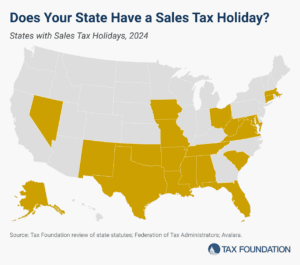

Sales Tax Holidays by State, 2024

However well-intended they may be, sales tax holidays remain the same as they always have been—ineffective and inefficient.

11 min readJoseph Johns is a State Tax Policy Analyst with the Tax Foundation.

Johns focused his research on taxes and spending while at a nearby think tank and has worked alongside various nonprofits in the Washington, D.C. area. He graduated from George Mason University in 2021 as an MA Fellow at the Mercatus Center, where he assisted Mercatus scholars with state-level economic research. He currently lives in Central Arkansas and enjoys outdoor activities and spending time with friends.

However well-intended they may be, sales tax holidays remain the same as they always have been—ineffective and inefficient.

11 min read

The proposal is a good example of what can be done to reduce tax burdens on residents if spending is constrained. There are real, tangible benefits associated with enacting this pro-growth reform that should not be discounted.

5 min read

Governor Sarah Huckabee Sanders (R) recently called a brief special legislative session to enact the fourth round of reductions to the Natural State’s individual and corporate income taxes. Legislators also passed a modest property tax reform proposal.

4 min read

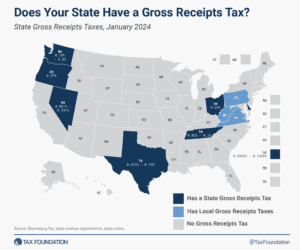

Gross receipts taxes impose costs on consumers, workers, and shareholders alike. Shifting from these economically damaging taxes can thus be a part of states’ plans for improving their tax codes in an increasingly competitive tax landscape.

7 min read

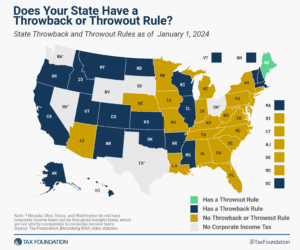

States have generally tried to encourage capital investment. Throwback and throwout rules are an unfortunate example of penalizing it.

4 min read