All Content

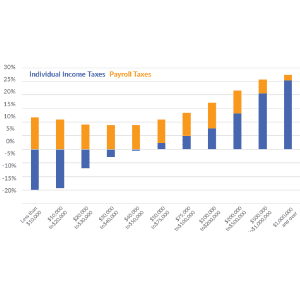

New Report Shows the Burdens of Payroll and Income Taxes

The tax burden for most Americans in 2019 –67.8 percent—will come primarily from payroll taxes, not income taxes. While the income tax is progressive, with average rates rising with income, the payroll tax is regressive, with the highest average rate falling on Americans with the lowest incomes.

4 min read

Reforming Rental Car Excise Taxes

The growing number of options that travelers have for rental cars, including peer-to-peer car-sharing arrangements, is an opportunity for policymakers to revisit the policy rationale for these discriminatory taxes.

26 min read

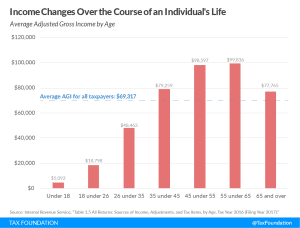

Average Income Tends to Rise with Age

Average income tends to rise dramatically as someone ages and gains education and experience. Viewing just one year of income tax data without digging any deeper misses some crucial context.

2 min read

Tax Treatment of Worker Training

15 min read

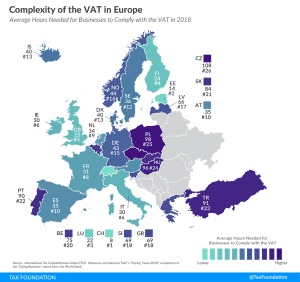

Complexity of the VAT in Europe

2 min read

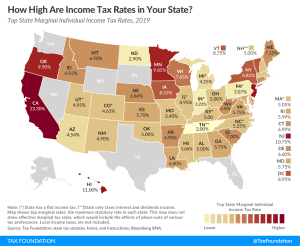

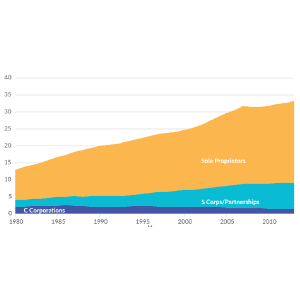

Increasing Individual Income Tax Rates Would Impact a Majority of US Businesses

Since most U.S. businesses are pass-through businesses, such as partnerships, S corporations, LLCs, and sole proprietorships, changes to the individual income tax, especially to top marginal rates, can affect a business’s incentives to invest, hire, and produce.

4 min read

Facts and Figures 2019: How Does Your State Compare?

Our updated 2019 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

Maine’s Water Extraction Tax Proposal Is Poor Tax Policy

Taxing the extraction of water does not make sense as an excise tax and does not make sense as a mechanism to finance rural broadband and public education.

4 min read

Corporate Tax Reform Comes to Arkansas

Arkansas’s Senate Bill 576 would overhaul the state’s corporate income tax code and dramatically increase its competitiveness from 46th to 44th nationally.

3 min read

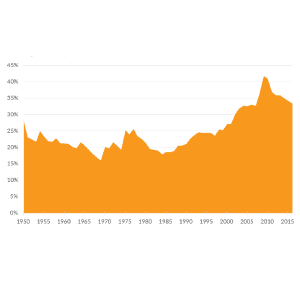

A Growing Percentage of Americans Have Zero Income Tax Liability

From 1986 to 2016, the top 1 percent’s share of income taxes rose from 25.8 percent to 37.3 percent, while the bottom 90 percent’s share fell from 45.3 percent to 30.5 percent.

4 min read