Stock Buybacks Don’t Hinder Investment Spending

Stock buybacks transfer capital from old established firms to new and innovative ones that need capital to meet their potential.

2 min read

Stock buybacks transfer capital from old established firms to new and innovative ones that need capital to meet their potential.

2 min read

The Organisation for Economic Co-operation and Development (OECD) praised a measure in the Tax Cuts and Jobs Act (TCJA) passed last December.

2 min read

Retail groups sent a letter to Congress explaining that the “retail glitch” in the Tax Cuts and Jobs Act would discourage business investment.

3 min read

Due to a legislative oversight, the Tax Cuts and Jobs Act excluded the category of qualified improvement property investment from 100 percent bonus depreciation.

12 min read

How have federal tax expenditures changed since passage of the Tax Cuts and Jobs Act? We compare 2017 and 2018 Joint Committee on Taxation estimates.

8 min read

One hundred percent expensing for short-life business investments was a great start but needs to be enacted on a permanent basis for it to have an impact on long-term decision-making.

15 min read

Indiana recently passed tax conformity legislation linking the state’s individual and corporate tax code to the new federal law.

2 min read

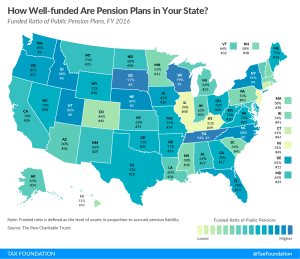

More than half the states have pension plans that are less than two-thirds funded, and five states have pension plans that are less than 50 percent funded.

2 min read