How Do Import Tariffs Affect Exports?

When the government imposes a tariff, it may be trading jobs and production in one part of the economy for jobs in another part of the economy by increasing production costs for downstream industries.

6 min read

When the government imposes a tariff, it may be trading jobs and production in one part of the economy for jobs in another part of the economy by increasing production costs for downstream industries.

6 min read

Explore the latest EU tobacco and cigarette tax rates, including EU excise duties on cigarettes. Compare cigarette taxes in Europe.

3 min read

Depending on the 2024 US election, the current corporate tax rate of 21 percent could be in for a change. See the modeling here.

4 min read

The recently released FY 2025 budget for New York State signals a degree of optimism, with caveats. New York cannot tax itself toward a balanced budget.

6 min read

Pillar Two risks creating a more complex and unfair international tax system. It is inadvertently fostering new, opaque, and complex forms of competition, and policymakers should consider alternative approaches to creating a fairer international tax environment.

4 min read

While many factors influence business location and investment decisions, sales taxes are something within policymakers’ control that can have immediate impacts—especially as a large number of major cities have combined rates of 9 percent or more.

6 min read

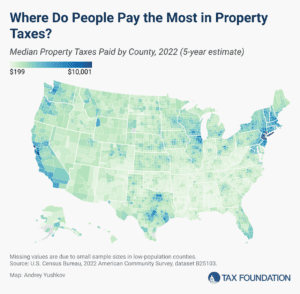

Property taxes are the primary tool for financing local governments and generate a significant share of state and local revenues.

6 min read

To encourage greater saving, the US federal income tax provides tax-neutral treatment to some types of saving through a variety of accounts. The type of tax treatment, contribution limits, withdrawal rules, and use cases for contributions all vary by account, leading to a complicated system for households to navigate.

11 min read

With pandemic-era savings now fully depleted and the majority of Americans pointing to their finances as their biggest source of stress, one thing is clear: the US needs policies that help people save more.

4 min read

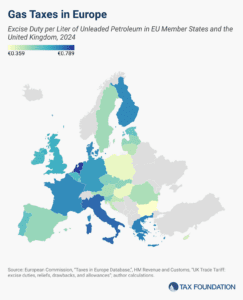

Gas and diesel taxes continue to be prominent policy issues throughout Europe. As the EU undergoes sweeping changes for its green transition, fuel taxes are likely to be a crucial aspect of policy discussions.

3 min read

Not every change in the Tax Cuts and Jobs Act simplified the tax code. However, the TCJA reduced compliance costs overall for individual filers, and allowing fundamental structural improvements to expire would make the tax code worse.

5 min read

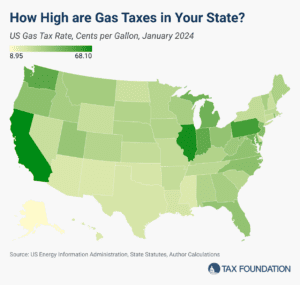

By 2034, the gas tax and other car-related excise taxes are projected to raise less than half of the Highway Trust Fund’s outlays. While broader tax and spending reforms are necessary for overall deficit reduction, improving transportation funding would be a crucial step forward.

34 min read

Gov. Walz’s tax policy record is notable because of how much it contrasts with broader national trends. In recent years, most governors have championed tax cuts. Walz, rare among his peers, chose tax increases.

5 min read

Americans will spend more than 7.9 billion hours complying with IRS tax filing and reporting requirements in 2024. This is equal to 3.8 million full-time workers doing nothing but tax return paperwork—roughly equal to the population of Los Angeles.

7 min read

Though gas taxes are intended to serve as user fees and pollution deterrents, they vary widely across states. How does your state’s burden compare?

4 min read

According to recent reports, 72 percent of the current marijuana market in the US is illicit. Evidently, the federal criminalization of marijuana has failed to prevent its sale or consumption.

6 min read

If Vice President Kamala Harris is elected the 47th U.S. president, she would inherit a trade war started by former President Donald Trump and continued by President Joe Biden. But she’d also have the chance to end it.

Exempting Social Security benefits from income tax would increase the budget deficit by about $1.6 trillion over 10 years, accelerate the insolvency of the Social Security and Medicare trust funds, and create a new hole in the income tax without a sound policy rationale.

6 min read

The 2024 Summer Olympics are underway, drawing the attention of billions and continuing a tradition dating back thousands of years. But you know what else originated thousands of years ago and affects even more people? Taxes.

3 min read

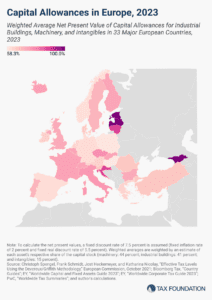

Although sometimes overlooked in discussions about corporate taxation, capital allowances play an important role in a country’s corporate tax base and can impact investment decisions—with far-reaching economic consequences.

4 min read