All Related Articles

Important Differences Between the House and Senate Tax Reform Bills Heading into Conference

The House and Senate have both passed legislation that would overhaul the federal tax code. Learn about the key differences between the two bills.

7 min read

Key Changes in Senate Tax Reform Bill Heading into the Vote-a-Rama

A brief summary of the most notable provisions of the Senate Tax Cuts and Jobs Act in the form in which it enters the “vote-a-rama.”

3 min read

JCT’s Dynamic Score is Positive But Underestimates Economic Benefits

The Joint Committee on Taxation (JCT) dynamic scoring estimate of the Senate’s Tax Cuts and Jobs Act confirms that tax changes impact economic growth. While JCT’s estimates are positive, there is reason to believe that the tax plan would produce even greater dynamic effects than its analysis shows.

3 min read

International Provisions in the Senate Tax Cuts and Jobs Act

The Senate’s version of the Tax Cuts and Jobs Act (TCJA) includes several important changes to the taxation of multinational corporations.

5 min read

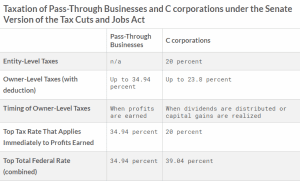

Are Pass-Through Businesses Treated Fairly Under the Senate Version of the Tax Cuts and Jobs Act?

A more careful look shows that the Senate Tax Cuts and Jobs Act doesn’t put pass-through businesses at a disadvantage compared to C corporations.

4 min read

The House Takes a Big Step Forward on Tax Reform

The House of Representatives passed the Tax Cuts and Jobs Act by a vote of 227-205. Here is a summary of the major provisions in the final package.

2 min read

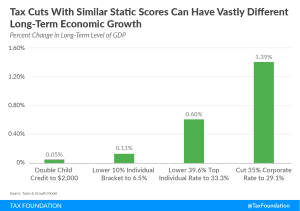

The Economics of Permanent Corporate Rate Cuts Must Outweigh the Optics of Sunsetting Individual Tax Cuts

The Senate Tax Cuts and Jobs Act is right to make the most pro-growth policies permanent and sunset the ones that will do less economic harm.

6 min read

Overview of the Senate’s Amendment to the Tax Cuts and Jobs Act

The Chairman’s Mark of the Senate’s Tax Cuts and Jobs Act includes a number of important changes. Here’s a quick overview of those that matter most.

3 min read

Preliminary Details and Analysis of the Senate’s 2017 Tax Cuts and Jobs Act

This comprehensive overview of the of the Senate Tax Cuts and Jobs Act includes a summary of its details and macroeconomic analysis of how it would impact federal revenue, wages, GDP, and after-tax incomes.

23 min read

Eight Important Changes in the Senate Tax Cuts and Jobs Act

The Senate Tax Cuts and Jobs Act includes hundreds of structural reforms to the tax code. Here is a guide to the eight most important changes.

5 min read

Important Differences Between House and Senate Versions of the Tax Cuts and Jobs Act

This list, though not exhaustive, catalogues the major differences between the House and Senate version of the Tax Cuts and Jobs Act.

4 min read

Details of the Senate Version of the Tax Cuts and Jobs Act

The Senate Tax Cuts and Jobs Act shares many things with its House counterpart, but also differs on several particulars. This guide consolidates all of the details of the Senate plan in one convenient location.

3 min read

Small Pass-Through Businesses Would See Some Benefits Under the House Tax Cuts and Jobs Act

Even with large changes, many in the pass-through community are arguing that small pass-throughs don’t benefit since most or all of their taxable income falls below the 25 percent maximum rate. While correct on the small point, advocates miss the greater tax reform picture. Small pass-through businesses would still benefit from a number of other changes.

2 min read

How The Tax Cut and Jobs Act Would Change International Business Taxation

One goal of the House Tax Cuts and Jobs Act is to move international business taxation to a territorial rather than a worldwide system. Here’s how it would work.

7 min read

Time to Shoulder Aside “Crowding Out” As an Excuse Not to Do Tax Reform

This paper evaluates the arguments for and against “crowding out” and compares these arguments to empirical studies. It discusses the impact of tax changes on the allocation of national income between consumption and saving, and the allocation of saving between private investment and government deficits. It finds that the crowding out argument is largely based on a mistaken assumption about the flexibility and availability of saving and credit for the financing of government deficits and private investment.

31 min read

Updated Details and Analysis of the 2017 House Tax Cuts and Jobs Act

This comprehensive overview of the of the House Tax Cuts and Jobs Act includes a summary of its details and macroeconomic analysis of how it would impact federal revenue, wages, GDP, and after-tax incomes.

20 min read

House Tax Cuts and Jobs Act Would Substantially Improve the U.S.’s International Tax Competitiveness

Considered as a whole, this plan would make the U.S. substantially more competitive, not only due to lower rates but also due to a better tax structure.

2 min read