse into early changes in state and local revenues and spending. All told, second-quarter state and local tax receipts came in about 3.8 percent lower than they did in the same quarter a year ago. Income and sales taxes fell considerably while property and excise tax collections remained stable.

3 min read

Because of the COVID-19 pandemic and the associated economic crisis, countries in the Asia-Pacific region will see a differentiated impact on their capacity of mobilizing domestic revenue depending on the structure of their economy. According to the OECD report, those economies that rely mostly on natural resources, tourism, and trade taxes are especially vulnerable.

5 min read

From a revenue standpoint, Wisconsin was better off than many states going into this crisis, but the policy decisions—including tax policy decisions—state policymakers make in the months ahead will have far-reaching implications for how quickly jobs and wages are restored in Wisconsin.

7 min read