What Would the “Big Six” Framework Mean for Lower-Middle Income Households?

Based on the details we have, the Big Six tax plan would lower taxes on the bottom 80% of taxpayers, and raise the tax burden on the top 20% of taxpayers.

7 min read

Based on the details we have, the Big Six tax plan would lower taxes on the bottom 80% of taxpayers, and raise the tax burden on the top 20% of taxpayers.

7 min read

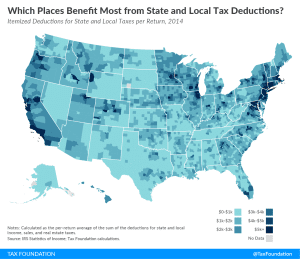

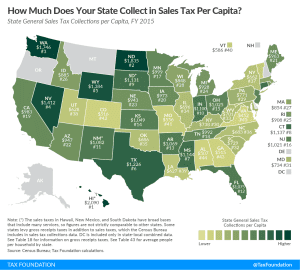

The state and local tax deduction favors high-income individuals in high-tax states. Six states—California, New York, New Jersey, Illinois, Texas, and Pennsylvania—claim more than half of the value of the deduction.

2 min read

Republican leadership in the House, Senate, and White House released a framework for a tax proposal that would lower taxes on businesses and individuals and simplify a number of aspects of the federal tax code. Here are the details we know right now.

3 min read

The Ohio Commercial Activity Tax, a 0.26 percent tax on business gross receipts above $1 million, is a throwback to an earlier era of taxation, bringing back a tax type that had been in steady retreat for nearly a century.

34 min read

Repealing the state and local tax deduction will be an important part of pro-growth tax reform. Eliminating the deduction would free up $1.8 trillion to use for lowering rates across the board. Special interest groups will want you to think this deduction protects you against double taxation. Don’t fall for it.

2 min read

These four Tax Foundation tax plans demonstrate ways in which lawmakers could achieve permanent, pro-growth tax reform while keeping the level of federal revenue and the distribution of the tax burden roughly the same as current law.

25 min read

The most important thing that Congress and the administration can do to boost economic growth, lift workers’ wages, create jobs, and make the U.S. economy more competitive globally, is reform our business tax system.

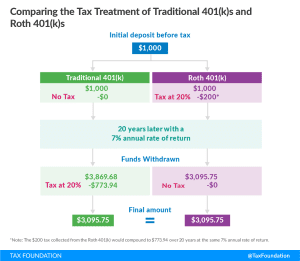

While no concrete plans for Rothification have been proposed, House GOP Republicans have kept the possibility on the table. Here’s what you should know.

4 min read

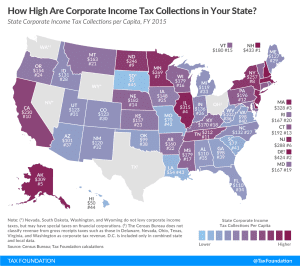

The last time the U.S. reduced its federal corporate income tax rate was in 1986. Since then, countries throughout the world have significantly reduced their rates, leaving the U.S. with the fourth highest statutory corporate tax rate in the world and an overall uncompetitive tax system.

11 min read