All Content

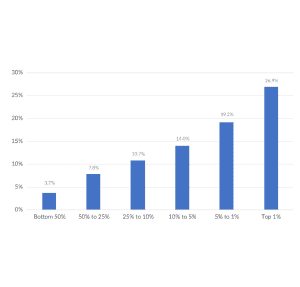

The Real Lesson of 70 Percent Tax Rates on Entrepreneurial Income

The fall and then rise of entrepreneurial income claimed on the wealthy’s 1040 tax returns clearly tracks the seeming decline of inequality from 1950 to 1980, followed by the sudden rise in inequality since 1986. The shifting composition of income claimed by the rich due to changes in tax laws explains this illusion.

12 min read

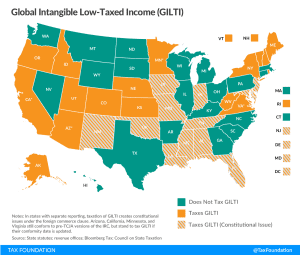

GILTI Minds: Why Some States Want to Tax International Income—And Why They Shouldn’t

The new federal tax on Global Intangible Low-Taxed Income (GILTI) is something of a misnomer: it’s certainly global and it’s definitely income, but the rest of it is, at best, an approximation. It’s not exclusively levied on low-taxed income, nor just on the economic returns from intangible property. So what is GILTI, why might states tax it, and what’s the problem with that?

8 min readToward a State of Conformity: State Tax Codes a Year After Federal Tax Reform

States incorporate provisions of the federal tax code into their own codes in varying degrees, meaning that federal tax reform has implications for state revenue beyond any broader economic effects of tax reform.

73 min read

Unclear if Warren’s Wealth Tax Proposal is Constitutional

There is a chance that Senator Warren’s proposed wealth tax would be found unconstitutional, but opinions are mixed and the precedents go both ways.

2 min read

Sen. Warren’s Wealth Tax Is Problematic

Sen. Elizabeth Warren recently proposed a wealth tax on high-net-worth individuals, a type of tax that is poorly targeted, difficult to administer, and raises constitutional questions.

4 min read

Sorry, Washington State: Capital Gains Taxes are Still Income Taxes—But There’s a Better Way

A new, high tax rate on capital gains income would be a risky move for Washington State even if it didn’t face an enormous constitutional challenge.

5 min read

Tax Relief is on the Agenda in Austria

3 min read

How Much Revenue Would a 70% Top Tax Rate Raise? An Initial Analysis

Due to a narrow tax base and a decrease in capital gains realizations, Congresswoman Ocasio-Cortez’s plan to tax income above $10 million would not raise as much revenue as intended. See our 10-year revenue estimates.

9 min read

America Already Has a Progressive Tax System

Recent interest in raising the tax burden on high-income individuals glosses over the fact that the U.S. federal tax code is already progressive.

3 min read