All Related Articles

Tax Relief is on the Agenda in Austria

3 min read

Opportunity Zones: What We Know and What We Don’t

Research suggests place-based incentive programs redistribute rather than generate new economic activity, subsidize investments that would have occurred anyway, and displace low-income residents.

20 min read

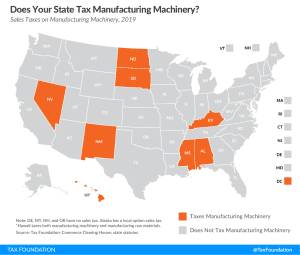

Where Did Americans Move in 2018?

2 min read

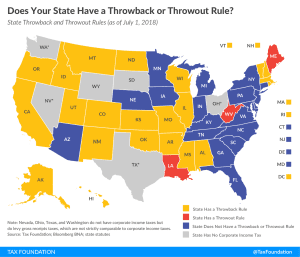

Tax Trends Heading Into 2019

In 2019, key trends in state tax policy include reductions in corporate tax rates, updating sales tax systems to include remote online sales, taxes on marijuana and sports betting, gross receipts taxes, and more. Explore our new 2019 guide!

32 min read

The Tax Cuts and Jobs Act After A Year

5 min read

Unequal Tax Treatment Is Contributing to Rising Debt Levels for Entrepreneurs

A recent paper discusses two main trends related to U.S. entrepreneurs: the decrease in the number of entrepreneurs and the increase in their borrowing. Entrepreneurs have increased their debt holdings relative to their assets over the past three decades.

3 min read

Updated Proposal for Year-End Tax Bill

2 min read

The Economic and Distributional Impact of the Trump Administration’s Tariff Actions

The Trump administration has imposed $42 billion worth of new taxes on Americans by levying tariffs on thousands of products. Outstanding threats to impose further tariffs mean additional tax increases up to $129 billion.

8 min read

South Carolina: A Road Map For Tax Reform

South Carolina is by no means a high tax state, though it can feel that way for certain taxpayers. The problems with South Carolina’s tax code come down to poor tax structure. Explore our new comprehensive guide to see how South Carolina can achieve meaningful tax reform.

16 min read