A Net Operating Loss (NOL) Carryforward allows businesses suffering losses in one year to deduct them from future years’ profits. Businesses thus are taxed on average profitability, making the tax code more neutral. In the U.S., a net operating loss can be carried forward indefinitely but are limited to 80 percent of taxable income.

Why Are NOL Carryforwards Important?

Net operating loss deductions are important because business profitability can vary over time. New businesses and those operating in cyclical industries especially may suffer from losses.

Imagine a business has $50 in losses in one year and then $100 in profits in the subsequent year. Without a carryforward provision, the business would not be taxed in the first year but would be taxed on the full $100 in profits in the second year.

A carryforward provision would allow the business to “carry forward” its $50 loss in year one to reduce its taxable profits in year two, averaging the taxable profits over the two years.

| Year One | Year Two | |

|---|---|---|

| Without a NOL Carryforward Provision | ||

| Taxable Profit (Loss) | -$50 | $100 |

| Tax Liability (Tax Rate of 21%) | $0 | $21 |

| With a NOL Carryforward Provision | ||

| Taxable Profit (Loss) | -$50 | $100 |

| Taxable Profit (Loss) with Carryback | -$50 | $50 |

| Tax Liability (Tax Rate of 21%) | $0 | $10.50 |

| Source: Tax Foundation calculation. | ||

U.S. Federal NOL Carryforward Provisions

At the federal level, businesses can carry forward their net operating losses indefinitely, but the deductions are limited to 80 percent of taxable income. Prior to the Tax Cuts and Jobs Act (TCJA) of 2017, businesses could carry losses forward for 20 years (without a deductibility limit).

U.S. State-Level NOL Carryforward Provisions

NOL carryforward provisions vary widely from state to state. While some states conform to the federal standard, other states limit the number of years and have different deductibility limits. An overview of state-level carryforward provisions can be found here.

NOL Carryforward Provisions in Europe

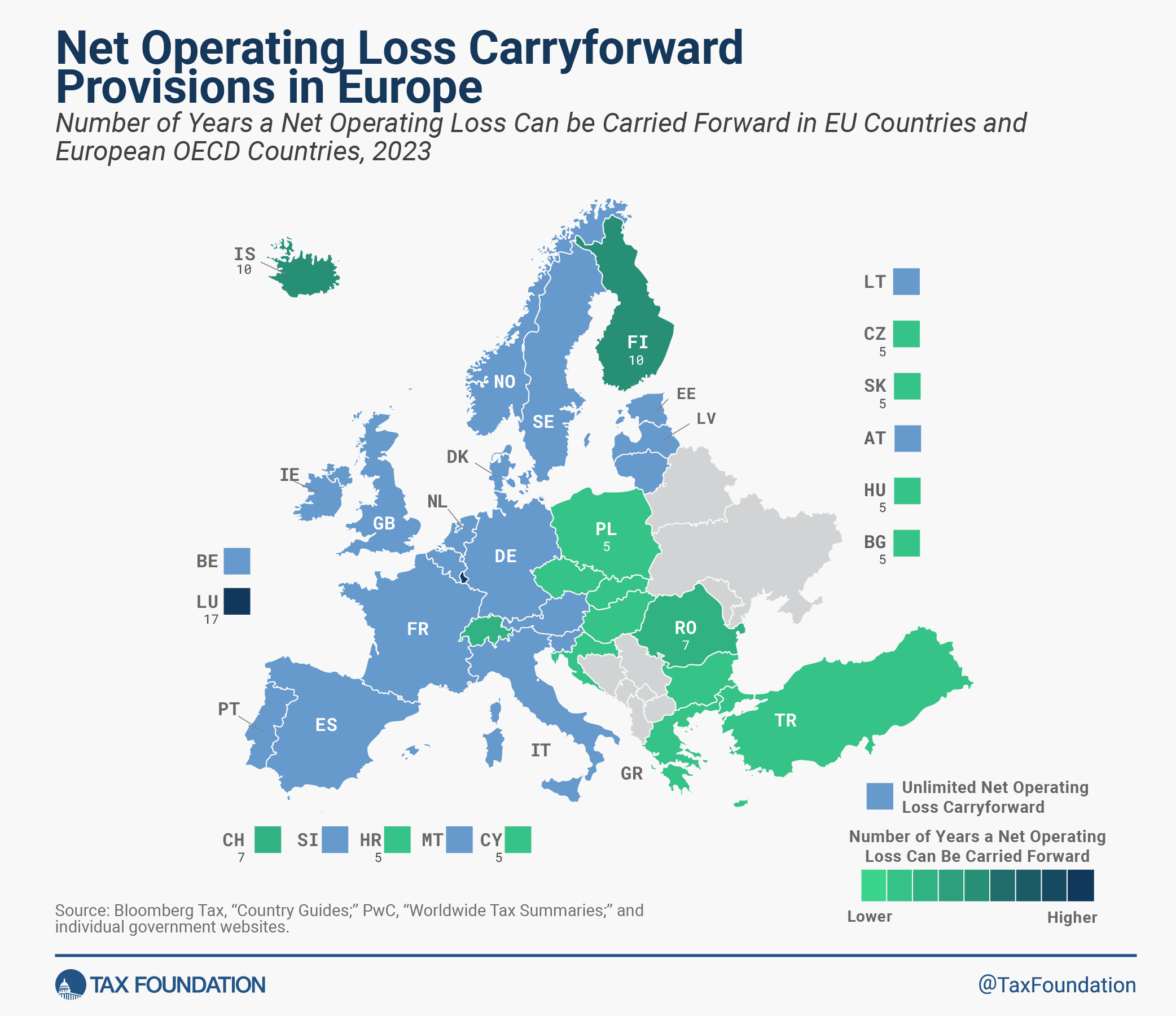

About half of European OECD countries allow businesses to carry forward their net operating losses indefinitely. Many of these countries—like the United States—limit their NOL deduction to a certain percentage of taxable income.

What Are NOL Carrybacks?

NOL carrybacks allow businesses to deduct current year losses against past profits.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe