Individual income taxes are a major source of state government revenue, accounting for 35 percent of state taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. collections.[1] Their prominence in public policy considerations is further enhanced by the fact that individuals are directly responsible for paying their income taxes, in contrast to the indirect payment of sales and excise taxes. To many taxpayers, the personal income tax is practically synonymous with their own tax burdens.

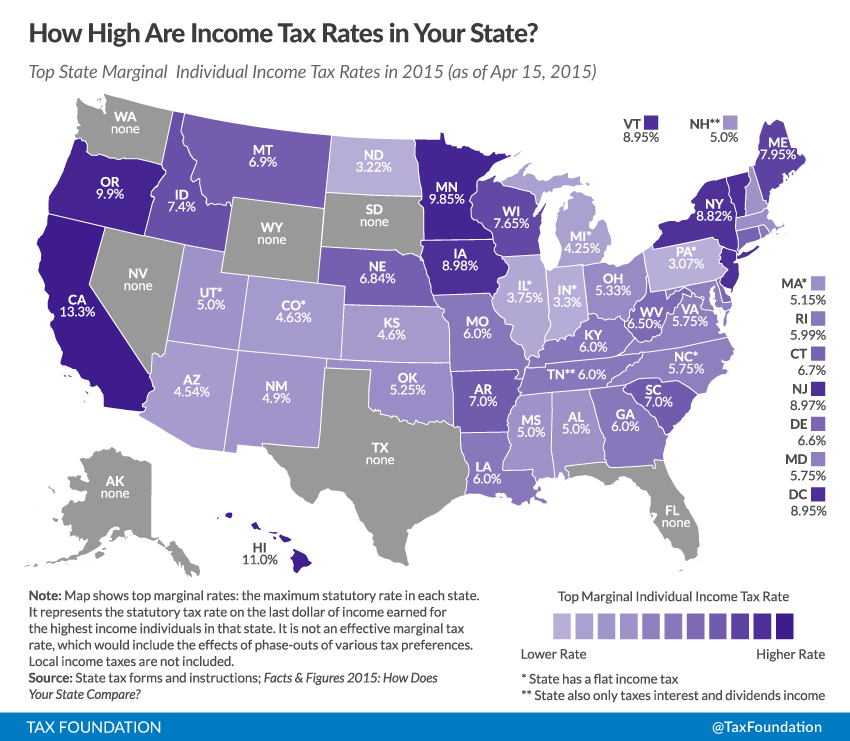

Forty-three states levy individual income taxes. Forty-one tax wage and salary income, while two states—New Hampshire and Tennessee—exclusively tax dividend and investment income. Seven states levy no income tax at all.

Of those states taxing wages, eight have single-rate tax structures, with one rate applying to all taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. Taxable income differs from—and is less than—gross income. . Conversely, thirty-three states levy graduated-rate income taxes, with the number of brackets varying widely by state. Two states—Kansas and Maine—impose two-rate income taxes. At the other end of the spectrum, three states have ten or more tax brackets, led by Hawaii with twelve. Top marginal rates range from Pennsylvania’s 3.07 percent to California’s 13.3 percent.

In some states, a large number of brackets are clustered within a narrow income band; Missouri taxpayers reach the state’s tenth and highest bracket at $9,001 in annual income. In other states, the top marginal rate kicks in at $500,000 (New Jersey) or even $1,000,000 (California, if one counts the state’s “millionaire’s tax” surcharge).

States’ approaches to income taxes vary in other details as well. Some states double their single-bracket widths for married filers (avoiding the “marriage penaltyA marriage penalty is when a household’s overall tax bill increases due to a couple marrying and filing taxes jointly. A marriage penalty typically occurs when two individuals with similar incomes marry; this is true for both high- and low-income couples. ”) and index tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. , exemptions, and deductions for inflation; many others do not. Some states tie their standard deductions and personal exemptions to the federal tax code, while others set their own or offer none at all. In the following table, we provide the most up-to-date data available on state individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. rates, brackets, standard deductions, and personal exemptions for both single and joint filers.

Notable Individual Income Tax Changes in 2015

Several states changed key features of their individual income tax codes between 2014 and 2015. These changes include:

- the sunset of Illinois’ temporary income tax rate hike, with the flat rate reverting from 5 to 3.75 percent;[2]

- the trimming of Indiana’s top rate from 3.4 to 3.3 percent;[3]

- an automatically triggered rate reduction from 5.2 to 5.15 percent in Massachusetts;[4]

- the reduction of North Carolina’s rate to 5.75 percent, down from 5.8 percent in 2014 and 7.75 percent in 2013 as part of its historic 2013 tax reform package;[5] and

- the introduction of a new bracket in the District of Columbia which subjects income between $40,000 and $60,000 to a 7 percent rate rather than including it in the 8.5 percent bracket.[6]

[1] U.S. Census Bureau, State & Local Government Finance, Fiscal Year 2012, http://www.census.gov/govs/local/.

[2] Bob Secter & Rick Pearson, Illinois Income Tax Rate Falls 25 Percent, Chicago Tribune, Jan. 1, 2014, http://www.chicagotribune.com/news/local/breaking/ct-illinois-income-tax-rate-falls-met-20141230-story.html.

[3] Joseph Henchman, Indiana Approves Income Tax Reduction, Tax Foundation Tax Policy Blog, May 14, 2013, https://taxfoundation.org/blog/indiana-approves-income-tax-reduction.

[4] Joshua Miller, Mass. Tax Rate Takes Slight Dip, Boston Globe, Jan. 1, 2015, http://www.bostonglobe.com/metro/2014/12/31/income-tax-rate-fall-jan/0z4PxvHvtSxWOFja3EDZfO/story.html.

[5] Liz Malm, North Carolina House, Senate, and Governor Announce Tax Agreement, Tax Foundation Tax Policy Blog, Jul. 15, 2013, https://taxfoundation.org/blog/north-carolina-house-senate-and-governor-announce-tax-agreement.

[6] Joseph Henchman, D.C. Council to Vote on Tax Reform Package Today, , Tax Foundation Tax Policy Blog, June 24, 2014, https://taxfoundation.org/blog/dc-council-vote-tax-reform-package-today.