All Content

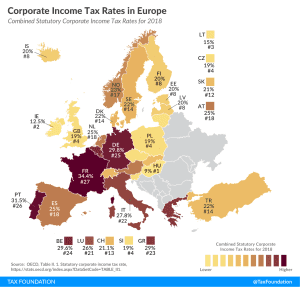

Opportunities for Pro-Growth Tax Reform in Austria

Austria needs to pursue comprehensive business and individual tax reform if it wants to remain competitive. Our new guide explores several ways the Austrian government can achieve a simpler, more pro-growth tax code.

10 min read

Ready to go on BEPS 2.0?

8 min read

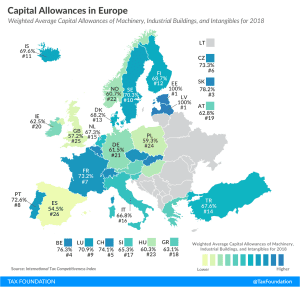

Capital Allowances in Europe, 2019

3 min read

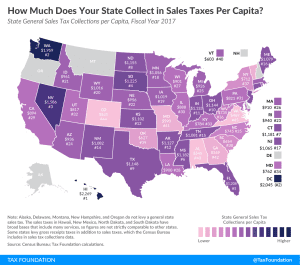

Wisconsin Tax Options: A Guide to Fair, Simple, Pro-Growth Reform

Despite tax cuts in recent years, Wisconsin’s overall tax structure lags behind competitor states in simplicity, tax rates, and business climate for residents and investment. Explore our new comprehensive guide to see how the Badger State can achieve meaningful tax reform.

11 min read

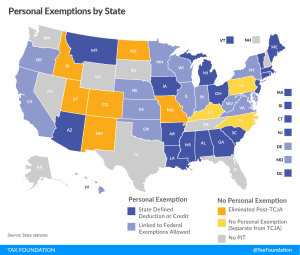

Amortizing Research and Development Expenses Under the Tax Cuts and Jobs Act

Expensing, or the immediate write-off of R&D costs, is a valuable component of the current tax system. The TCJA’s change to amortization in 2022, requiring firms to write off their business costs over time rather than immediately, would raise the cost of investment, discourage R&D, and reduce economic output.

12 min read

A High Tax Rate on Star Inventors Lowers Total Innovation

Findings from a new study suggest that while a policy agenda to revive innovation must include an assortment of changes – including greater access to mentorship – tax policy matters too.

2 min read

Sanders’ Estate Tax Plan Won’t Likely Raise the Revenue Intended

While progressivity may look appealing—particularly at a time when policymakers in Congress seem to be competing on how best to extract revenue from the wealthiest in the country—it may not raise the revenue intended.

2 min read

Income Taxes on the Top 0.1 Percent Weren’t Much Higher in the 1950s

Recent plans to increase the tax burden on wealthy Americans, such as higher marginal income tax rates and wealth taxes, are flawed in several ways, including in their lack of understanding of tax history.

4 min read