All Content

Opportunity Zones: What We Know and What We Don’t

Research suggests place-based incentive programs redistribute rather than generate new economic activity, subsidize investments that would have occurred anyway, and displace low-income residents.

20 min read

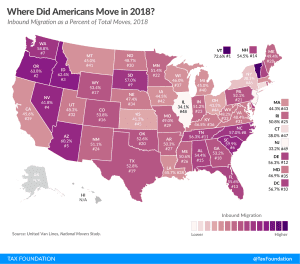

Where Did Americans Move in 2018?

2 min read

We Shouldn’t Scrap Dynamic Scoring

2 min read

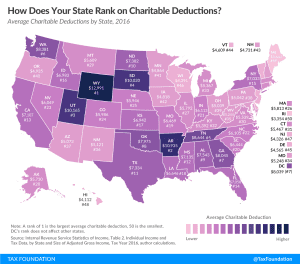

Charitable Deductions by State

2 min read

Tax Trends Heading Into 2019

In 2019, key trends in state tax policy include reductions in corporate tax rates, updating sales tax systems to include remote online sales, taxes on marijuana and sports betting, gross receipts taxes, and more. Explore our new 2019 guide!

32 min read

The Tax Cuts and Jobs Act After A Year

5 min read

Unequal Tax Treatment Is Contributing to Rising Debt Levels for Entrepreneurs

A recent paper discusses two main trends related to U.S. entrepreneurs: the decrease in the number of entrepreneurs and the increase in their borrowing. Entrepreneurs have increased their debt holdings relative to their assets over the past three decades.

3 min read

Wireless Taxes and Fees Climb Again in 2018

A typical family with four cell phones paying $100 per month for service can expect to pay about $229 per year in wireless taxes, fees, and surcharges. Nationally, these impositions make up about 19.1 percent of the average customer’s cell phone bill.

35 min read

Updated Proposal for Year-End Tax Bill

2 min read