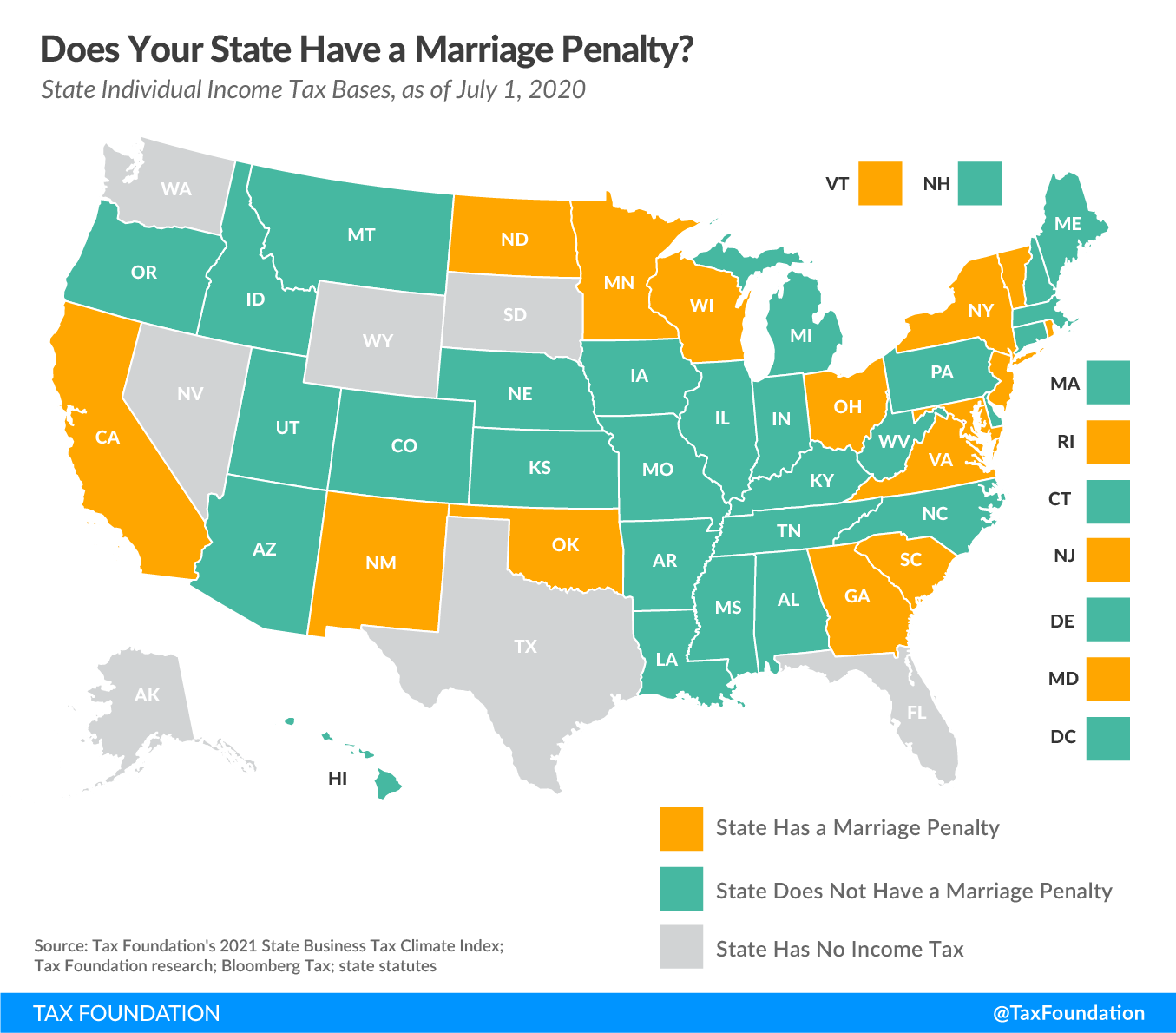

Today’s map zeroes in on states that have a “marriage penalty” in their individual income tax brackets.

Under a graduated-rate income tax system, a taxpayer’s marginal income is exposed to progressively higher taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates. A marriage penaltyA marriage penalty is when a household’s overall tax bill increases due to a couple marrying and filing taxes jointly. A marriage penalty typically occurs when two individuals with similar incomes marry; this is true for both high- and low-income couples. exists when a state’s income brackets for married taxpayers filing jointly are less than double the bracket widths that apply to single filers. In other words, married couples who file jointly under this scenario face a higher effective tax rate than they would if they filed as two single individuals with the same amount of combined income.

This nonneutral tax treatment is particularly harmful to owners of pass-through businesses, who pay taxes on their business income under the individual income tax system. Under a marriage penalty, married business owners are subject to higher effective tax rates on their business income than they would be otherwise.

Fifteen states have a marriage penalty built into their bracket structure. Seven additional states (Arkansas, Delaware, Iowa, Mississippi, Missouri, Montana, and West Virginia), as well as the District of Columbia, fail to double bracket widths, but offset the marriage penalty in their bracket structure by allowing married taxpayers to file separately on the same return to avoid losing credits and exemptions. Ten states have a graduated-rate income tax but double their brackets to avoid a marriage penalty: Alabama, Arizona, Connecticut, Hawaii, Idaho, Kansas, Louisiana, Maine, Nebraska, and Oregon.

The ability to file separately on the same return is important in states that do not double bracket widths, as is the ability to do so even if the couple files jointly for federal purposes. While married couples have the option of filing separately—though some states only allow this if they do so on their federal forms as well—this normally creates a disadvantage, because it either disallows or reduces the value of deductions and credits available to the family jointly, which is also a form of marriage penalty. Filing separately on the same return eliminates this problem, though at the cost of slightly greater complexity than doubling tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. for joint filers so that there is no penalty for filing jointly.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe