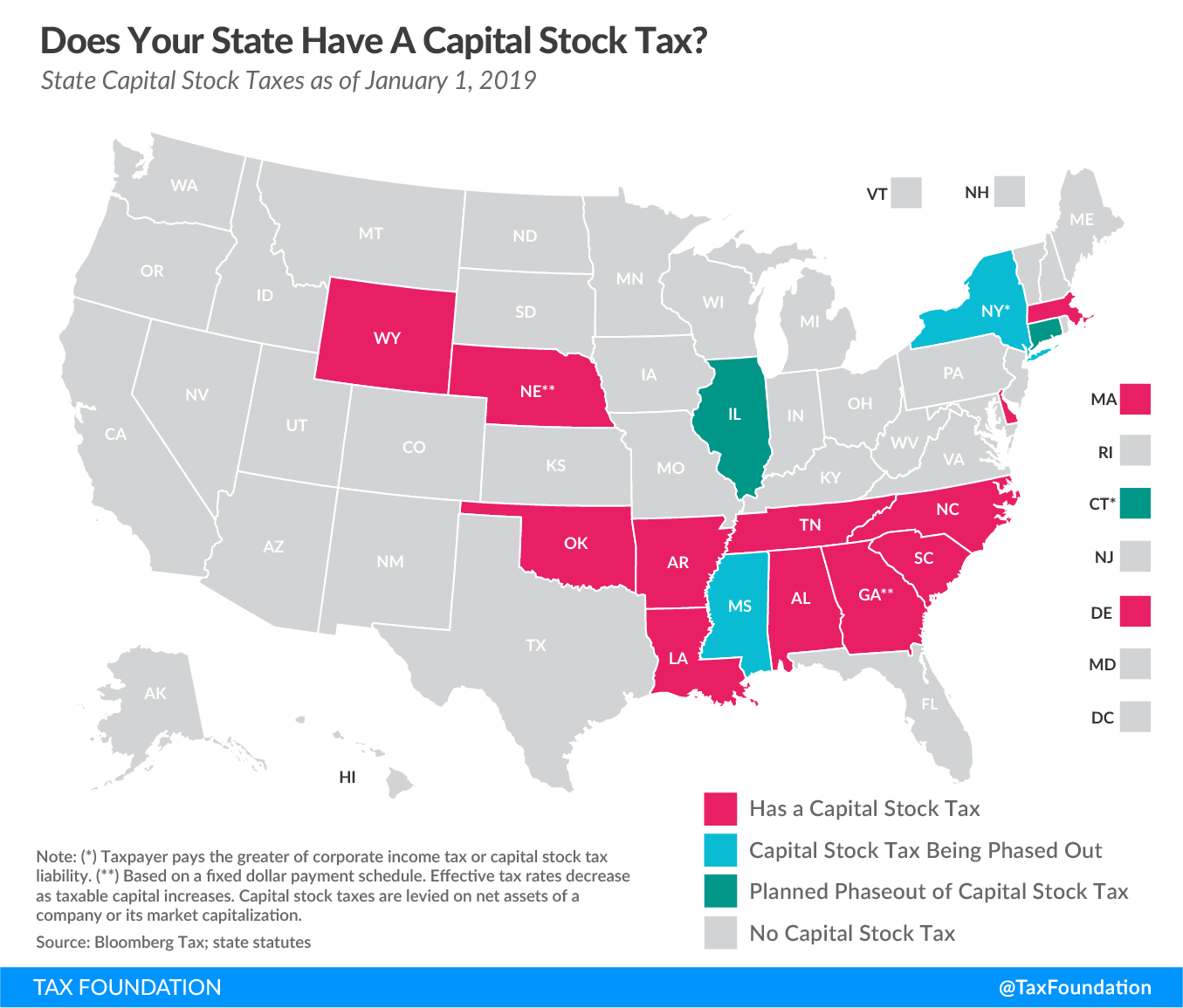

Unlike corporate income taxes, which are levied on a business’s net income (or profit), capital stock taxes are imposed on a business’s net worth (or accumulated wealth). As such, businesses must pay a capital stock taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. regardless of whether they make a profit in a given year, or ever. Sixteen states levy capital stock taxes (or franchise taxes). Capital stock taxes are not always limited to C corporations, either; different states have different laws regarding the types of businesses that fall under a capital stock tax. However, regardless of which entities are subject to the tax, the incentive is clear – capital stock taxes disincentivize capital accumulation in a state.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeWhile exact formulas and methodologies vary from state to state, capital stock taxes are usually levied as a percentage of a firm’s net assets, with rates ranging from a low of 0.02 percent in Wyoming to a high of 0.341 percent in Connecticut. Among the states that levy a capital stock tax, half place a cap on the maximum capital stock tax liability a business may be required to pay, while the other half do not have a limit. Among the eight states with a cap, Georgia’s is the lowest at $5,000, while New York’s is the highest at $5 million.

In Connecticut and New York, the capital stock tax functions similarly to an alternative minimum tax, where firms calculate both their corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. liability and their capital stock tax liability and pay whichever amount is greater.

In Georgia and Nebraska, the capital stock tax is based on a fixed dollar payment schedule, rather than on a percentage of net assets, with tax rates decreasing as taxable capital increases.

|

(a) Taxpayer pays the greater of corporate income tax or capital stock tax liability. (b) Based on a fixed dollar payment schedule. Effective tax rates decrease as taxable capital increases. (c) The tax rate is 0.15% for the first year and 0.1% for all following years. (d) The rate is 0.15% for the first $300,000 of taxable capital. (e) Tax will be fully phased out before 2028. (f) Tax is being phased out; liability limited to liability in tax year ending Dec. 31, 2010 Note: Capital stock taxes are levied on net assets of a company or its market capitalization. Sources: State statutes; Bloomberg Tax. |

||

| State | Tax Rate | Max Payment |

|---|---|---|

| Ala. | 0.175% | $15,000 |

| Ark. | 0.3% | Unlimited |

| Conn. (a) | 0.341% | $1,000,000 |

| Del. | 0.04% | $200,000 |

| Ga. | (b) | $5,000 |

| Ill. (c) | 0.1% | $2,000,000 |

| La. (d) | 0.3% | Unlimited |

| Mass. | 0.26% | Unlimited |

| Miss. (e) | 0.225% | Unlimited |

| Nebr. | (b) | $11,995 |

| N.Y. (a,f) | 0.05% | $5,000,000 |

| N.C. | 0.15% | Unlimited |

| Okla. | 0.125% | $20,000 |

| S.C. | 0.1% | Unlimited |

| Tenn. | 0.25% | Unlimited |

| Wyo. | 0.02% | Unlimited |

Taxing a company based on its net worth disincentivizes the accumulation of wealth, or capital, which in turn can distort the size of firms and lead to harmful economic effects. As legislators have wizened up to the damaging effects of capital stock taxes, many states have reduced them or repealed them altogether. Kansas completely phased out its capital stock tax prior to tax year 2011, followed by West Virginia and Rhode Island in 2015 and Pennsylvania in 2016. New York and Mississippi are in the process of phasing out their capital stock taxes, with New York’s scheduled to phase out by 2021 and Mississippi’s by 2028. Illinois repealed its franchise tax in its most recent session, and will begin phasing it out in 2020, completing the process by 2024. Connecticut will phase out its capital stock tax over five years starting in 2021.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe