FDA’s Proposed Cigarette Prohibition Would Cost $33 Billion in Annual Tax Revenue

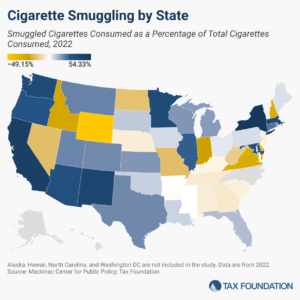

The US already has massive problems with cigarette smuggling. A cigarette prohibition would be devastating to tax coffers while pushing smokers toward what could become the world’s largest illicit market.

4 min read