California Considers Business Head Tax Plan that Seattle Repealed

With California’s unemployment rate approaching 25 percent, it is somewhat surprising to find policymakers contemplating a literal tax on jobs.

3 min read

With California’s unemployment rate approaching 25 percent, it is somewhat surprising to find policymakers contemplating a literal tax on jobs.

3 min read

The digitalization of the economy has been a key focus of tax debates in recent years. Our new report reviews digital tax policies around the world with a focus on OECD countries, explores the various flaws and benefits associated with the wide set of proposals, and provides recommendations for lawmakers to consider.

12 min read

The European Commission announced new budget plans including loans, grants, and some revenue offsets. The proposals follow other support mechanisms for workers and businesses that were designed in response to the Covid-19 pandemic and economic shutdown.

5 min read

Alesina’s work suggests that raising taxes to reduce the federal deficit and national debt would be an economic mistake. The less economically damaging path is to cut spending, what some have called austerity policies.

3 min read

Rather than find ways to restrict net operating loss (NOL) carrybacks, lawmakers should focus on ways to improve liquidity by cashing out accrued NOLs, which would benefit startups and new small businesses without taxable income to offset in prior years.

3 min read

A digital services tax like the one implemented by France likely violates both the General Agreement on Trade in Services and a model U.S. free trade agreement. However, it is uncertain whether meaningful relief could be obtained under either regime.

26 min read

While other states are starting to think about the recovery, California is contemplating tax policies that would stand in the way of economic expansion once the health crisis abates. California’s shortfall is all too real, but tax policies which impede recovery are a hindrance, not a help.

5 min read

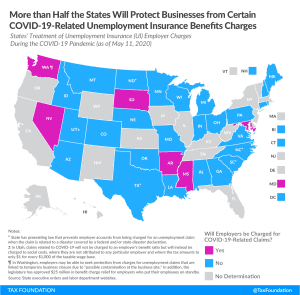

Lawmakers can help expedite their state’s economic recovery by protecting employers from facing higher unemployment insurance tax rates at a time when they can least afford to pay them.

8 min read

The SMART Act, sponsored by Senators Bob Menendez and Bill Cassidy and Rep. Mikie Sherrill, would provide $500 billion in flexible funding to state and local governments.

6 min read

As stated by Rep. Jack Kemp in 1985, “Neutral cost recovery is designed to provide the present value of investment expensing without some of its practical problems.”

5 min read

The Tax Foundation’s General Equilibrium Model suggests that allowing businesses to immediately deduct or “expense” their capital investments in the year in which they are purchased delivers the biggest bang for the buck in spurring economic growth and jobs compared to other tax policies.

7 min read

State recovery plans should lessen the burden on businesses by shifting from capital stock taxes and other taxes that are charged regardless of profitability. Louisiana does well to target its Corporation Franchise Tax, a burdensome tax that would target businesses that may already be struggling.

2 min read

Improving the tax treatment of structures is one of the most cost-effective tax policy changes available to lawmakers as they consider how to remove investment barriers in the tax code to hasten the economic recovery. Policymakers must weigh the trade-offs among long-run economic output goals, revenue constraints, and the existing stock of structures.

13 min read

The HEROES Act, the $3 trillion relief package proposed by House Democrats, is the first bid to provide additional phase 4 aid for businesses and individuals amid the coronavirus pandemic.

7 min read

Although the U.S. has a progressive tax system and a relatively low tax burden compared to the OECD average, average-wage workers still pay about 30 percent of their wages in taxes.

15 min read

The HEROES Act, proposed by House Democrats as a next round of fiscal relief during the coronavirus outbreak, contains about $1.08 trillion in aid to states and localities. That would bring the pandemic total to $1.63 trillion—an amount so large that it might overwhelm their ability to spend it and could reward fiscal irresponsibility.

8 min read

The HEROES Act would provide more than $1 trillion to state and local governments. Here’s how funding would be distributed and provisional estimates of how much aid each state would receive.

5 min read