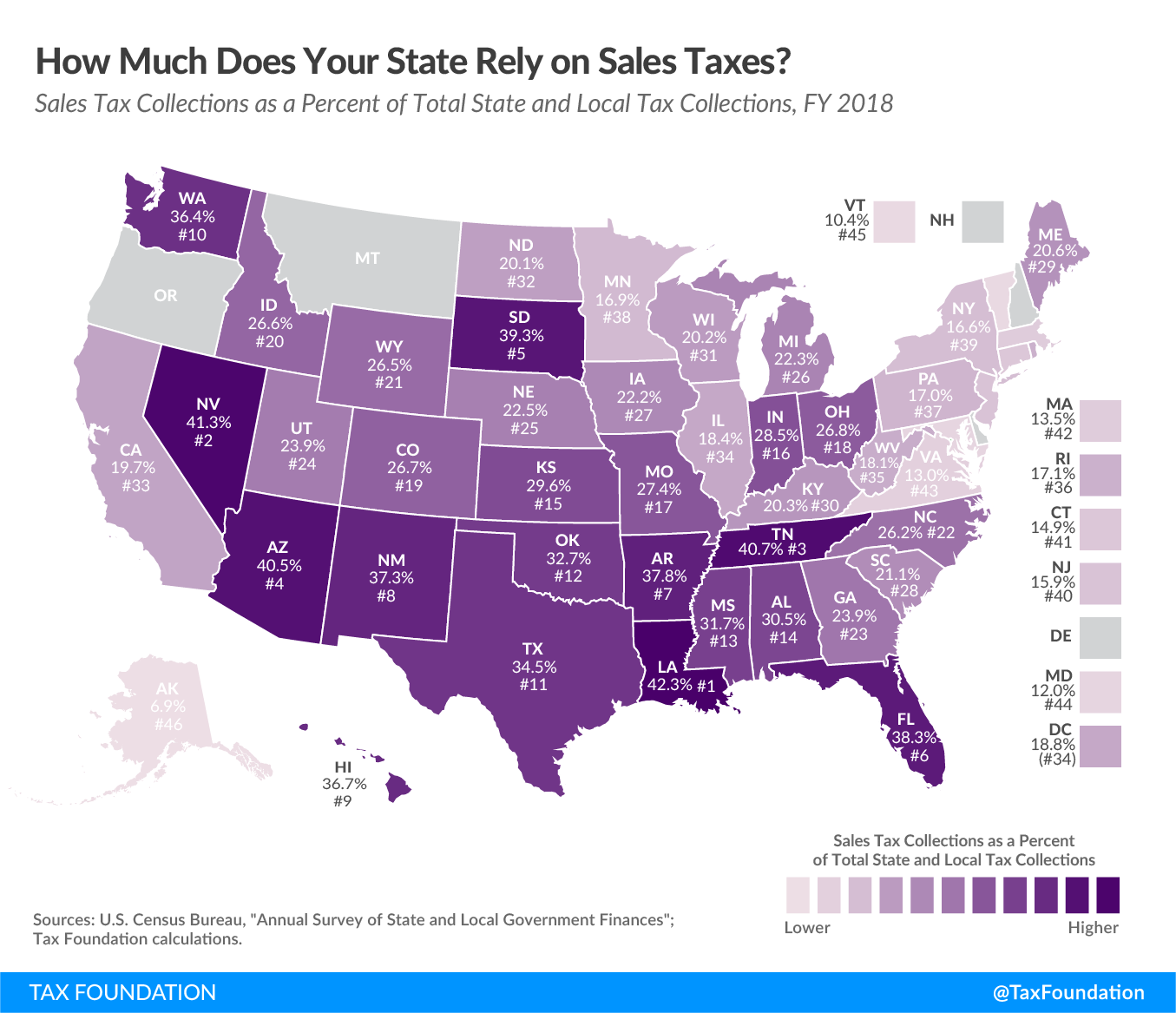

This week’s map continues our look at state revenue sources, this time focusing on revenue collected through the general sales tax.

Sales taxes are the second largest source of state and local taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. revenue, accounting for 23.3 percent of total U.S. state and local tax collections in fiscal year 2018 (the latest data available).

Consumption taxes (like sales taxes) are more economically neutral than taxes on capital and income because they target only current consumption. Income taxes fall on both present and future consumption, thus partially acting as a tax on investment by capturing savings.

Consumption taxes are generally more stable than income taxes in economic downturns as well. Although there was an initial drop in consumption during the coronavirus crisis, sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. revenues have bounced back as many stores have reopened, and as people have moved much of their shopping online.

While 45 states levy a statewide sales tax and 38 allow localities to collect separate sales taxes, four states levy neither a state nor a local sales tax: Delaware, Montana, New Hampshire, and Oregon. Eight states levy a sales tax at the state, but not the local, level: Connecticut, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, and Rhode Island. Alaska is the only state that permits local sales taxes without imposing a state sales tax.

Today’s map compares the extent to which sales taxes are responsible for tax revenue generation in each state. Louisiana is the most reliant on sales tax revenue, with 42.3 percent of tax collections attributable to sales taxes. Nevada, which does not have an income tax, comes in second with 41.3 percent of state and local tax collections. Tennessee, which does not tax wage income and fully phased out its investment income tax this year, is next with 40.8 percent, followed by Arizona at 40.5 percent.

Although Nevada, Tennessee, and South Dakota (39.3 percent) all rely heavily on the sales tax, they are not high-tax states. All three states forgo an individual income tax and choose to raise a large portion of their revenue through the sales tax instead. South Dakota additionally forgoes corporate income taxes. Wyoming does not levy individual or corporate income taxes either but lands near the middle of the pack (26.5 percent) in terms of sales tax reliance due to its heavy reliance on severance tax collections. This trade-off between income and sales can be a good thing, as it allows states to avoid relying on the less economically neutral individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. .

Many factors can affect sales tax reliance. States and localities that border low-sales tax or no-sales tax jurisdictions often struggle to levy sales taxes with high rates, as these could prompt consumers to shop across the border.

Another consideration is the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. , the transactions that are subject to the sales tax. The most neutral form of sales tax would fall on final consumption of both goods and services at a low rate, while exempting business inputs. In practice, though, many states fall short of this ideal due to historical accident or policy decisions to exempt certain classes of goods.

Note: This is part of a map series in which we examine the primary sources of state and local tax collections

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe