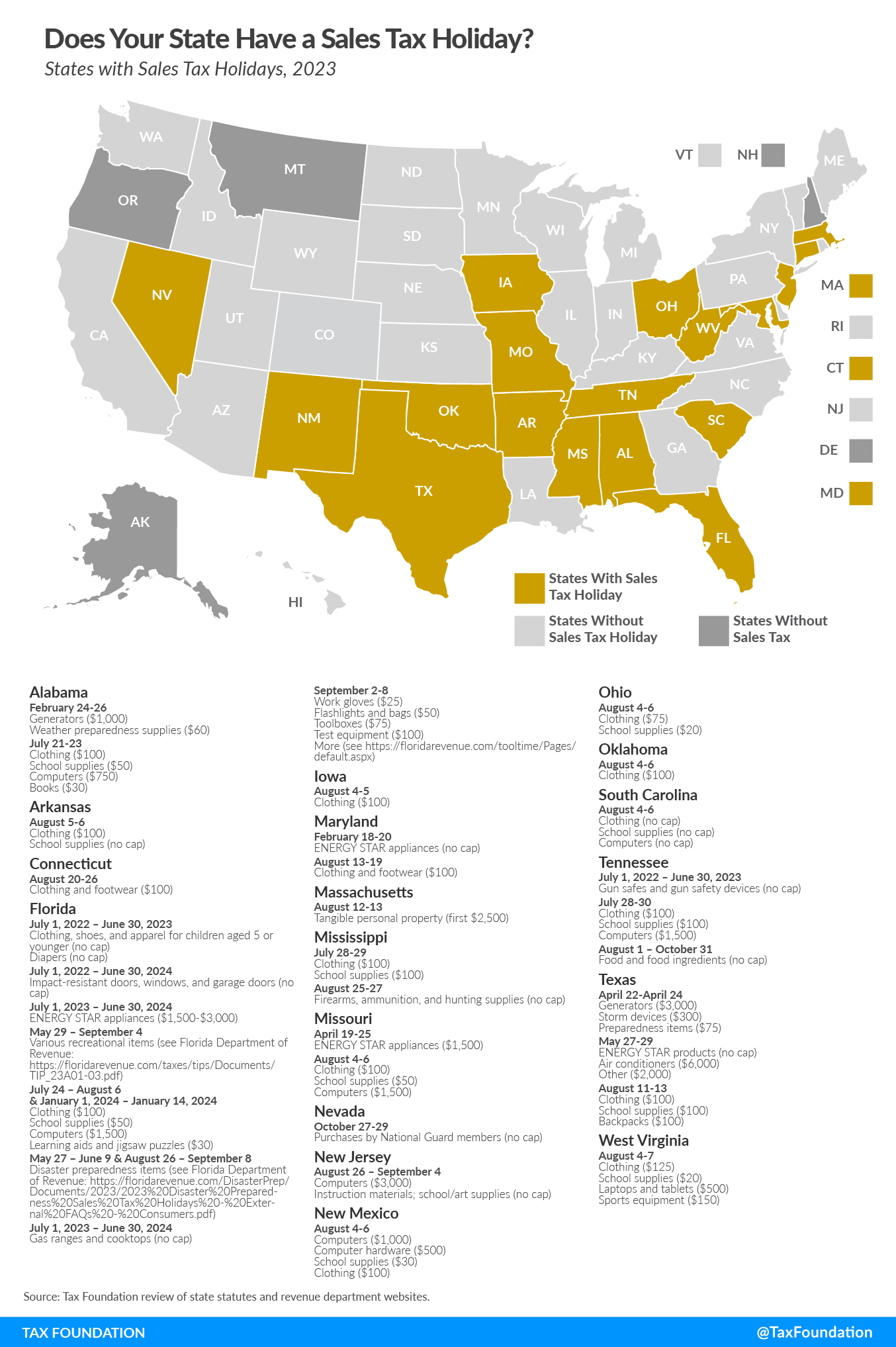

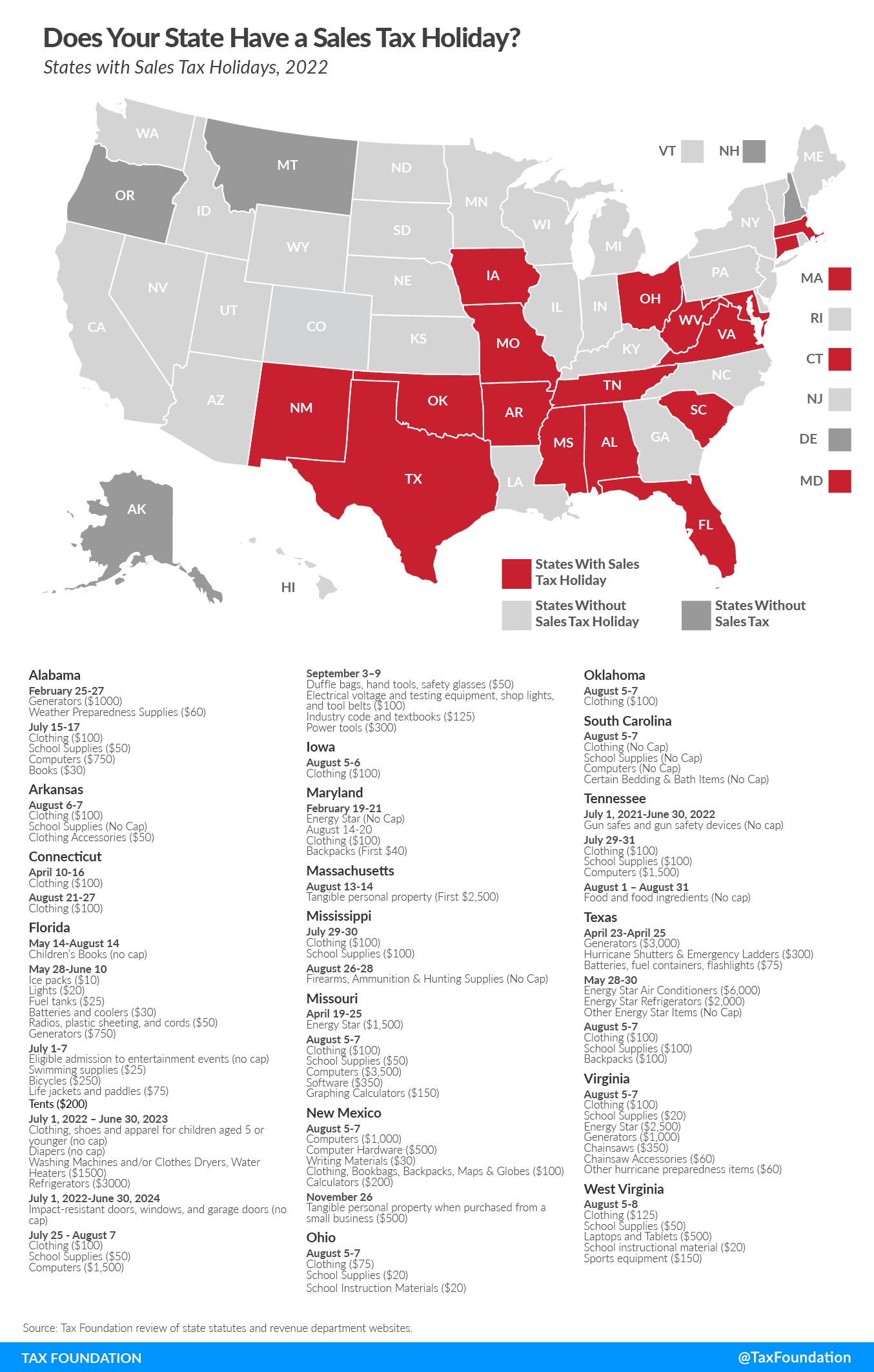

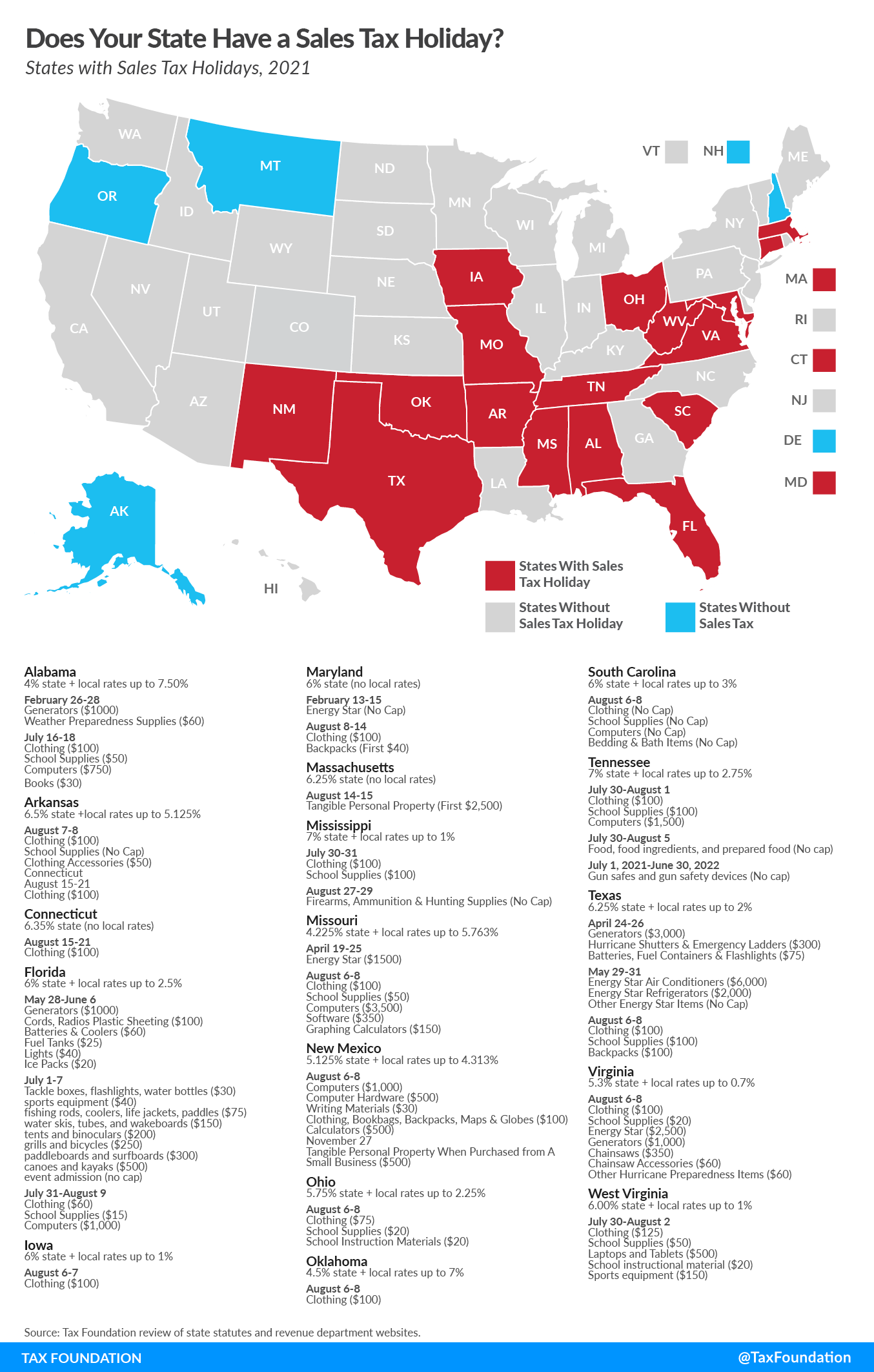

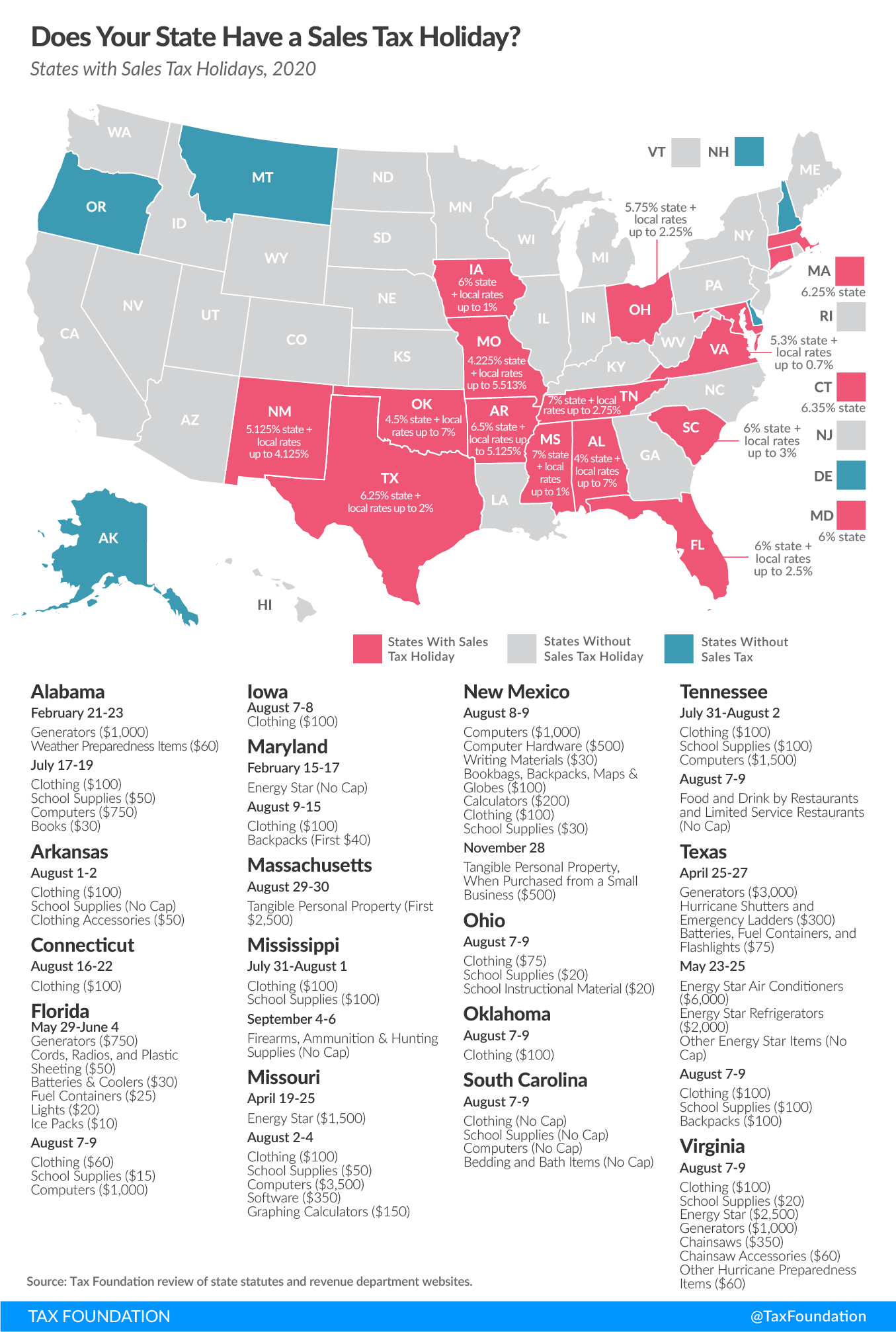

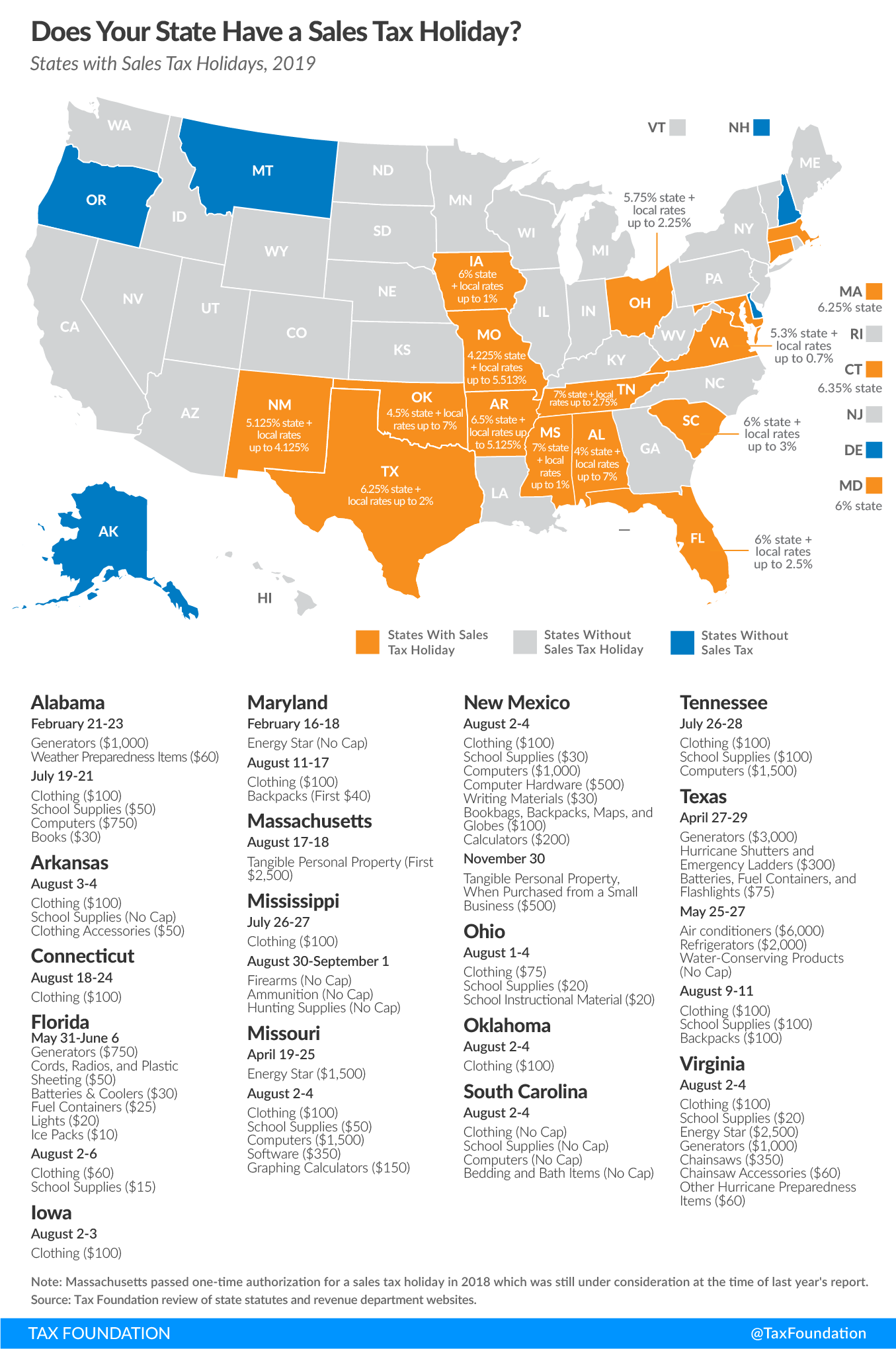

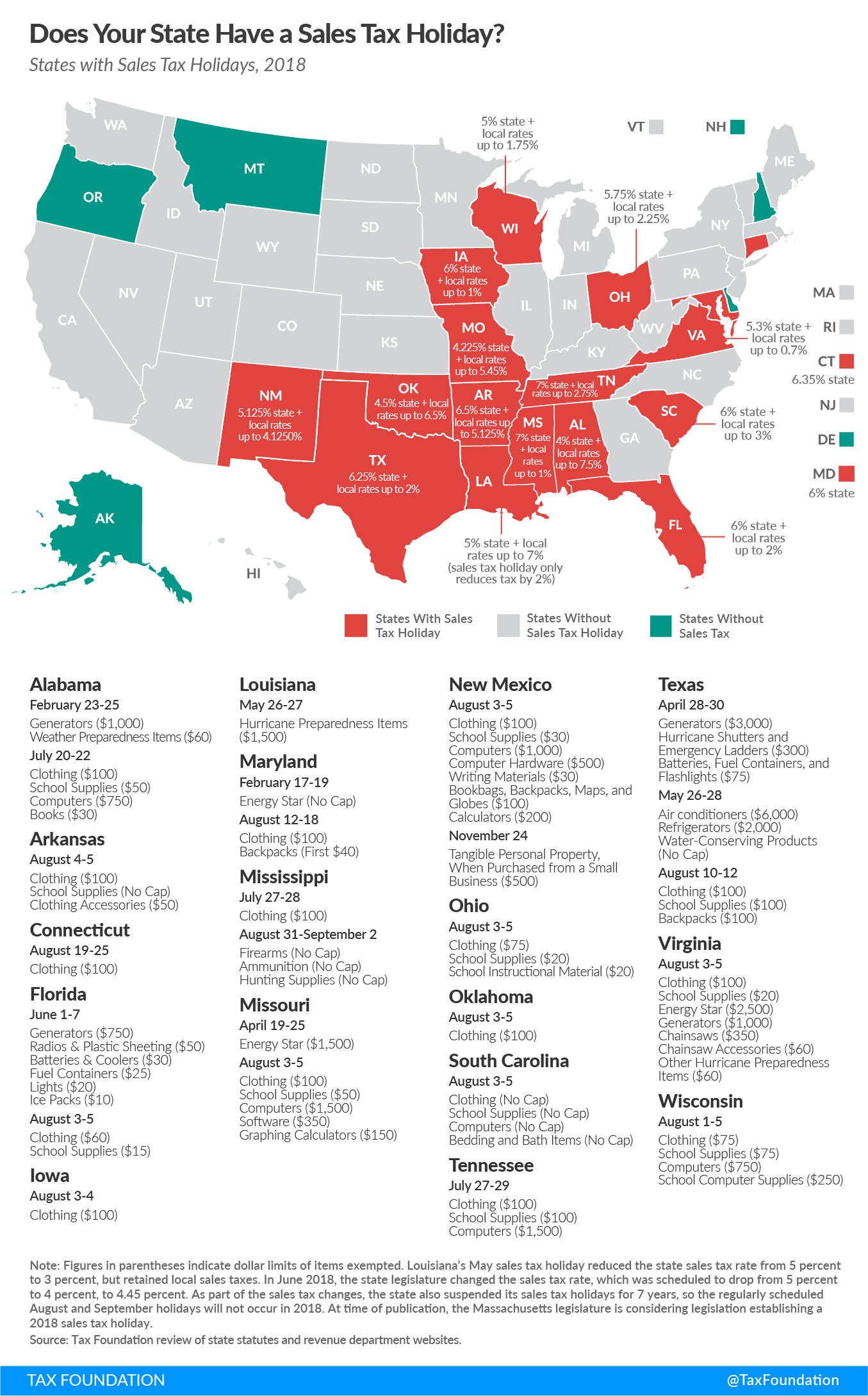

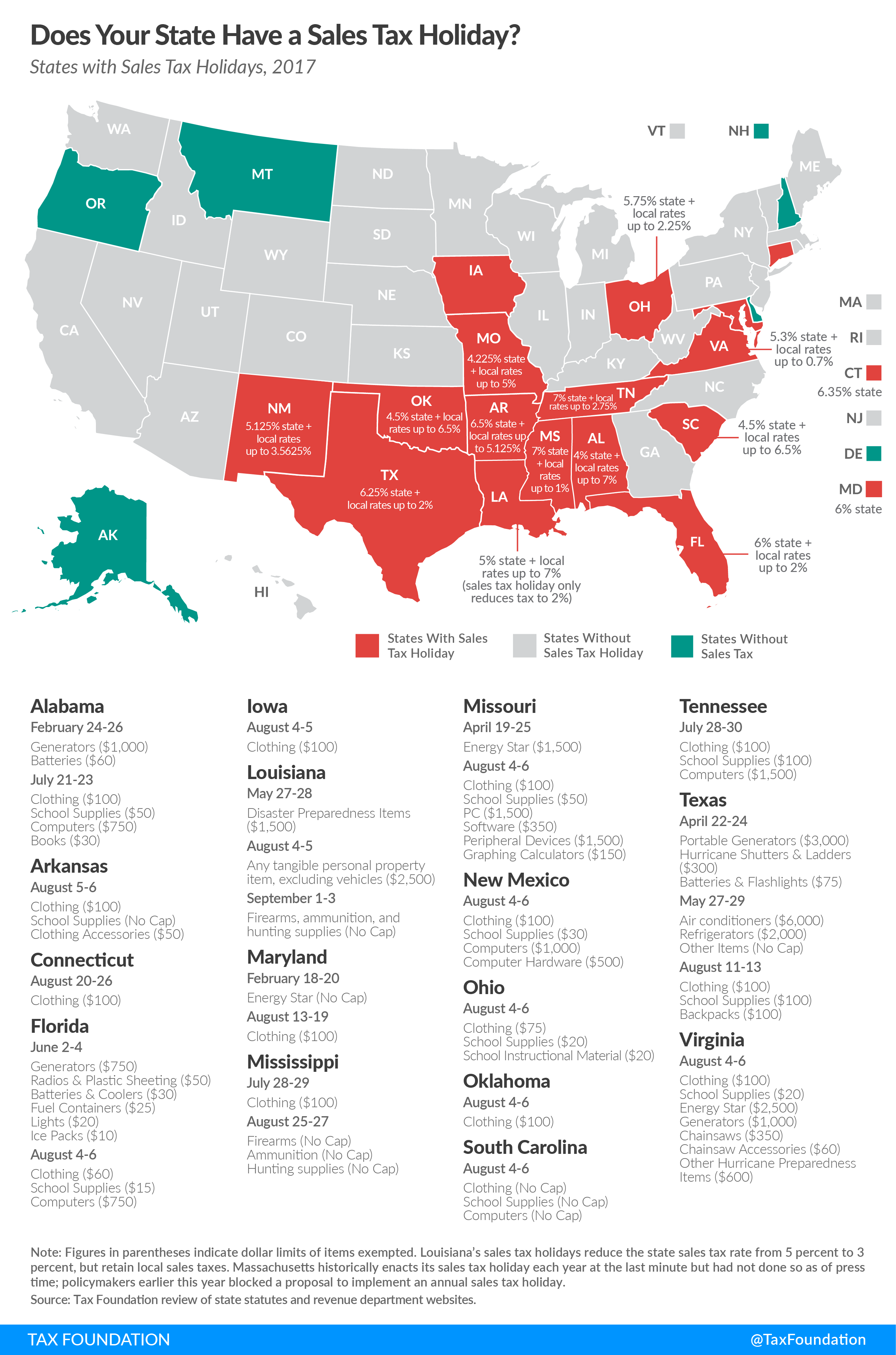

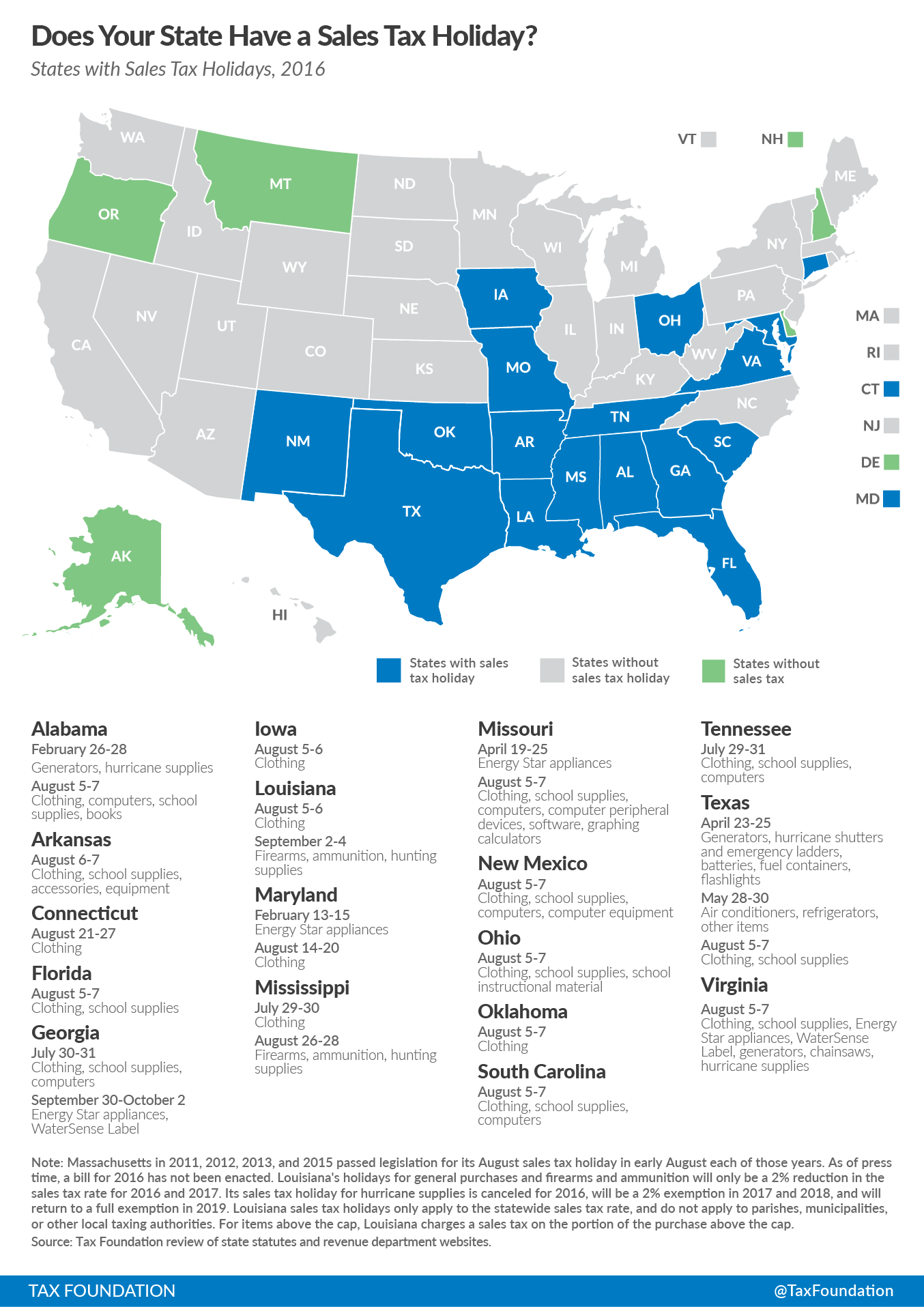

Sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. holidays, designated periods when select goods or services are exempted from state (and sometimes local) sales taxes, continue to be politically popular among the states: 19 have held or will be holding sales taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. holidays in 2025, matching the number from last year. (This total does not include the local sales tax holidayA sales tax holiday is a period of time when selected goods are exempted from state (and sometimes local) sales taxes. Such holidays have become an annual event in many states, with exemptions for such targeted products as back-to-school supplies, clothing, computers, hurricane preparedness supplies, and more. offered by one municipality in Alaska.)

They also take different forms in different places. In recent years, Iowa, Oklahoma, and West Virginia have exempted clothing during their holidays, while Maryland and Missouri have targeted energy-efficient appliances for temporary sales tax relief. Sales tax holidays are politically popular with elected officials because they offer direct discounts, whether real or perceived, to consumers in a highly visible way. Consumers often believe they’re getting a good deal. Thus, sales tax holidays remain popular despite their economic inefficiencies, unintended consequences, and frequent inability to achieve their stated goals.

Proponents of sales tax holidays claim they create economic growth by increasing retail activity within their timeframes. However, studies show that much of the increased shopping during holidays is shopping that consumers would have done at other times but moved to the holiday timeframe to take advantage of discounts. While some consumers make incidental “impulse” purchases during these holidays, those additional purchases are not enough to justify the revenue costs associated with these holidays, even if such impulse purchases are desirable. Since sales tax holidays shift the timing of demand but do little to increase its magnitude, sales tax holidays reduce state and local tax collections for little or no economic benefit.

Additionally, states often schedule sales tax holidays to exempt specified goods and services during times when demand for these goods and services is highest, such as back-to-school products in August and hurricane preparedness supplies before storm seasons. As a result, most of these revenue losses are associated with retail transactions that would have occurred without the added incentive. The prevalence of sales tax holidays is indicative of deeper structural weaknesses in state tax codes: the existence of a sales tax holiday is a tacit admission that the sales tax is overly burdensome throughout the rest of the year. If policymakers believe that suspending the sales tax for a single week, for example, can stimulate economic growth, they are implicitly acknowledging that the tax suppresses economic growth for the other 51 weeks. In this sense, the sales tax holiday is not genuine relief, but a political concession. It acknowledges flaws in the underlying tax structure while revealing a lack of will to enact meaningful, permanent reforms.

While revenue losses associated with most sales tax holidays are not particularly large, they still have to be offset by revenue generated elsewhere, which is a net negative for states’ overall economic health since other revenue sources are often more economically damaging than sales taxes. And states that can consistently cover these holidays out of surplus revenues could better utilize their excess funds on more economically efficient tax reforms, particularly rate reductions.

Proponents of sales tax holidays sometimes suggest that they encourage out-of-state consumers to travel for discounts, increasing in-state sales. Since so many states now have tax holidays, and because the holidays often apply to lower-cost items that wouldn’t justify a large detour, their effect in attracting out-of-state purchasers is doubtful. Furthermore, while compliance is undeniably low, a consumer who makes a sales-tax-free, out-of-state purchase intended to be consumed in their own state is legally obligated to pay use tax on that purchase.

Tax holidays also incentivize consumers to put off shopping for selected items. A lower-income family that waits to buy school supplies until a back-to-school sales tax holiday on the weekend before school starts—a point when many families have already finished their shopping—might have been better off if they had shopped earlier, when products are most likely to be well stocked. This is just one aspect of sales tax holidays that can inadvertently harm lower-income consumers. Because sales tax holidays induce high demand for an often narrow, predetermined set of goods during a limited timeframe, retailers often increase prices to avoid running out of stock. Though this aspect of sales tax holidays is difficult to study, some research has suggested companies can absorb up to 20 percent of the benefit of sales tax holidays through price increases, blunting their benefit for consumers with the lowest incomes. These shoppers are also the most likely to face difficulties in being able to prepare for sales tax holidays by increasing household savings or requesting time off work. If governments truly want to help low-income consumers, targeted assistance policies are better options. Better yet, policymakers could permanently ease tax burdens by trimming rates year-round—but permanent solutions tend to be deprioritized when politically easier, temporary gimmicks like sales tax holidays persist.

In addition to their inefficiencies as a vehicle for tax relief, sales tax holidays often have economically distortive structural flaws. For example, by imposing a cap on the price of goods that qualify for the sales tax holiday, consumers may be influenced to purchase a less expensive and lower quality product when they otherwise would have purchased a higher quality product that exceeds the specified price threshold. Low price caps can also disadvantage goods from small businesses whose prices may be higher.

The compliance costs associated with sales tax holidays are further damaging to small businesses. Additional short-term staffing is often necessary to handle the induced spikes in demand (which represents a concentration of purchases during a particular time period, not necessarily a desirable overall increase), and that can be harder to schedule for businesses with fewer employees. Moreover, small businesses may find it more difficult to absorb the spending slowdowns in the weeks immediately before and after sales tax holidays, as consistent revenue is more important when margins are thin. Even if overall revenue remains only slightly changed, the timing distortions can be painful. Additionally, the work required to comply with sales tax holiday provisions (e.g., determining which products qualify for exemption and changing cash register settings in accordance) can be especially difficult for small businesses, which are often unable to sustain entire teams dedicated to legal compliance.

Sales tax holiday structures vary widely from state to state, exacerbating these compliance difficulties. Beyond the differences in product lists and price caps, different states treat shipping, handling, layaway sales, and “rain check” sales differently. The difficult task of compliance must often be done on short notice, because details sometimes aren’t agreed to until just weeks before holidays are scheduled to take place.

For example, traditionally, Florida’s sales tax holidays have not recurred automatically but have been renewed (and often modified) each year, typically through the state budget. While they are often reauthorized, this is not guaranteed. For example, this year, the legislature did not include the Freedom Month sales tax holiday in the budget, which was signed just one day before the exemption for certain outdoor activity supplies would have typically begun. This kind of uncertainty and last-minute decision-making can disrupt planning for both retailers and consumers, limiting the intended economic boost, especially when shoppers are unsure whether the holiday will even occur. However, with the enactment of H.B. 7031 on June 30, Florida made permanent its back-to-school sales tax holiday for the month of August and also created permanent year-round sales tax exemptions, to take effect August 1, 2025, for some of the goods and services that were previously included in Florida’s disaster preparedness and “Freedom Summer” sales tax holidays.

For small online retailers selling into states with sales tax holidays, compliance can be a nightmare. There are legal consequences for over-collecting sales tax from consumers, so last-minute sales tax holiday legislative decisions force sellers to scramble to make sales tax determinations on an evolving range of products, and often with definitions that require careful product-by-product eligibility judgments.

Some businesses thrive on sales tax holidays while others struggle to comply with them. Some consumers benefit from them while others might be inadvertently hurt by them. Sales tax holidays pick winners and losers—and their costs aren’t offset by any meaningful economic benefit.

While most sales tax holidays impose steep compliance burdens on retailers, Nevada’s holiday, uniquely, imposes steep administrative burdens on the few Nevada residents who are eligible to take advantage of it. Specifically, Nevada offers a narrowly targeted sales tax holiday exclusively for members of the Nevada National Guard and qualifying relatives. Until 2023, eligible individuals were required to present to retailers a copy of an eligibility letter that they had applied for through their National Guard unit at least 45 days in advance of the holiday, and retailers were required to offer the exemption at the time of sale.

However, with the adoption of SB 50 in 2023, the process has been amended such that retailers no longer offer the exemption at the time of sale. Instead, to participate in the sales tax holiday, eligible individuals must request an exemption letter from their National Guard unit at least 45 days before the holiday and pay the sales tax during the holiday. After paying the sales tax during the holiday, eligible individuals must submit to the Department of Taxation a request for a refund of sales taxes paid, a copy of the letter of exemption that they received from the National Guard, and the receipt issued by the retailer indicating that they paid the tax. Only after completing this process may Nevada National Guard members and qualifying relatives receive their refund and benefit from the sales tax holiday. While the previous system was more burdensome for retailers, the new system is burdensome and inefficient for taxpayers and likely discourages many qualifying individuals from taking advantage of the exemption, especially on smaller purchases.

From a political standpoint, sales tax holidays are harmful because they create space for politicians and regulators to pick political favorites in the process of selecting eligible products. They also pave the way for lobbyists to solicit policymakers in hopes of securing a sales tax holiday for their products. Because small retail businesses often lack resources for lobbying, and because there is no way for legislators to perfectly know what consumers want, the lists of goods included in tax holidays can become an unholy matrimony of centralized economic planning and corporate lobbying. Any decision about which goods are and aren’t exempt will discriminate against some consumers.

Overall, sales tax holidays are an inefficient vehicle for providing tax relief or generating additional economic activity. They often end up hurting the taxpayers they intend to help. They inject unnecessary instability into government and business revenue streams; create administrative and compliance costs for businesses, governments, and consumers; and do not promote long-term economic growth. Several states realized these downfalls and accordingly abandoned their sales tax holidays in recent years. However, their electoral utility remains an incentive for policymakers, and with 19 states offering sales tax holidays in 2025—matching peak historic levels—it doesn’t look like they’re going away anytime soon.

For a more detailed analysis of the arguments for and against sales tax holidays, see our 2022 full-length report

2025 Sales Tax Holidays by State

2025 Alabama Sales Tax Holidays

- February 21-23 – Severe Weather Preparedness

- Portable generators and power cords (single purchase of $1,000 or less)

- Severe weather preparedness supplies ($60 or less per item)

- July 18–20 – Back to School

- Books ($30 or less per book)

- Clothing ($100 or less per item)

- Computers, computer software, and school computer supplies (single purchase of $750 or less)

- School supplies, school art supplies, and school instructional material ($50 or less per item)

2025 Alaska Sales Tax Holiday*

- October 1, 2024 – March 31, 2025

- All retail sales*

*Alaska does not assess a state sales tax. However, the state constitution allows municipalities, defined as cities and boroughs, to assess a local option sales tax. Only one municipality, the Skagway Borough, passed a resolution enacting a local sales tax holiday from October 1, 2024, to March 31, 2025.

2025 Arkansas Sales Tax Holiday

- August 2-3

- Clothing (less than $100 per item)

- Accessories and cosmetics (less than $50 per item)

- Electronic devices (no cap)

- School supplies, school art supplies, and school instructional materials (no cap)

2025 Connecticut Sales Tax Holiday

- August 17-23

- Clothing, footwear (less than $100 per item)

2025 Florida Sales Tax Holiday

- August 1-31 – Back to School

- Computers and related accessories ($1,500 or less per item)

- Clothing, footwear, and accessories ($100 or less per item)

- School supplies ($50 or less per item)

- Learning aids and jigsaw puzzles ($30 or less per item)

- September 8 – December 31 – Hunting, Fishing, and Camping

- Firearms, ammunition, and hunting supplies (no cap)

- Bait and tackle ($5 or less per item; $10 or less if multiple items sold together)

- Flashlights, lanterns, and tackle boxes/bags ($30 or less per item)

- Camping stoves, chairs, hammocks, and sleeping bags ($50 or less per item)

- Rods and reels ($75 or less per item; $150 or less if sold as a set)

- Tents ($200 or less per item)

2025 Iowa Sales Tax Holiday

- August 1-2

- Clothing and footwear (less than $100 per item)

2025 Louisiana Sales Tax Holiday

- September 5-7

- Firearms, ammunition, and hunting supplies (no cap)

2025 Maryland Sales Tax Holiday

- February 15-17

- Solar water heaters, ENERGYSTAR products (no cap)

- August 10-16

- Clothing and footwear ($100 or less per item)

- Backpacks and bookbags (first $40 is sales tax-free)

2025 Massachusetts Sales Tax Holiday

- August 9-10

- All retail purchases by individuals of tangible personal property* ($2,500 or less per item)

*Exclusions include meals, motor vehicles, motorboats, telecommunication services, gas, steam, electricity, tobacco products, marijuana or marijuana products, alcoholic beverages, layaway sales, and rentals for longer than 30 days.

2025 Mississippi Sales Tax Holiday

- July 11-13

- Clothing and footwear (less than $100 per item)

- School supplies (less than $100 per item)

- August 29-31

- Firearms, ammunition, hunting supplies, and firearm safety equipment excluding safes (no cap)

2025 Missouri Sales Tax Holiday

- April 19-25

- ENERGY STAR products (first $1,500 is tax-free)

- August 1-3

- Clothing ($100 or less per item)

- School supplies ($50 or less per purchase)

- Computer software ($350 or less per item)

- Personal computers and related accessories ($1,500 or less per item)

- Graphing calculators ($150 or less per item)

2025 Nevada Sales Tax Holiday

- October 31-November 2

- All purchases by Nevada National Guard members and qualifying relatives.* Must apply for exemption a minimum of thirty days in advance.

*Nevada amended its state sales tax holiday provisions for National Guard members through SB 50, enacted in 2023. Under prior law, Nevada businesses selling qualified goods and services during the sales tax holiday exempted the qualifying goods and services from the state sales tax. Since the 2023 state sales tax holiday, consumers must first pay the sales tax, then submit three separate documents to receive a refund of the sales tax. This introduces inefficiencies and reduces the likelihood that eligible individuals will go through the trouble of filing to receive the small benefit the state sales tax holiday provides.

2025 New Mexico Sales Tax Holiday

- July 25-27

- Bookbags, maps, and globes (less than $100 per item)

- Clothing and footwear (less than $100 per item)

- Computers and tablets ($1,000 or less per item)

- Computer-related accessories ($500 or less per item)

- School supplies (less than $30 per item)

- Calculators (less than $200 per item)

2025 Ohio Sales Tax Holiday

- August 1-14

- All tangible personal property ($500 or less per item)

- Exclusions include watercraft or outboard motors required to be titled, alcoholic beverages, tobacco, tobacco products, marijuana, and vapor products.

2025 Oklahoma Sales Tax Holiday

- August 1-3

- Clothing and footwear (less than $100 per item)

2025 South Carolina Sales Tax Holiday

- August 1-3

- Clothing, clothing accessories, and footwear (no cap)

- Computers, printers, printer supplies, software (no cap)

- School supplies (no cap)

- Certain bed and bath products (no cap)

2025 Tennessee Sales Tax Holiday

- July 25-27

- Clothing ($100 or less per item)

- Computers, laptops, and tablets ($1,500 or less per item)

- School supplies and art supplies ($100 or less per item)

2025 Texas Sales Tax Holiday

- April 26-28 – Emergency Preparation Supplies

- Hurricane shutters and emergency ladders (less than $300 per item)

- Portable generators (less than $3,000 per item)

- Specific emergency preparedness supplies (less than $75 per item)

- May 24-26 – ENERGY STAR Products

- WaterSense products (no cap)

- Water conserving products (no cap)

- ENERGY STAR air conditioners ($6,000 or less per item)

- ENERGY STAR refrigerators ($2,000 or less per item)

- ENERGY STAR ceiling fans, light bulbs, clothes washers, dishwashers, and dehumidifiers (no cap)

- August 8-10 – Back to School

- Clothing and footwear (less than $100 per item)

- School supplies and backpacks (less than $100 per item)

2025 Virginia Sales Tax Holiday

- August 1-3

- Clothing and footwear ($100 or less per item)

- ENERGY STAR and WaterSense products ($2,500 or less per item)

- Gas-powered chainsaws ($350 or less per item)

- Portable generators ($1,000 or less per item)

- School supplies ($20 or less per item)

- Chainsaw accessories and hurricane preparedness items ($60 or less per item)

2025 West Virginia Sales Tax Holiday

- August 1-4

- Clothing and footwear ($125 or less per item)

- Laptops and tablets ($500 or less per item)

- School instructional materials ($20 or less per item)

- School supplies ($50 or less per item)

- Sports equipment ($150 or less per item)