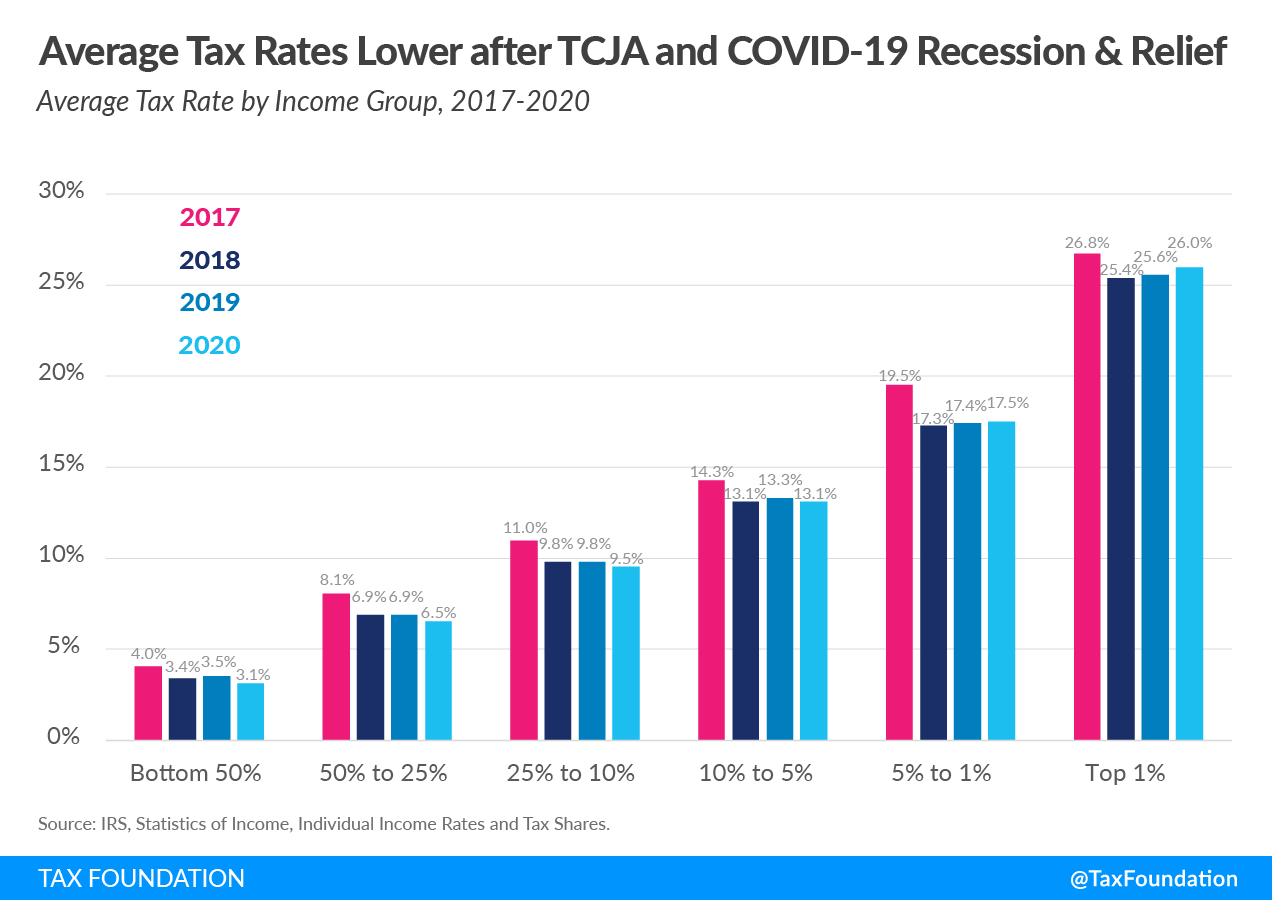

New Internal Revenue Service (IRS) data on individual income taxes for taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. year 2020 shows the federal income tax system continues to be progressive as high-income taxpayers pay the highest average income tax rates.[1] Average tax rates for all income groups remained lower in 2020, three years after the Tax Cuts and Jobs Act, than they were in 2017 prior to the reform.

- In 2020, taxpayers filed 157.5 million tax returns, reported earning nearly $12.5 trillion in adjusted gross income (AGI), and paid $1.7 trillion in individual income taxes.

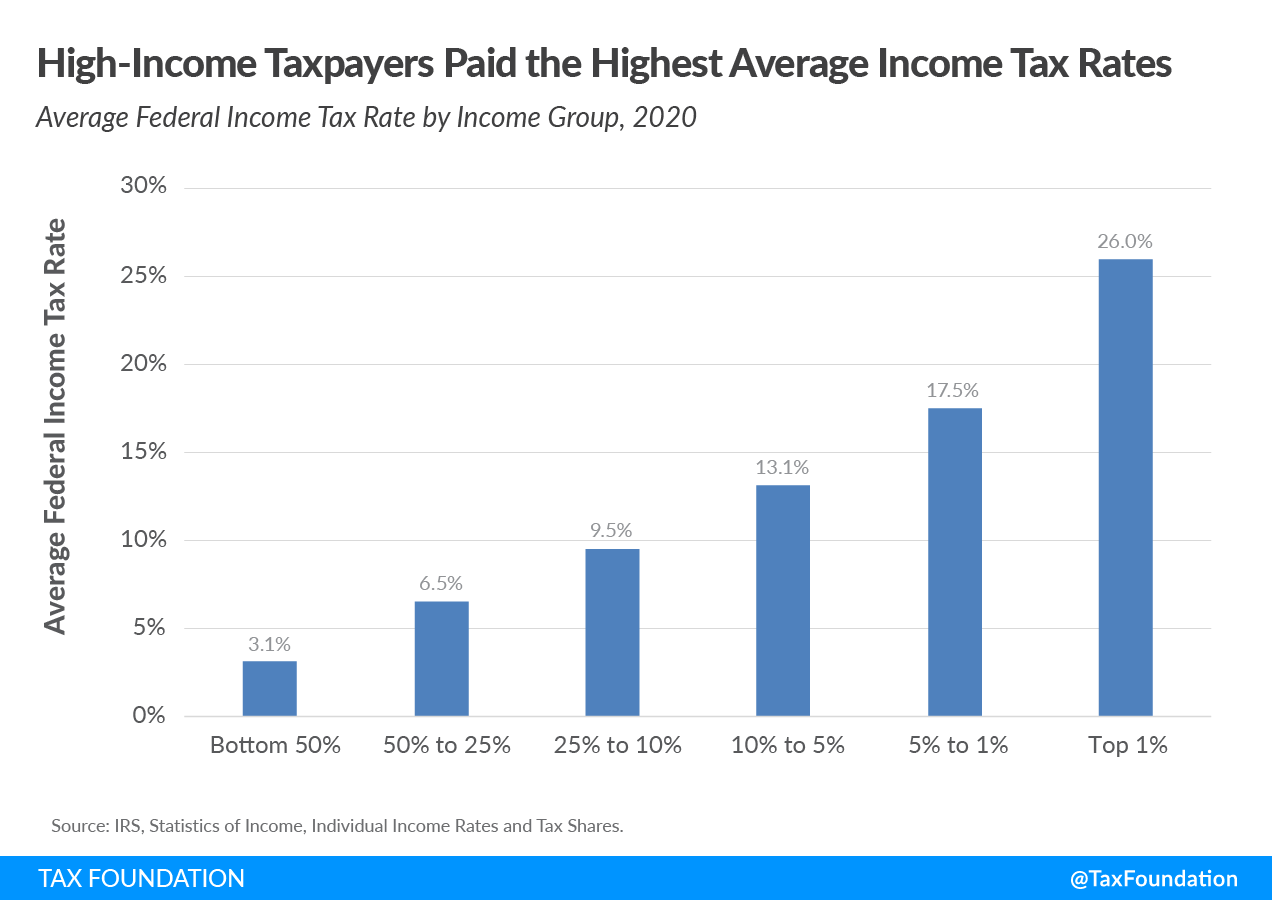

- The average income tax rate in 2020 was 13.6 percent. The top 1 percent of taxpayers paid a 25.99 percent average rate, more than eight times higher than the 3.1 percent average rate paid by the bottom half of taxpayers.

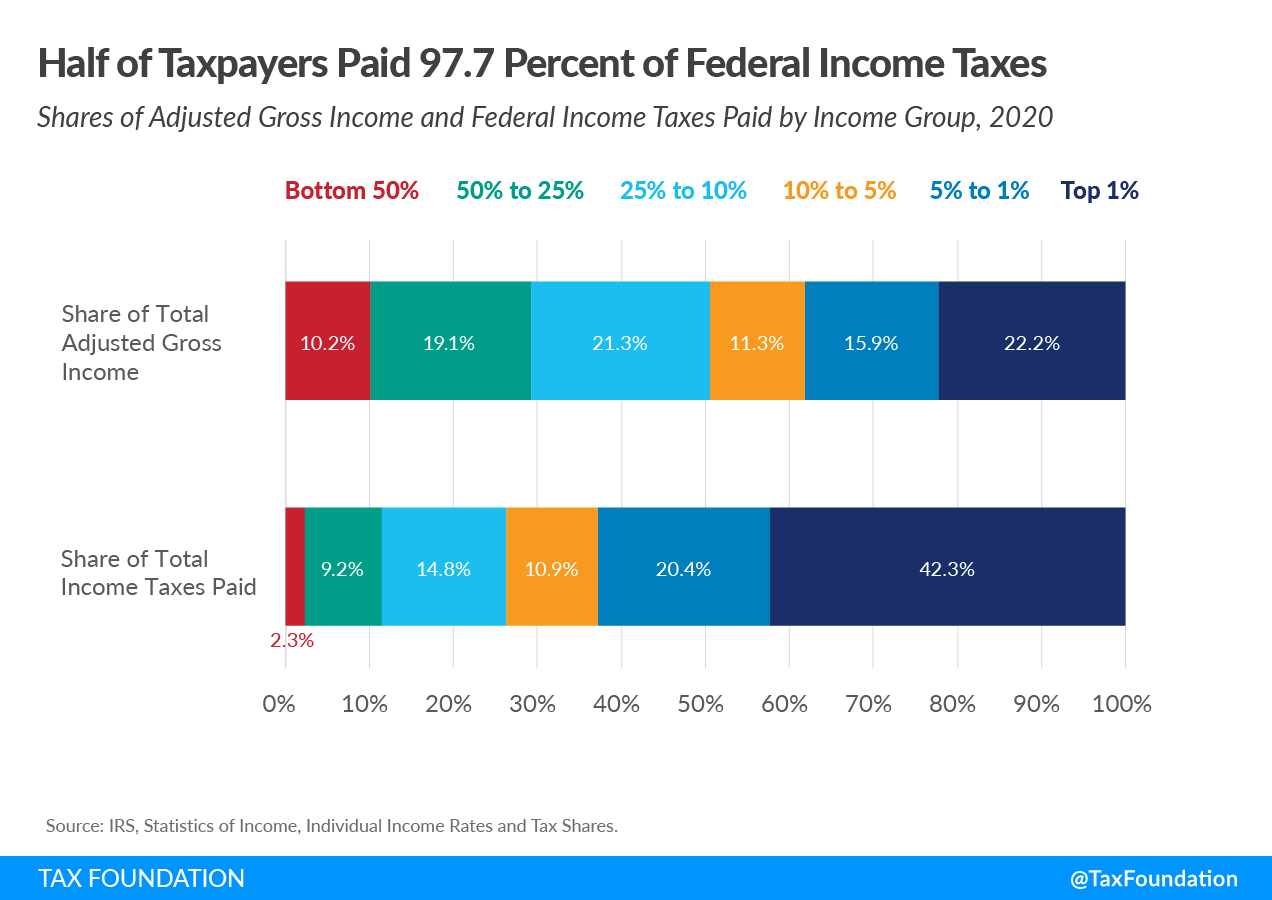

- The top 1 percent’s income share rose from 20.1 percent in 2019 to 22.2 percent in 2020 and its share of federal income taxes paid rose from 38.8 percent to 42.3 percent.

- The top 50 percent of all taxpayers paid 97.7 percent of all federal individual income taxes, while the bottom 50 percent paid the remaining 2.3 percent.

- The 2020 figures include pandemic-related tax items such as the non-refundable part of the first two rounds of Recovery Rebates and the $10,200 unemployment compensation exclusion.

Reported Income and Taxes Paid Increased in Tax Year 2020

Taxpayers reported more than $12.5 trillion in AGI on 157.5 million tax returns in 2020, an increase of $650 million in AGI and 9.3 million in returns above 2019.[2] Total income taxes paid rose by $129 billion to $1.7 trillion, an 8 percent increase above 2019. The average individual income tax rate inched up slightly from 13.29 percent in 2019 to 13.63 percent in 2020.

| Top 1% | Top 5% | Top 10% | Top 25% | Top 50% | Bottom 50% | All Taxpayers | |

|---|---|---|---|---|---|---|---|

| Number of Returns | 1,574,942 | 7,874,712 | 15,749,424 | 39,373,561 | 78,747,121 | 78,747,121 | 157,494,242 |

| Average Tax Rate | 26.0% | 22.4% | 20.3% | 17.1% | 14.8% | 3.1% | 13.6% |

| Average Income Taxes Paid | $458,894 | $136,091 | $79,897 | $38,396 | $21,187 | $504 | $10,845 |

| Adjusted Gross Income ($ millions) | $2,780,754 | $4,775,995 | $6,198,022 | $8,862,578 | $11,257,092 | $1,276,009 | $12,533,102 |

| Share of Total Adjusted Gross Income | 22.2% | 38.1% | 49.5% | 70.7% | 89.8% | 10.2% | 100.0% |

| Income Taxes Paid ($ millions) | $722,732 | $1,071,681 | $1,258,335 | $1,511,786 | $1,668,410 | $39,671 | $1,708,081 |

| Share of Total Income Taxes Paid | 42.3% | 62.7% | 73.7% | 88.5% | 97.7% | 2.3% | 100.0% |

| Income Split Point | $548,336 | $220,521 | $152,321 | $85,853 | $42,184 | $42,184 | |

| Source: IRS, Statistics of Income, ”Individual Income Rates and Tax Shares.” | |||||||

Because the Office of Management and Budget (OMB) classifies the refundable part of tax credits as spending, the IRS does not include it in tax share figures. The result overstates the tax burden of the bottom half of taxpayers.

Pandemic-Related Downturn and Relief Programs

The pandemic-related downturn and relief programs both affect the 2020 data. The recessionA recession is a significant and sustained decline in the economy. Typically, a recession lasts longer than six months, but recovery from a recession can take a few years. caused financial hardships for many lower- and middle-income households. Between 2019 and 2020, AGI dropped by 6.6 percent for the bottom half of taxpayers, while it increased by 7 percent for the top half of taxpayers. As unemployment rose to record highs, lawmakers expanded unemployment benefits beginning in early 2020 and created a $10,200 income tax exclusion for the 2020 tax year, available to taxpayers with modified AGI below $150,000.[3]

Two rounds of Recovery Rebates also reduced tax liability for qualifying taxpayers.[4] The first round of payments provided $1,200 for single filers, $2,400 for joint filers, and $500 for each qualifying child. The second provided $600 for single filers, $1,200 for joint filers, and $600 for each qualifying child. Credit amounts began phasing out at $75,000 for single filers, $112,500 for head of household filers, and $150,000 for joint filers.

The income dip for the bottom half of taxpayers combined with the tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. boost unavailable to higher-income households led to lower average tax rates at the bottom and a greater share of taxes borne by households at the top, compared to a typical year.

High-Income Taxpayers Paid the Highest Average Income Tax Rates

In 2020, taxpayers with higher incomes paid much higher average income tax rates than taxpayers with lower incomes.[5]

The bottom half of taxpayers, or taxpayers making under $42,184, faced an average income tax rate of 3.1 percent. As household income increases, average income tax rates rise. For example, taxpayers with AGI between the 10th and 5th percentiles ($152,321 and $220,521) paid an average income tax rate of 13.3 percent—almost four times the rate paid by taxpayers in the bottom half.

The top 1 percent of taxpayers (AGI of $548,336 and above) paid the highest average income tax rate of 25.99 percent—more than eight times the rate faced by the bottom half of taxpayers.

High-Income Taxpayers Paid the Majority of Federal Income Taxes

In 2020, the bottom half of taxpayers earned 10.2 percent of total AGI and paid 2.3 percent of all federal individual income taxes. The top 1 percent earned 22.2 percent of total AGI and paid 42.3 percent of all federal income taxes.

In all, the top 1 percent of taxpayers accounted for more income taxes paid than the bottom 90 percent combined. The top 1 percent of taxpayers paid $723 billion in income taxes while the bottom 90 percent paid $450 billion.

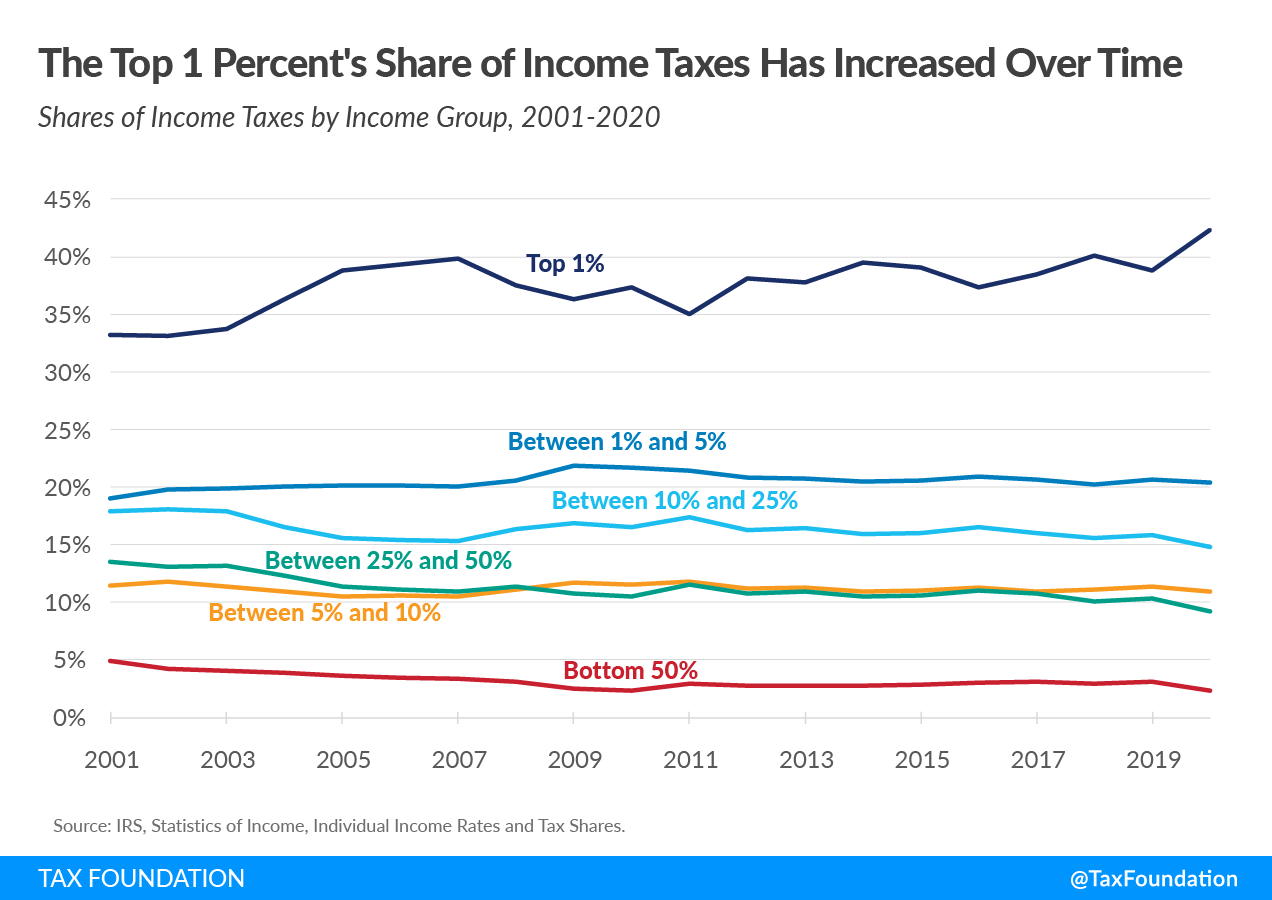

The share of income taxes paid by the top 1 percent increased from 33.2 percent in 2001 to 42.3 percent in 2020. Over the same period, the share paid by the bottom 50 percent of taxpayers fell from 4.9 percent to just over 2.3 percent in 2020.

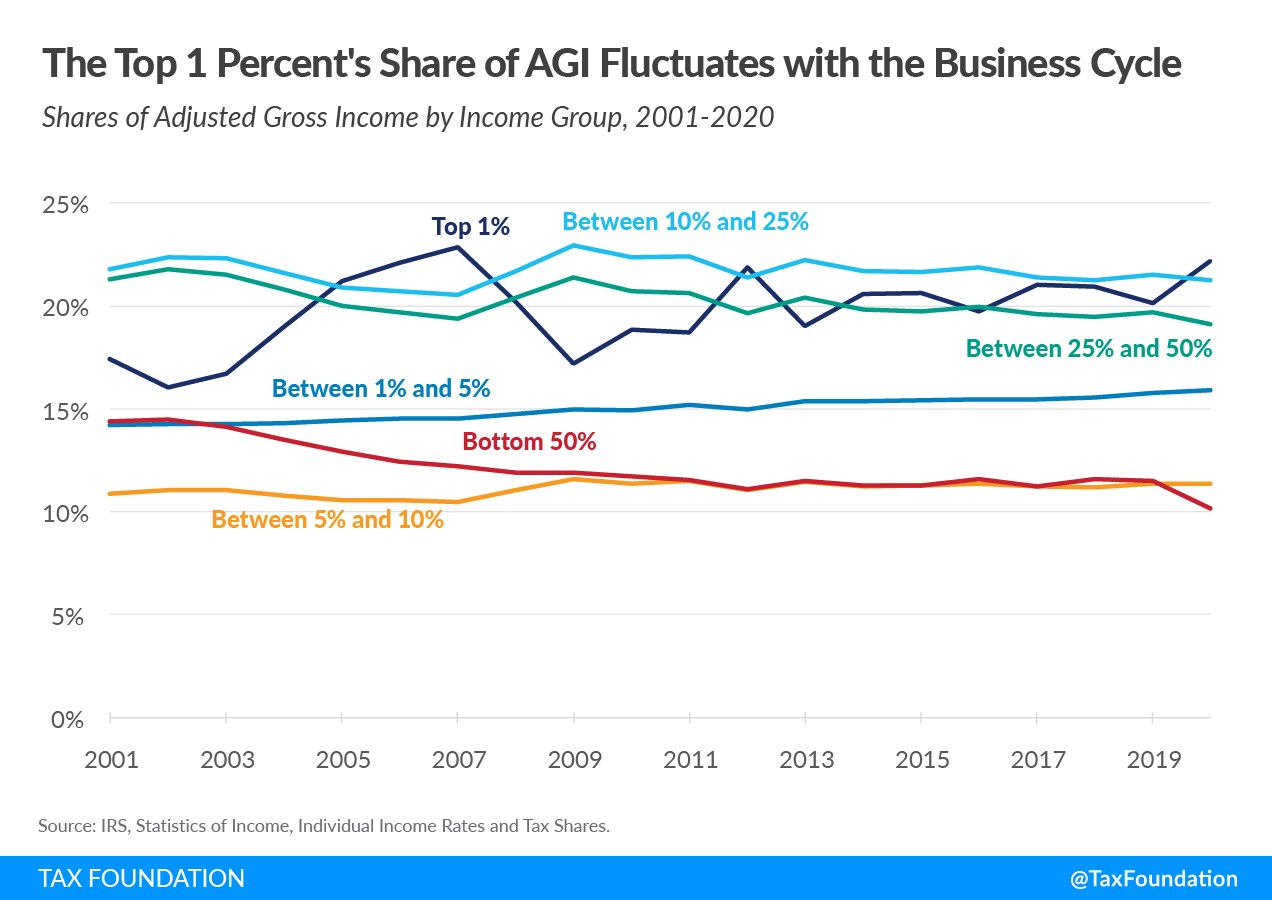

Similarly, the share of adjusted gross incomeFor individuals, gross income is the total pre-tax earnings from wages, tips, investments, interest, and other forms of income and is also referred to as “gross pay.” For businesses, gross income is total revenue minus cost of goods sold and is also known as “gross profit” or “gross margin.” reported by the top 1 percent increased from 20.1 percent in 2019 to 22.2 percent in 2020. The AGI share of the top 1 percent fluctuates considerably over the business cycle, tending to rise and fall to a greater extent than income reported by other groups. The share of AGI reported by the bottom 50 percent of taxpayers fell from 14.4 percent in 2001 to 10.2 percent in 2020.

The Tax Cuts and Jobs Act Reduced Average Tax Rates Across Income Groups

The 2020 tax year was the third since the Tax Cuts and Jobs Act (TCJA). The TCJA made many significant, but temporary, changes to the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. code to lower tax rates, widen brackets, increase the standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing their federal income taxes. and child tax credit, and more. The changes lowered tax burdens, on average, for taxpayers across all income levels. In 2020, lower-income taxpayers reported lower incomes due to the pandemic-induced recession, and lawmakers provided relief in the form of Recovery Rebate tax credits.

In 2020, individual taxpayers paid $1.7 trillion in individual income taxes. Compared to 2017, taxpayers paid $107 billion more in taxes while reporting nearly $1.6 trillion more in income. Average tax rates were lower in 2019 than in 2017 across all income groups. Average rates for the bottom 50 percent fell from 4.05 percent in 2017 to 3.11 percent in 2020; for the top 1 percent, they fell from 26.76 percent to 25.99 percent.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeAppendix

- For data prior to 2001, all tax returns that have a positive AGI are included, even those that do not have a positive income tax liability. For data from 2001 forward, returns with negative AGI are also included, but dependent returns are excluded.

- Income tax after credits (the measure of “income taxes paid” above) does not account for the refundable portion of tax credits such as the Earned Income Tax Credit. If the refundable portion were included, the tax share of the top income groups would be higher and the average tax rateThe average tax rate is the total tax paid divided by taxable income. While marginal tax rates show the amount of tax paid on the next dollar earned, average tax rates show the overall share of income paid in taxes. of bottom income groups would be lower. The refundable portion is classified as a spending program by the Office of Management and Budget (OMB) and therefore is not included by the IRS in these figures.

- The only tax analyzed here is the federal individual income tax, which is responsible for more than 25 percent of the nation’s taxes paid (at all levels of government). Federal income taxes are much more progressive than federal payroll taxes, which are responsible for about 20 percent of all taxes paid (at all levels of government), and are more progressive than most state and local taxes.

- AGI is a fairly narrow income concept and does not include income items like government transfers (except for the portion of Social Security benefits that is taxed), the value of employer-provided health insurance, underreported or unreported income (most notably that of sole proprietors), income derived from municipal bond interest, net imputed rental income, and others.

- The unit of analysis here is the tax return. In the figures prior to 2001, some dependent returns are included. Under other units of analysis (like the U.S. Treasury Department’s Family Economic Unit), these returns would likely be paired with parents’ returns.

- These figures represent the legal incidence of the income tax. Most distributional tables (such as those from the Congressional Budget Office, the Tax Policy Center, Citizens for Tax Justice, the Treasury Department, and the Joint Committee on Taxation) assume that the entire economic incidence of personal income taxes falls on the income earner.

| Year | Total | Top 0.1% | Top 1% | Between 1% and 5% | Top 5% | Between 5% and 10% | Top 10% | Between 10% and 25% | Top 25% | Between 25% and 50% | Top 50% | Bottom 50% |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1981 | 94,587 | 946 | 3,783 | 4,729 | 4,729 | 9,459 | 14,188 | 23,647 | 23,647 | 47,293 | 47,293 | |

| 1982 | 94,426 | 944 | 3,777 | 4,721 | 4,721 | 9,443 | 14,164 | 23,607 | 23,607 | 47,213 | 47,213 | |

| 1983 | 95,331 | 953 | 3,814 | 4,767 | 4,767 | 9,533 | 14,300 | 23,833 | 23,833 | 47,665 | 47,665 | |

| 1984 | 98,436 | 984 | 3,938 | 4,922 | 4,922 | 9,844 | 14,765 | 24,609 | 24,609 | 49,218 | 49,219 | |

| 1985 | 100,625 | 1,006 | 4,025 | 5,031 | 5,031 | 10,063 | 15,094 | 25,156 | 25,156 | 50,313 | 50,313 | |

| 1986 | 102,088 | 1,021 | 4,083 | 5,104 | 5,104 | 10,209 | 15,313 | 25,522 | 25,522 | 51,044 | 51,044 | |

| The Tax Reform Act of 1986 changed the definition of AGI, so data above and below this line is not strictly comparable. | ||||||||||||

| 1987 | 106,155 | 1,062 | 4,246 | 5,308 | 5,308 | 10,615 | 15,923 | 26,539 | 26,539 | 53,077 | 53,077 | |

| 1988 | 108,873 | 1,089 | 4,355 | 5,444 | 5,444 | 10,887 | 16,331 | 27,218 | 27,218 | 54,436 | 54,436 | |

| 1989 | 111,313 | 1,113 | 4,453 | 5,566 | 5,566 | 11,131 | 16,697 | 27,828 | 27,828 | 55,656 | 55,656 | |

| 1990 | 112,812 | 1,128 | 4,513 | 5,641 | 5,641 | 11,281 | 16,922 | 28,203 | 28,203 | 56,406 | 56,406 | |

| 1991 | 113,804 | 1,138 | 4,552 | 5,690 | 5,690 | 11,380 | 17,071 | 28,451 | 28,451 | 56,902 | 56,902 | |

| 1992 | 112,653 | 1,127 | 4,506 | 5,633 | 5,633 | 11,265 | 16,898 | 28,163 | 28,163 | 56,326 | 56,326 | |

| 1993 | 113,681 | 1,137 | 4,547 | 5,684 | 5,684 | 11,368 | 17,052 | 28,420 | 28,420 | 56,841 | 56,841 | |

| 1994 | 114,990 | 1,150 | 4,599 | 5,749 | 5,749 | 11,499 | 17,248 | 28,747 | 28,747 | 57,495 | 57,495 | |

| 1995 | 117,274 | 1,173 | 4,691 | 5,864 | 5,864 | 11,727 | 17,591 | 29,319 | 29,319 | 58,637 | 58,637 | |

| 1996 | 119,442 | 1,194 | 4,778 | 5,972 | 5,972 | 11,944 | 17,916 | 29,860 | 29,860 | 59,721 | 59,721 | |

| 1997 | 121,503 | 1,215 | 4,860 | 6,075 | 6,075 | 12,150 | 18,225 | 30,376 | 30,376 | 60,752 | 60,752 | |

| 1998 | 123,776 | 1,238 | 4,951 | 6,189 | 6,189 | 12,378 | 18,566 | 30,944 | 30,944 | 61,888 | 61,888 | |

| 1999 | 126,009 | 1,260 | 5,040 | 6,300 | 6,300 | 12,601 | 18,901 | 31,502 | 31,502 | 63,004 | 63,004 | |

| 2000 | 128,227 | 1,282 | 5,129 | 6,411 | 6,411 | 12,823 | 19,234 | 32,057 | 32,057 | 64,114 | 64,114 | |

| The IRS changed methodology, so data above and below this line is not strictly comparable. | ||||||||||||

| 2001 | 119,371 | 119 | 1,194 | 4,775 | 5,969 | 5,969 | 11,937 | 17,906 | 29,843 | 29,843 | 59,685 | 59,685 |

| 2002 | 119,851 | 120 | 1,199 | 4,794 | 5,993 | 5,993 | 11,985 | 17,978 | 29,963 | 29,963 | 59,925 | 59,925 |

| 2003 | 120,759 | 121 | 1,208 | 4,830 | 6,038 | 6,038 | 12,076 | 18,114 | 30,190 | 30,190 | 60,379 | 60,379 |

| 2004 | 122,510 | 123 | 1,225 | 4,900 | 6,125 | 6,125 | 12,251 | 18,376 | 30,627 | 30,627 | 61,255 | 61,255 |

| 2005 | 124,673 | 125 | 1,247 | 4,987 | 6,234 | 6,234 | 12,467 | 18,701 | 31,168 | 31,168 | 62,337 | 62,337 |

| 2006 | 128,441 | 128 | 1,284 | 5,138 | 6,422 | 6,422 | 12,844 | 19,266 | 32,110 | 32,110 | 64,221 | 64,221 |

| 2007 | 132,655 | 133 | 1,327 | 5,306 | 6,633 | 6,633 | 13,265 | 19,898 | 33,164 | 33,164 | 66,327 | 66,327 |

| 2008 | 132,892 | 133 | 1,329 | 5,316 | 6,645 | 6,645 | 13,289 | 19,934 | 33,223 | 33,223 | 66,446 | 66,446 |

| 2009 | 132,620 | 133 | 1,326 | 5,305 | 6,631 | 6,631 | 13,262 | 19,893 | 33,155 | 33,155 | 66,310 | 66,310 |

| 2010 | 135,033 | 135 | 1,350 | 5,402 | 6,752 | 6,752 | 13,503 | 20,255 | 33,758 | 33,758 | 67,517 | 67,517 |

| 2011 | 136,586 | 137 | 1,366 | 5,463 | 6,829 | 6,829 | 13,659 | 20,488 | 34,146 | 34,146 | 68,293 | 68,293 |

| 2012 | 136,080 | 136 | 1,361 | 5,443 | 6,804 | 6,804 | 13,608 | 20,412 | 34,020 | 34,020 | 68,040 | 68,040 |

| 2013 | 138,313 | 138 | 1,383 | 5,533 | 6,916 | 6,916 | 13,831 | 20,747 | 34,578 | 34,578 | 69,157 | 69,157 |

| 2014 | 139,562 | 140 | 1,396 | 5,582 | 6,978 | 6,978 | 13,956 | 20,934 | 34,891 | 34,891 | 69,781 | 69,781 |

| 2015 | 141,205 | 141 | 1,412 | 5,648 | 7,060 | 7,060 | 14,120 | 21,181 | 35,301 | 35,301 | 70,602 | 70,602 |

| 2016 | 140,889 | 141 | 1,409 | 5,636 | 7,044 | 7,044 | 14,089 | 21,133 | 35,222 | 35,222 | 70,444 | 70,444 |

| 2017 | 143,295 | 143 | 1,433 | 5,732 | 7,165 | 7,165 | 14,330 | 21,494 | 35,824 | 35,824 | 71,648 | 71,648 |

| 2018 | 144,318 | 144 | 1,443 | 5,773 | 7,216 | 7,216 | 14,432 | 21,648 | 36,079 | 36,079 | 72,159 | 72,159 |

| 2019 | 148,246 | 148 | 1,482 | 5,930 | 7,412 | 7,412 | 14,825 | 22,237 | 37,061 | 37,061 | 74,123 | 74,123 |

| 2020 | 157,494 | 157 | 1,575 | 6,300 | 7,875 | 7,875 | 15,749 | 23,624 | 39,374 | 39,374 | 78,747 | 78,747 |

| Source: IRS, Statistics of Income, Individual Income Rates and Tax Shares (2020). | ||||||||||||

| Year | Total | Top 0.1% | Top 1% | Between 1% and 5% | Top 5% | Between 5% & 10% | Top 10% | Between 10% & 25% | Top 25% | Between 25% & 50% | Top 50% | Bottom 50% |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1980 | $1,627 | $138 | $204 | $342 | $181 | $523 | $400 | $922 | $417 | $1,339 | $288 | |

| 1981 | $1,791 | $149 | $223 | $372 | $201 | $573 | $442 | $1,015 | $458 | $1,473 | $318 | |

| 1982 | $1,876 | $167 | $231 | $398 | $207 | $605 | $460 | $1,065 | $478 | $1,544 | $332 | |

| 1983 | $1,970 | $183 | $245 | $428 | $217 | $646 | $481 | $1,127 | $498 | $1,625 | $344 | |

| 1984 | $2,173 | $210 | $272 | $482 | $240 | $723 | $528 | $1,251 | $543 | $1,794 | $379 | |

| 1985 | $2,344 | $235 | $296 | $531 | $260 | $791 | $567 | $1,359 | $580 | $1,939 | $405 | |

| 1986 | $2,524 | $285 | $323 | $608 | $278 | $887 | $604 | $1,490 | $613 | $2,104 | $421 | |

| The Tax Reform Act of 1986 changed the definition of AGI, so data above and below this line is not strictly comparable. | ||||||||||||

| 1987 | $2,814 | $347 | $375 | $722 | $316 | $1,038 | $671 | $1,709 | $664 | $2,374 | $440 | |

| 1988 | $3,124 | $474 | $417 | $891 | $342 | $1,233 | $718 | $1,951 | $707 | $2,658 | $466 | |

| 1989 | $3,299 | $468 | $450 | $918 | $368 | $1,287 | $768 | $2,054 | $751 | $2,805 | $494 | |

| 1990 | $3,451 | $483 | $470 | $953 | $385 | $1,338 | $806 | $2,144 | $788 | $2,933 | $519 | |

| 1991 | $3,516 | $457 | $486 | $943 | $400 | $1,343 | $832 | $2,175 | $809 | $2,984 | $532 | |

| 1992 | $3,681 | $524 | $507 | $1,031 | $413 | $1,444 | $856 | $2,299 | $832 | $3,131 | $549 | |

| 1993 | $3,776 | $521 | $527 | $1,048 | $426 | $1,474 | $883 | $2,358 | $854 | $3,212 | $563 | |

| 1994 | $3,961 | $547 | $556 | $1,103 | $449 | $1,552 | $929 | $2,481 | $890 | $3,371 | $590 | |

| 1995 | $4,245 | $620 | $603 | $1,223 | $482 | $1,705 | $985 | $2,690 | $938 | $3,628 | $617 | |

| 1996 | $4,591 | $737 | $657 | $1,394 | $515 | $1,909 | $1,043 | $2,953 | $992 | $3,944 | $646 | |

| 1997 | $5,023 | $873 | $724 | $1,597 | $554 | $2,151 | $1,116 | $3,268 | $1,060 | $4,328 | $695 | |

| 1998 | $5,469 | $1,010 | $787 | $1,797 | $597 | $2,394 | $1,196 | $3,590 | $1,132 | $4,721 | $748 | |

| 1999 | $5,909 | $1,153 | $859 | $2,012 | $641 | $2,653 | $1,274 | $3,927 | $1,199 | $5,126 | $783 | |

| 2000 | $6,424 | $1,337 | $930 | $2,267 | $688 | $2,955 | $1,358 | $4,314 | $1,276 | $5,590 | $834 | |

| The IRS changed methodology, so data above and below this line is not strictly comparable. | ||||||||||||

| 2001 | $6,116 | $492 | $1,065 | $869 | $1,934 | $666 | $2,600 | $1,334 | $3,933 | $1,302 | $5,235 | $881 |

| 2002 | $5,982 | $421 | $960 | $852 | $1,812 | $660 | $2,472 | $1,339 | $3,812 | $1,303 | $5,115 | $867 |

| 2003 | $6,157 | $466 | $1,030 | $878 | $1,908 | $679 | $2,587 | $1,375 | $3,962 | $1,325 | $5,287 | $870 |

| 2004 | $6,735 | $615 | $1,279 | $964 | $2,243 | $725 | $2,968 | $1,455 | $4,423 | $1,403 | $5,826 | $908 |

| 2005 | $7,366 | $784 | $1,561 | $1,062 | $2,623 | $778 | $3,401 | $1,540 | $4,940 | $1,473 | $6,413 | $953 |

| 2006 | $7,970 | $895 | $1,761 | $1,157 | $2,918 | $841 | $3,760 | $1,652 | $5,412 | $1,568 | $6,980 | $990 |

| 2007 | $8,622 | $1,030 | $1,971 | $1,252 | $3,223 | $905 | $4,128 | $1,770 | $5,898 | $1,673 | $7,571 | $1,051 |

| 2008 | $8,206 | $826 | $1,657 | $1,211 | $2,868 | $905 | $3,773 | $1,782 | $5,555 | $1,673 | $7,228 | $978 |

| 2009 | $7,579 | $602 | $1,305 | $1,134 | $2,439 | $878 | $3,317 | $1,740 | $5,058 | $1,620 | $6,678 | $900 |

| 2010 | $8,040 | $743 | $1,517 | $1,199 | $2,716 | $915 | $3,631 | $1,800 | $5,431 | $1,665 | $7,096 | $944 |

| 2011 | $8,317 | $737 | $1,556 | $1,263 | $2,819 | $956 | $3,775 | $1,866 | $5,641 | $1,716 | $7,357 | $961 |

| 2012 | $9,042 | $1,017 | $1,977 | $1,354 | $3,331 | $997 | $4,328 | $1,934 | $6,262 | $1,776 | $8,038 | $1,004 |

| 2013 | $9,034 | $816 | $1,720 | $1,389 | $3,109 | $1,034 | $4,143 | $2,008 | $6,152 | $1,844 | $7,996 | $1,038 |

| 2014 | $9,709 | $986 | $1,998 | $1,493 | $3,491 | $1,093 | $4,583 | $2,107 | $6,690 | $1,924 | $8,615 | $1,094 |

| 2015 | $10,143 | $1,033 | $2,095 | $1,564 | $3,659 | $1,145 | $4,803 | $2,194 | $6,998 | $2,000 | $8,998 | $1,145 |

| 2016 | $10,157 | $966 | $2,003 | $1,572 | $3,575 | $1,155 | $4,729 | $2,221 | $6,950 | $2,030 | $8,980 | $1,177 |

| 2017 | $10,937 | $1,150 | $2,301 | $1,694 | $3,995 | $1,226 | $5,221 | $2,340 | $7,561 | $2,145 | $9,706 | $1,230 |

| 2018 | $11,564 | $1,197 | $2,420 | $1,798 | $4,218 | $1,293 | $5,511 | $2,458 | $7,969 | $2,253 | $10,222 | $1,342 |

| 2019 | $11,883 | $1,141 | $2,393 | $1,876 | $4,270 | $1,351 | $5,621 | $2,556 | $8,177 | $2,340 | $10,517 | $1,366 |

| 2020 | $12,533 | $1,419 | $2,781 | $1,995 | $4,776 | $1,422 | $6,198 | $2,665 | $8,863 | $2,395 | $11,257 | $1,276 |

| Source: IRS, Statistics of Income, Individual Income Rates and Tax Shares (2020). | ||||||||||||

| Year | Total | Top 0.1% | Top 1% | Between 1% and 5% | Top 5% | Between 5% & 10% | Top 10% | Between 10% & 25% | Top 25% | Between 25% & 50% | Top 50% | Bottom 50% |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1980 | $249 | $47 | $45 | $92 | $31 | $123 | $59 | $182 | $50 | $232 | $18 | |

| 1981 | $282 | $50 | $49 | $99 | $36 | $135 | $69 | $204 | $57 | $261 | $21 | |

| 1982 | $276 | $53 | $47 | $100 | $34 | $134 | $66 | $200 | $56 | $256 | $20 | |

| 1983 | $272 | $55 | $46 | $101 | $34 | $135 | $64 | $199 | $54 | $252 | $19 | |

| 1984 | $297 | $63 | $50 | $113 | $37 | $150 | $68 | $219 | $57 | $276 | $22 | |

| 1985 | $322 | $70 | $55 | $125 | $41 | $166 | $73 | $238 | $60 | $299 | $23 | |

| 1986 | $367 | $94 | $62 | $156 | $44 | $201 | $78 | $279 | $64 | $343 | $24 | |

| The Tax Reform Act of 1986 changed the definition of AGI, so data above and below this line is not strictly comparable. | ||||||||||||

| 1987 | $369 | $92 | $68 | $160 | $46 | $205 | $79 | $284 | $63 | $347 | $22 | |

| 1988 | $413 | $114 | $74 | $188 | $48 | $236 | $85 | $321 | $68 | $389 | $24 | |

| 1989 | $433 | $109 | $81 | $190 | $51 | $241 | $93 | $334 | $73 | $408 | $25 | |

| 1990 | $447 | $112 | $83 | $195 | $52 | $248 | $97 | $344 | $77 | $421 | $26 | |

| 1991 | $448 | $111 | $83 | $194 | $56 | $250 | $96 | $347 | $77 | $424 | $25 | |

| 1992 | $476 | $131 | $87 | $218 | $58 | $276 | $97 | $374 | $78 | $452 | $24 | |

| 1993 | $503 | $146 | $92 | $238 | $60 | $298 | $101 | $399 | $80 | $479 | $24 | |

| 1994 | $535 | $154 | $100 | $254 | $64 | $318 | $108 | $425 | $84 | $509 | $25 | |

| 1995 | $588 | $178 | $110 | $288 | $70 | $357 | $115 | $473 | $88 | $561 | $27 | |

| 1996 | $658 | $213 | $122 | $335 | $76 | $411 | $124 | $535 | $95 | $630 | $28 | |

| 1997 | $727 | $241 | $136 | $377 | $82 | $460 | $134 | $594 | $102 | $696 | $31 | |

| 1998 | $788 | $274 | $151 | $425 | $88 | $513 | $139 | $652 | $103 | $755 | $33 | |

| 1999 | $877 | $317 | $169 | $486 | $97 | $583 | $150 | $733 | $109 | $842 | $35 | |

| 2000 | $981 | $367 | $187 | $554 | $106 | $660 | $164 | $824 | $118 | $942 | $38 | |

| The IRS changed methodology, so data above and below this line is not strictly comparable. | ||||||||||||

| 2001 | $885 | $139 | $294 | $168 | $462 | $101 | $564 | $158 | $722 | $120 | $842 | $43 |

| 2002 | $794 | $120 | $263 | $157 | $420 | $93 | $513 | $143 | $657 | $104 | $761 | $33 |

| 2003 | $746 | $115 | $251 | $148 | $399 | $85 | $484 | $133 | $617 | $98 | $715 | $30 |

| 2004 | $829 | $142 | $301 | $166 | $467 | $91 | $558 | $137 | $695 | $102 | $797 | $32 |

| 2005 | $932 | $176 | $361 | $188 | $549 | $98 | $647 | $145 | $793 | $106 | $898 | $33 |

| 2006 | $1,020 | $196 | $402 | $205 | $607 | $108 | $715 | $157 | $872 | $113 | $986 | $35 |

| 2007 | $1,112 | $221 | $443 | $223 | $666 | $117 | $783 | $170 | $953 | $122 | $1,075 | $37 |

| 2008 | $1,029 | $187 | $386 | $211 | $597 | $115 | $712 | $168 | $880 | $117 | $997 | $32 |

| 2009 | $863 | $146 | $314 | $188 | $502 | $101 | $604 | $146 | $749 | $93 | $842 | $21 |

| 2010 | $949 | $170 | $355 | $206 | $561 | $110 | $670 | $156 | $827 | $100 | $927 | $22 |

| 2011 | $1,043 | $168 | $366 | $223 | $589 | $123 | $712 | $181 | $893 | $120 | $1,012 | $30 |

| 2012 | $1,185 | $220 | $451 | $248 | $699 | $133 | $831 | $193 | $1,024 | $128 | $1,152 | $33 |

| 2013 | $1,232 | $228 | $466 | $255 | $721 | $139 | $860 | $203 | $1,063 | $135 | $1,198 | $34 |

| 2014 | $1,374 | $273 | $543 | $281 | $824 | $150 | $974 | $219 | $1,193 | $144 | $1,337 | $38 |

| 2015 | $1,454 | $284 | $568 | $298 | $866 | $160 | $1,027 | $233 | $1,260 | $154 | $1,413 | $41 |

| 2016 | $1,442 | $261 | $538 | $302 | $840 | $162 | $1,002 | $238 | $1,240 | $159 | $1,399 | $44 |

| 2017 | $1,601 | $310 | $616 | $331 | $947 | $175 | $1,122 | $257 | $1,379 | $173 | $1,552 | $50 |

| 2018 | $1,536 | $311 | $616 | $311 | $926 | $170 | $1,096 | $240 | $1,336 | $155 | $1,491 | $45 |

| 2019 | $1,579 | $298 | $612 | $326 | $938 | $179 | $1,118 | $250 | $1,368 | $162 | $1,530 | $48 |

| 2020 | $1,708 | $377 | $723 | $349 | $1,072 | $187 | $1,258 | $253 | $1,512 | $157 | $1,668 | $40 |

| Source: IRS, Statistics of Income, Individual Income Rates and Tax Shares | ||||||||||||

| Year | Total | Top 0.1% | Top 1% | Between 1% and 5% | Top 5% | Between 5% & 10% | Top 10% | Between 10% & 25% | Top 25% | Between 25% & 50% | Top 50% | Bottom 50% |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1980 | 100% | 8.46% | 12.54% | 21.01% | 11.12% | 32.13% | 24.57% | 56.70% | 25.62% | 82.32% | 17.68% | |

| 1981 | 100% | 8.30% | 12.45% | 20.78% | 11.20% | 31.98% | 24.69% | 56.67% | 25.59% | 82.25% | 17.75% | |

| 1982 | 100% | 8.91% | 12.31% | 21.23% | 11.03% | 32.26% | 24.53% | 56.79% | 25.50% | 82.29% | 17.71% | |

| 1983 | 100% | 9.29% | 12.44% | 21.74% | 11.04% | 32.78% | 24.44% | 57.22% | 25.30% | 82.52% | 17.48% | |

| 1984 | 100% | 9.66% | 12.52% | 22.19% | 11.06% | 33.25% | 24.31% | 57.56% | 25.00% | 82.56% | 17.44% | |

| 1985 | 100% | 10.03% | 12.63% | 22.67% | 11.10% | 33.77% | 24.21% | 57.97% | 24.77% | 82.74% | 17.26% | |

| 1986 | 100% | 11.30% | 12.80% | 24.11% | 11.02% | 35.12% | 23.92% | 59.04% | 24.30% | 83.34% | 16.66% | |

| The Tax Reform Act of 1986 changed the definition of AGI, so data above and below this line is not strictly comparable. | ||||||||||||

| 1987 | 100% | 12.32% | 13.33% | 25.67% | 11.23% | 36.90% | 23.85% | 60.75% | 23.62% | 84.37% | 15.63% | |

| 1988 | 100% | 15.16% | 13.35% | 28.51% | 10.94% | 39.45% | 22.99% | 62.44% | 22.63% | 85.07% | 14.93% | |

| 1989 | 100% | 14.19% | 13.64% | 27.84% | 11.16% | 39.00% | 23.28% | 62.28% | 22.76% | 85.04% | 14.96% | |

| 1990 | 100% | 14.00% | 13.62% | 27.62% | 11.15% | 38.77% | 23.36% | 62.13% | 22.84% | 84.97% | 15.03% | |

| 1991 | 100% | 12.99% | 13.82% | 26.83% | 11.37% | 38.20% | 23.65% | 61.85% | 23.01% | 84.87% | 15.13% | |

| 1992 | 100% | 14.23% | 13.77% | 28.01% | 11.21% | 39.23% | 23.25% | 62.47% | 22.61% | 85.08% | 14.92% | |

| 1993 | 100% | 13.79% | 13.96% | 27.76% | 11.29% | 39.05% | 23.40% | 62.45% | 22.63% | 85.08% | 14.92% | |

| 1994 | 100% | 13.80% | 14.04% | 27.85% | 11.34% | 39.19% | 23.45% | 62.64% | 22.48% | 85.11% | 14.89% | |

| 1995 | 100% | 14.60% | 14.20% | 28.81% | 11.35% | 40.16% | 23.21% | 63.37% | 22.09% | 85.46% | 14.54% | |

| 1996 | 100% | 16.04% | 14.31% | 30.36% | 11.23% | 41.59% | 22.73% | 64.32% | 21.60% | 85.92% | 14.08% | |

| 1997 | 100% | 17.38% | 14.41% | 31.79% | 11.03% | 42.83% | 22.22% | 65.05% | 21.11% | 86.16% | 13.84% | |

| 1998 | 100% | 18.47% | 14.39% | 32.85% | 10.92% | 43.77% | 21.87% | 65.63% | 20.69% | 86.33% | 13.67% | |

| 1999 | 100% | 19.51% | 14.54% | 34.04% | 10.85% | 44.89% | 21.57% | 66.46% | 20.29% | 86.75% | 13.25% | |

| 2000 | 100% | 20.81% | 14.48% | 35.30% | 10.71% | 46.01% | 21.15% | 67.15% | 19.86% | 87.01% | 12.99% | |

| The IRS changed methodology, so data above and below this line is not strictly comparable. | ||||||||||||

| 2001 | 100% | 8.05% | 17.41% | 14.21% | 31.61% | 10.89% | 42.50% | 21.80% | 64.31% | 21.29% | 85.60% | 14.40% |

| 2002 | 100% | 7.04% | 16.05% | 14.24% | 30.29% | 11.04% | 41.33% | 22.39% | 63.71% | 21.79% | 85.50% | 14.50% |

| 2003 | 100% | 7.56% | 16.73% | 14.26% | 30.99% | 11.03% | 42.01% | 22.33% | 64.34% | 21.52% | 85.87% | 14.13% |

| 2004 | 100% | 9.14% | 18.99% | 14.31% | 33.31% | 10.77% | 44.07% | 21.60% | 65.68% | 20.83% | 86.51% | 13.49% |

| 2005 | 100% | 10.64% | 21.19% | 14.42% | 35.61% | 10.56% | 46.17% | 20.90% | 67.07% | 19.99% | 87.06% | 12.94% |

| 2006 | 100% | 11.23% | 22.10% | 14.52% | 36.62% | 10.56% | 47.17% | 20.73% | 67.91% | 19.68% | 87.58% | 12.42% |

| 2007 | 100% | 11.95% | 22.86% | 14.52% | 37.39% | 10.49% | 47.88% | 20.53% | 68.41% | 19.40% | 87.81% | 12.19% |

| 2008 | 100% | 10.06% | 20.19% | 14.76% | 34.95% | 11.03% | 45.98% | 21.71% | 67.69% | 20.39% | 88.08% | 11.92% |

| 2009 | 100% | 7.94% | 17.21% | 14.96% | 32.18% | 11.59% | 43.77% | 22.96% | 66.74% | 21.38% | 88.12% | 11.88% |

| 2010 | 100% | 9.24% | 18.87% | 14.91% | 33.78% | 11.38% | 45.17% | 22.38% | 67.55% | 20.71% | 88.26% | 11.74% |

| 2011 | 100% | 8.86% | 18.70% | 15.19% | 33.89% | 11.50% | 45.39% | 22.43% | 67.82% | 20.63% | 88.45% | 11.55% |

| 2012 | 100% | 11.25% | 21.86% | 14.97% | 36.84% | 11.03% | 47.87% | 21.39% | 69.25% | 19.64% | 88.90% | 11.10% |

| 2013 | 100% | 9.03% | 19.04% | 15.38% | 34.42% | 11.45% | 45.87% | 22.23% | 68.10% | 20.41% | 88.51% | 11.49% |

| 2014 | 100% | 10.16% | 20.58% | 15.38% | 35.96% | 11.25% | 47.21% | 21.70% | 68.91% | 19.82% | 88.73% | 11.27% |

| 2015 | 100% | 10.19% | 20.65% | 15.42% | 36.07% | 11.29% | 47.36% | 21.64% | 68.99% | 19.72% | 88.72% | 11.28% |

| 2016 | 100% | 9.52% | 19.72% | 15.48% | 35.20% | 11.37% | 46.56% | 21.86% | 68.43% | 19.98% | 88.41% | 11.59% |

| 2017 | 100% | 10.52% | 21.04% | 15.49% | 36.53% | 11.21% | 47.74% | 21.40% | 69.14% | 19.61% | 88.75% | 11.25% |

| 2018 | 100% | 10.35% | 20.93% | 15.55% | 36.48% | 11.18% | 47.66% | 21.26% | 68.91% | 19.48% | 88.39% | 11.61% |

| 2019 | 100% | 9.60% | 20.14% | 15.79% | 35.93% | 11.37% | 47.30% | 21.51% | 68.82% | 19.69% | 88.51% | 11.49% |

| 2020 | 100% | 11.32% | 22.19% | 15.92% | 38.11% | 11.35% | 49.45% | 21.26% | 70.71% | 19.11% | 89.82% | 10.18% |

| Source: IRS, Statistics of Income, Individual Income Rates and Tax Shares | ||||||||||||

| Year | Total | Top 0.1% | Top 1% | Between 1% and 5% | Top 5% | Between 5% & 10% | Top 10% | Between 10% & 25% | Top 25% | Between 25% & 50% | Top 50% | Bottom 50% |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1980 | 100% | 19.05% | 17.79% | 36.84% | 12.44% | 49.28% | 23.74% | 73.02% | 19.93% | 92.95% | 7.05% | |

| 1981 | 100% | 17.58% | 17.48% | 35.06% | 12.90% | 47.96% | 24.33% | 72.29% | 20.26% | 92.55% | 7.45% | |

| 1982 | 100% | 19.03% | 17.10% | 36.13% | 12.45% | 48.59% | 23.91% | 72.50% | 20.15% | 92.65% | 7.35% | |

| 1983 | 100% | 20.32% | 16.94% | 37.26% | 12.44% | 49.71% | 23.39% | 73.10% | 19.73% | 92.83% | 7.17% | |

| 1984 | 100% | 21.12% | 16.86% | 37.98% | 12.58% | 50.56% | 22.92% | 73.49% | 19.16% | 92.65% | 7.35% | |

| 1985 | 100% | 21.81% | 16.97% | 38.78% | 12.67% | 51.46% | 22.60% | 74.06% | 18.77% | 92.83% | 7.17% | |

| 1986 | 100% | 25.75% | 16.82% | 42.57% | 12.12% | 54.69% | 21.33% | 76.02% | 17.52% | 93.54% | 6.46% | |

| The Tax Reform Act of 1986 changed the definition of AGI, so data above and below this line is not strictly comparable. | ||||||||||||

| 1987 | 100% | 24.81% | 18.45% | 43.26% | 12.35% | 55.61% | 21.31% | 76.92% | 17.02% | 93.93% | 6.07% | |

| 1988 | 100% | 27.58% | 18.04% | 45.62% | 11.66% | 57.28% | 20.57% | 77.84% | 16.44% | 94.28% | 5.72% | |

| 1989 | 100% | 25.24% | 18.70% | 43.94% | 11.85% | 55.78% | 21.44% | 77.22% | 16.94% | 94.17% | 5.83% | |

| 1990 | 100% | 25.13% | 18.51% | 43.64% | 11.73% | 55.36% | 21.66% | 77.02% | 17.16% | 94.19% | 5.81% | |

| 1991 | 100% | 24.82% | 18.56% | 43.38% | 12.45% | 55.82% | 21.46% | 77.29% | 17.23% | 94.52% | 5.48% | |

| 1992 | 100% | 27.54% | 18.34% | 45.88% | 12.12% | 58.01% | 20.47% | 78.48% | 16.46% | 94.94% | 5.06% | |

| 1993 | 100% | 29.01% | 18.35% | 47.36% | 11.88% | 59.24% | 20.03% | 79.27% | 15.92% | 95.19% | 4.81% | |

| 1994 | 100% | 28.86% | 18.66% | 47.52% | 11.93% | 59.45% | 20.10% | 79.55% | 15.68% | 95.23% | 4.77% | |

| 1995 | 100% | 30.26% | 18.65% | 48.91% | 11.84% | 60.75% | 19.62% | 80.36% | 15.03% | 95.39% | 4.61% | |

| 1996 | 100% | 32.31% | 18.66% | 50.97% | 11.54% | 62.51% | 18.80% | 81.32% | 14.36% | 95.68% | 4.32% | |

| 1997 | 100% | 33.17% | 18.70% | 51.87% | 11.33% | 63.20% | 18.47% | 81.67% | 14.05% | 95.72% | 4.28% | |

| 1998 | 100% | 34.75% | 19.09% | 53.84% | 11.20% | 65.04% | 17.65% | 82.69% | 13.10% | 95.79% | 4.21% | |

| 1999 | 100% | 36.18% | 19.27% | 55.45% | 11.00% | 66.45% | 17.09% | 83.54% | 12.46% | 96.00% | 4.00% | |

| 2000 | 100% | 37.42% | 19.05% | 56.47% | 10.86% | 67.33% | 16.68% | 84.01% | 12.08% | 96.09% | 3.91% | |

| The IRS changed methodology, so data above and below this line is not strictly comparable. | ||||||||||||

| 2001 | 100% | 15.68% | 33.22% | 19.02% | 52.24% | 11.44% | 63.68% | 17.88% | 81.56% | 13.54% | 95.10% | 4.90% |

| 2002 | 100% | 15.09% | 33.09% | 19.77% | 52.86% | 11.77% | 64.63% | 18.04% | 82.67% | 13.12% | 95.79% | 4.21% |

| 2003 | 100% | 15.37% | 33.69% | 19.85% | 53.54% | 11.35% | 64.89% | 17.87% | 82.76% | 13.17% | 95.93% | 4.07% |

| 2004 | 100% | 17.12% | 36.28% | 20.07% | 56.35% | 10.96% | 67.30% | 16.52% | 83.82% | 12.31% | 96.13% | 3.87% |

| 2005 | 100% | 18.91% | 38.78% | 20.15% | 58.93% | 10.52% | 69.46% | 15.61% | 85.07% | 11.35% | 96.41% | 3.59% |

| 2006 | 100% | 19.24% | 39.36% | 20.13% | 59.49% | 10.59% | 70.08% | 15.41% | 85.49% | 11.10% | 96.59% | 3.41% |

| 2007 | 100% | 19.84% | 39.81% | 20.09% | 59.90% | 10.51% | 70.41% | 15.30% | 85.71% | 10.93% | 96.64% | 3.36% |

| 2008 | 100% | 18.20% | 37.51% | 20.55% | 58.06% | 11.14% | 69.20% | 16.37% | 85.57% | 11.33% | 96.90% | 3.10% |

| 2009 | 100% | 16.91% | 36.34% | 21.83% | 58.17% | 11.72% | 69.89% | 16.85% | 86.74% | 10.80% | 97.54% | 2.46% |

| 2010 | 100% | 17.88% | 37.38% | 21.69% | 59.07% | 11.55% | 70.62% | 16.49% | 87.11% | 10.53% | 97.64% | 2.36% |

| 2011 | 100% | 16.14% | 35.06% | 21.43% | 56.49% | 11.77% | 68.26% | 17.36% | 85.62% | 11.50% | 97.11% | 2.89% |

| 2012 | 100% | 18.60% | 38.09% | 20.86% | 58.95% | 11.22% | 70.17% | 16.25% | 86.42% | 10.80% | 97.22% | 2.78% |

| 2013 | 100% | 18.48% | 37.80% | 20.75% | 58.55% | 11.25% | 69.80% | 16.47% | 86.27% | 10.94% | 97.22% | 2.78% |

| 2014 | 100% | 19.85% | 39.48% | 20.49% | 59.97% | 10.91% | 70.88% | 15.90% | 86.78% | 10.47% | 97.25% | 2.75% |

| 2015 | 100% | 19.50% | 39.04% | 20.54% | 59.58% | 11.01% | 70.59% | 16.03% | 86.62% | 10.55% | 97.17% | 2.83% |

| 2016 | 100.00% | 18.12% | 37.32% | 20.91% | 58.23% | 11.24% | 69.47% | 16.50% | 85.97% | 10.99% | 96.96% | 3.04% |

| 2017 | 100.00% | 19.34% | 38.47% | 20.67% | 59.14% | 10.94% | 70.08% | 16.02% | 86.10% | 10.79% | 96.89% | 3.11% |

| 2018 | 100.00% | 20.22% | 40.08% | 20.22% | 60.30% | 11.06% | 71.37% | 15.60% | 86.97% | 10.09% | 97.06% | 2.94% |

| 2019 | 100.00% | 18.87% | 38.77% | 20.68% | 59.44% | 11.37% | 70.81% | 15.84% | 86.65% | 10.29% | 96.94% | 3.06% |

| 2020 | 100.00% | 22.06% | 42.31% | 20.43% | 62.74% | 10.93% | 73.67% | 14.84% | 88.51% | 9.17% | 97.68% | 2.32% |

| Source: IRS, Statistics of Income, Individual Income Rates and Tax Shares | ||||||||||||

| Year | Top 0.1% | Top 1% | Top 5% | Top 10% | Top 25% | Top 50% |

|---|---|---|---|---|---|---|

| 1980 | $80,580 | $43,792 | $35,070 | $23,606 | $12,936 | |

| 1981 | $85,428 | $47,845 | $38,283 | $25,655 | $14,000 | |

| 1982 | $89,388 | $49,284 | $39,676 | $27,027 | $14,539 | |

| 1983 | $93,512 | $51,553 | $41,222 | $27,827 | $15,044 | |

| 1984 | $100,889 | $55,423 | $43,956 | $29,360 | $15,998 | |

| 1985 | $108,134 | $58,883 | $46,322 | $30,928 | $16,688 | |

| 1986 | $118,818 | $62,377 | $48,656 | $32,242 | $17,302 | |

| The Tax Reform Act of 1986 changed the definition of AGI, so data above and below this line is not strictly comparable. | ||||||

| 1987 | $139,289 | $68,414 | $52,921 | $33,983 | $17,768 | |

| 1988 | $157,136 | $72,735 | $55,437 | $35,398 | $18,367 | |

| 1989 | $163,869 | $76,933 | $58,263 | $36,839 | $18,993 | |

| 1990 | $167,421 | $79,064 | $60,287 | $38,080 | $19,767 | |

| 1991 | $170,139 | $81,720 | $61,944 | $38,929 | $20,097 | |

| 1992 | $181,904 | $85,103 | $64,457 | $40,378 | $20,803 | |

| 1993 | $185,715 | $87,386 | $66,077 | $41,210 | $21,179 | |

| 1994 | $195,726 | $91,226 | $68,753 | $42,742 | $21,802 | |

| 1995 | $209,406 | $96,221 | $72,094 | $44,207 | $22,344 | |

| 1996 | $227,546 | $101,141 | $74,986 | $45,757 | $23,174 | |

| 1997 | $250,736 | $108,048 | $79,212 | $48,173 | $24,393 | |

| 1998 | $269,496 | $114,729 | $83,220 | $50,607 | $25,491 | |

| 1999 | $293,415 | $120,846 | $87,682 | $52,965 | $26,415 | |

| 2000 | $313,469 | $128,336 | $92,144 | $55,225 | $27,682 | |

| The IRS changed methodology, so data above and below this line is not strictly comparable. | ||||||

| 2001 | $1,393,718 | $306,635 | $132,082 | $96,151 | $59,026 | $31,418 |

| 2002 | $1,245,352 | $296,194 | $130,750 | $95,699 | $59,066 | $31,299 |

| 2003 | $1,317,088 | $305,939 | $133,741 | $97,470 | $59,896 | $31,447 |

| 2004 | $1,617,918 | $339,993 | $140,758 | $101,838 | $62,794 | $32,622 |

| 2005 | $1,938,175 | $379,261 | $149,216 | $106,864 | $64,821 | $33,484 |

| 2006 | $2,124,625 | $402,603 | $157,390 | $112,016 | $67,291 | $34,417 |

| 2007 | $2,251,017 | $426,439 | $164,883 | $116,396 | $69,559 | $35,541 |

| 2008 | $1,867,652 | $392,513 | $163,512 | $116,813 | $69,813 | $35,340 |

| 2009 | $1,469,393 | $351,968 | $157,342 | $114,181 | $68,216 | $34,156 |

| 2010 | $1,634,386 | $369,691 | $161,579 | $116,623 | $69,126 | $34,338 |

| 2011 | $1,717,675 | $388,905 | $167,728 | $120,136 | $70,492 | $34,823 |

| 2012 | $2,161,175 | $434,682 | $175,817 | $125,195 | $73,354 | $36,055 |

| 2013 | $1,860,848 | $428,713 | $179,760 | $127,695 | $74,955 | $36,841 |

| 2014 | $2,136,762 | $465,626 | $188,996 | $133,445 | $77,714 | $38,173 |

| 2015 | $2,220,264 | $480,930 | $195,778 | $138,031 | $79,655 | $39,275 |

| 2016 | $2,124,117 | $480,804 | $197,651 | $139,713 | $80,921 | $40,078 |

| 2017 | $2,374,937 | $515,371 | $208,053 | $145,135 | $83,682 | $41,740 |

| 2018 | $2,514,209 | $540,009 | $217,913 | $151,935 | $87,044 | $43,614 |

| 2019 | $2,458,432 | $546,434 | $221,572 | $154,589 | $87,917 | $44,269 |

| 2020 | $2,614,565 | $548,336 | $220,521 | $152,321 | $85,853 | $42,184 |

| Source: IRS, Statistics of Income, Individual Income Rates and Tax Shares | ||||||

| Year | Total | Top 0.1% | Top 1% | Between 1% and 5% | Top 5% | Between 5% & 10% | Top 10% | Between 10% & 25% | Top 25% | Between 25% & 50% | Top 50% | Bottom 50% |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1980 | 15.31% | 34.47% | 22.06% | 26.85% | 17.13% | 23.49% | 14.80% | 19.72% | 11.91% | 17.29% | 6.10% | |

| 1981 | 15.76% | 33.37% | 21.97% | 26.59% | 18.16% | 23.64% | 15.53% | 20.11% | 12.48% | 17.73% | 6.62% | |

| 1982 | 14.72% | 31.43% | 20.35% | 25.05% | 16.61% | 22.17% | 14.35% | 18.79% | 11.63% | 16.57% | 6.10% | |

| 1983 | 13.79% | 30.18% | 18.78% | 23.64% | 15.54% | 20.91% | 13.20% | 17.62% | 10.76% | 15.52% | 5.66% | |

| 1984 | 13.68% | 29.92% | 18.38% | 23.42% | 15.57% | 20.81% | 12.90% | 17.47% | 10.48% | 15.35% | 5.77% | |

| 1985 | 13.73% | 29.86% | 18.58% | 23.50% | 15.69% | 20.93% | 12.83% | 17.55% | 10.41% | 15.41% | 5.70% | |

| 1986 | 14.54% | 33.13% | 19.20% | 25.68% | 15.99% | 22.64% | 12.97% | 18.72% | 10.48% | 16.32% | 5.63% | |

| The Tax Reform Act of 1986 changed the definition of AGI, so data above and below this line is not strictly comparable. | ||||||||||||

| 1987 | 13.12% | 26.41% | 18.13% | 22.10% | 14.43% | 19.77% | 11.71% | 16.61% | 9.45% | 14.60% | 5.09% | |

| 1988 | 13.21% | 24.04% | 17.75% | 21.14% | 14.07% | 19.18% | 11.82% | 16.47% | 9.60% | 14.64% | 5.06% | |

| 1989 | 13.12% | 23.34% | 18.00% | 20.71% | 13.93% | 18.77% | 12.08% | 16.27% | 9.77% | 14.53% | 5.11% | |

| 1990 | 12.95% | 23.25% | 17.66% | 20.46% | 13.63% | 18.50% | 12.01% | 16.06% | 9.73% | 14.36% | 5.01% | |

| 1991 | 12.75% | 24.37% | 17.08% | 20.62% | 13.96% | 18.63% | 11.57% | 15.93% | 9.55% | 14.20% | 4.62% | |

| 1992 | 12.94% | 25.05% | 17.16% | 21.19% | 13.99% | 19.13% | 11.39% | 16.25% | 9.42% | 14.44% | 4.39% | |

| 1993 | 13.32% | 28.01% | 17.46% | 22.71% | 14.01% | 20.20% | 11.40% | 16.90% | 9.37% | 14.90% | 4.29% | |

| 1994 | 13.50% | 28.23% | 17.99% | 23.04% | 14.20% | 20.48% | 11.57% | 17.15% | 9.42% | 15.11% | 4.32% | |

| 1995 | 13.86% | 28.73% | 18.24% | 23.53% | 14.46% | 20.97% | 11.71% | 17.58% | 9.43% | 15.47% | 4.39% | |

| 1996 | 14.34% | 28.87% | 18.57% | 24.07% | 14.74% | 21.55% | 11.86% | 18.12% | 9.53% | 15.96% | 4.40% | |

| 1997 | 14.48% | 27.64% | 18.78% | 23.62% | 14.87% | 21.36% | 12.04% | 18.18% | 9.63% | 16.09% | 4.48% | |

| 1998 | 14.42% | 27.12% | 19.19% | 23.63% | 14.79% | 21.42% | 11.63% | 18.16% | 9.12% | 16.00% | 4.44% | |

| 1999 | 14.85% | 27.53% | 19.67% | 24.18% | 15.06% | 21.98% | 11.76% | 18.66% | 9.12% | 16.43% | 4.48% | |

| 2000 | 15.26% | 27.45% | 20.11% | 24.42% | 15.48% | 22.34% | 12.04% | 19.09% | 9.28% | 16.86% | 4.60% | |

| The IRS changed methodology, so data above and below this line is not strictly comparable. | ||||||||||||

| 2001 | 14.47% | 28.17% | 27.60% | 19.33% | 23.91% | 15.20% | 21.68% | 11.87% | 18.35% | 9.20% | 16.08% | 4.92% |

| 2002 | 13.28% | 28.48% | 27.37% | 18.43% | 23.17% | 14.15% | 20.76% | 10.70% | 17.23% | 8.00% | 14.87% | 3.86% |

| 2003 | 12.11% | 24.60% | 24.38% | 16.86% | 20.92% | 12.46% | 18.70% | 9.69% | 15.57% | 7.41% | 13.53% | 3.49% |

| 2004 | 12.31% | 23.06% | 23.52% | 17.22% | 20.83% | 12.53% | 18.80% | 9.41% | 15.71% | 7.27% | 13.68% | 3.53% |

| 2005 | 12.65% | 22.48% | 23.15% | 17.70% | 20.93% | 12.61% | 19.03% | 9.45% | 16.04% | 7.18% | 14.01% | 3.51% |

| 2006 | 12.80% | 21.94% | 22.80% | 17.72% | 20.80% | 12.84% | 19.02% | 9.52% | 16.12% | 7.22% | 14.12% | 3.51% |

| 2007 | 12.90% | 21.42% | 22.46% | 17.81% | 20.66% | 12.92% | 18.96% | 9.61% | 16.16% | 7.27% | 14.19% | 3.56% |

| 2008 | 12.54% | 22.67% | 23.29% | 17.42% | 20.83% | 12.66% | 18.87% | 9.45% | 15.85% | 6.97% | 13.79% | 3.26% |

| 2009 | 11.39% | 24.28% | 24.05% | 16.58% | 20.59% | 11.53% | 18.19% | 8.36% | 14.81% | 5.76% | 12.61% | 2.35% |

| 2010 | 11.81% | 22.84% | 23.39% | 17.18% | 20.64% | 11.98% | 18.46% | 8.70% | 15.22% | 6.01% | 13.06% | 2.37% |

| 2011 | 12.54% | 22.82% | 23.50% | 17.66% | 20.89% | 12.83% | 18.85% | 9.70% | 15.82% | 6.98% | 13.76% | 3.13% |

| 2012 | 13.11% | 21.67% | 22.83% | 18.32% | 20.97% | 13.33% | 19.21% | 9.96% | 16.35% | 7.21% | 14.33% | 3.28% |

| 2013 | 13.64% | 27.91% | 27.08% | 18.36% | 23.20% | 13.40% | 20.75% | 10.11% | 17.28% | 7.31% | 14.98% | 3.30% |

| 2014 | 14.16% | 27.67% | 27.16% | 18.82% | 23.61% | 13.73% | 21.25% | 10.37% | 17.83% | 7.48% | 15.52% | 3.45% |

| 2015 | 14.34% | 27.44% | 27.10% | 19.05% | 23.68% | 13.99% | 21.37% | 10.62% | 18.00% | 7.67% | 15.71% | 3.59% |

| 2016 | 14.20% | 27.05% | 26.87% | 19.19% | 23.49% | 14.05% | 21.19% | 10.71% | 17.84% | 7.81% | 15.57% | 3.73% |

| 2017 | 14.64% | 26.93% | 26.76% | 19.54% | 23.70% | 14.29% | 21.49% | 10.96% | 18.23% | 8.06% | 15.99% | 4.05% |

| 2018 | 13.28% | 25.96% | 25.44% | 17.28% | 21.96% | 13.14% | 19.89% | 9.75% | 16.77% | 6.88% | 14.59% | 3.36% |

| 2019 | 13.29% | 26.12% | 25.57% | 17.40% | 21.98% | 13.28% | 19.89% | 9.78% | 16.73% | 6.94% | 14.55% | 3.54% |

| 2020 | 13.63% | 26.55% | 25.99% | 17.49% | 22.44% | 13.13% | 20.30% | 9.51% | 17.06% | 6.54% | 14.82% | 3.11% |

| Source: IRS, Statistics of Income, Individual Income Rates and Tax Shares | ||||||||||||

| [All figures are estimates based on samples] | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Total | Descending cumulative percentiles | ||||||||||||||

| Top 0.001 percent | Top 0.01 percent | Top 0.1 percent | Top 1 percent | Top 2 percent | Top 3 percent | Top 4 percent | Top 5 percent | Top 10 percent | Top 20 percent | Top 25 percent | Top 30 percent | Top 40 percent | Top 50 percent | ||

| Number of returns: | |||||||||||||||

| 2001 | 119,370,886 | 1,194 | 11,937 | 119,371 | 1,193,709 | 2,387,418 | 3,581,127 | 4,774,835 | 5,968,544 | 11,937,089 | 23,874,177 | 29,842,722 | 35,811,266 | 47,748,354 | 59,685,443 |

| 2002 | 119,850,561 | 1,199 | 11,985 | 119,851 | 1,198,506 | 2,397,011 | 3,595,517 | 4,794,022 | 5,992,528 | 11,985,056 | 23,970,112 | 29,962,640 | 35,955,168 | 47,940,224 | 59,925,281 |

| 2003 | 120,758,947 | 1,208 | 12,076 | 120,759 | 1,207,589 | 2,415,179 | 3,622,768 | 4,830,358 | 6,037,947 | 12,075,895 | 24,151,789 | 30,189,737 | 36,227,684 | 48,303,579 | 60,379,474 |

| 2004 | 122,509,974 | 1,225 | 12,251 | 122,510 | 1,225,100 | 2,450,199 | 3,675,299 | 4,900,399 | 6,125,499 | 12,250,997 | 24,501,995 | 30,627,494 | 36,752,992 | 49,003,990 | 61,254,987 |

| 2005 | 124,673,055 | 1,247 | 12,467 | 124,673 | 1,246,731 | 2,493,461 | 3,740,192 | 4,986,922 | 6,233,653 | 12,467,306 | 24,934,611 | 31,168,264 | 37,401,917 | 49,869,222 | 62,336,528 |

| 2006 | 128,441,165 | 1,284 | 12,844 | 128,441 | 1,284,412 | 2,568,823 | 3,853,235 | 5,137,647 | 6,422,058 | 12,844,117 | 25,688,233 | 32,110,291 | 38,532,350 | 51,376,466 | 64,220,583 |

| 2007 | [4] 132,654,911 | 1,327 | 13,265 | 132,654 | 1,326,549 | 2,653,098 | 3,979,647 | 5,306,196 | 6,632,746 | 13,265,491 | 26,530,982 | 33,163,728 | 39,796,473 | 53,061,964 | 66,327,456 |

| 2008 | 132,891,770 | 1,329 | 13,289 | 132,892 | 1,328,918 | 2,657,835 | 3,986,753 | 5,315,671 | 6,644,589 | 13,289,177 | 26,578,354 | 33,222,943 | 39,867,531 | 53,156,708 | 66,445,885 |

| 2009 | 132,619,936 | 1,326 | 13,262 | 132,620 | 1,326,199 | 2,652,399 | 3,978,598 | 5,304,797 | 6,630,997 | 13,261,994 | 26,523,987 | 33,154,984 | 39,785,981 | 53,047,974 | 66,309,968 |

| 2010 | 135,033,492 | 1,350 | 13,503 | 135,033 | 1,350,335 | 2,700,670 | 4,051,005 | 5,401,340 | 6,751,675 | 13,503,349 | 27,006,698 | 33,758,373 | 40,510,048 | 54,013,397 | 67,516,746 |

| 2011 | 136,585,712 | 1,366 | 13,659 | 136,586 | 1,365,857 | 2,731,714 | 4,097,571 | 5,463,428 | 6,829,286 | 13,658,571 | 27,317,142 | 34,146,428 | 40,975,714 | 54,634,285 | 68,292,856 |

| 2012 | 136,080,353 | 1,361 | 13,608 | 136,080 | 1,360,804 | 2,721,607 | 4,082,411 | 5,443,214 | 6,804,018 | 13,608,035 | 27,216,071 | 34,020,088 | 40,824,106 | 54,432,141 | 68,040,177 |

| 2013 | 138,313,155 | 1,383 | 13,831 | 138,313 | 1,383,132 | 2,766,263 | 4,149,395 | 5,532,526 | 6,915,658 | 13,831,316 | 27,662,631 | 34,578,289 | 41,493,947 | 55,325,262 | 69,156,578 |

| 2014 | 139,562,034 | 1,396 | 13,956 | 139,562 | 1,395,620 | 2,791,241 | 4,186,861 | 5,582,481 | 6,978,102 | 13,956,203 | 27,912,407 | 34,890,509 | 41,868,610 | 55,824,814 | 69,781,017 |

| 2015 | 141,204,625 | 1,412 | 14,120 | 141,205 | 1,412,046 | 2,824,093 | 4,236,139 | 5,648,185 | 7,060,231 | 14,120,463 | 28,240,925 | 35,301,156 | 42,361,388 | 56,481,850 | 70,602,313 |

| 2016 | 140,888,785 | 1,409 | 14,089 | 140,889 | 1,408,888 | 2,817,776 | 4,226,664 | 5,635,551 | 7,044,439 | 14,088,879 | 28,177,757 | 35,222,196 | 42,266,636 | 56,355,514 | 70,444,393 |

| 2017 | 143,295,160 | 1,433 | 14,330 | 143,295 | 1,432,952 | 2,865,903 | 4,298,855 | 5,731,806 | 7,164,758 | 14,329,516 | 28,659,032 | 35,823,790 | 42,988,548 | 57,318,064 | 71,647,580 |

| 2018 | 144,317,866 | 1,443 | 14,432 | 144,318 | 1,443,179 | 2,886,357 | 4,329,536 | 5,772,715 | 7,215,893 | 14,431,787 | 28,863,573 | 36,079,467 | 43,295,360 | 57,727,146 | 72,158,933 |

| 2019 | 148,245,929 | 1,482 | 14,825 | 148,246 | 1,482,459 | 2,964,919 | 4,447,378 | 5,929,837 | 7,412,296 | 14,824,593 | 29,649,186 | 37,061,482 | 44,473,779 | 59,298,372 | 74,122,965 |

| 2020 | 157,494,242 | 1,575 | 15,749 | 157,494 | 1,574,942 | 3,149,885 | 4,724,827 | 6,299,770 | 7,874,712 | 15,749,424 | 31,498,848 | 39,373,561 | 47,248,273 | 62,997,697 | 78,747,121 |

| Adjusted gross income floor on percentiles (current dollars): | |||||||||||||||

| 2001 | N/A | 31,331,335 | 6,869,952 | 1,393,718 | 306,635 | 207,592 | 167,788 | 145,667 | 132,082 | 96,151 | 67,818 | 59,026 | 51,863 | 40,293 | 31,418 |

| 2002 | N/A | 25,921,482 | 5,891,214 | 1,245,352 | 296,194 | 200,654 | 164,409 | 144,575 | 130,750 | 95,699 | 67,928 | 59,066 | 51,721 | 40,073 | 31,299 |

| 2003 | N/A | 28,489,160 | 6,386,149 | 1,317,088 | 305,939 | 205,565 | 168,248 | 147,132 | 133,741 | 97,470 | 69,304 | 59,896 | 52,353 | 40,383 | 31,447 |

| 2004 | N/A | 38,780,500 | 8,455,107 | 1,617,918 | 339,993 | 224,320 | 181,127 | 156,665 | 140,758 | 101,838 | 72,069 | 62,794 | 54,765 | 42,081 | 32,622 |

| 2005 | N/A | 50,796,495 | 10,738,867 | 1,938,175 | 379,261 | 245,392 | 194,726 | 167,281 | 149,216 | 106,864 | 74,790 | 64,821 | 56,583 | 43,361 | 33,484 |

| 2006 | N/A | 54,665,360 | 11,649,460 | 2,124,625 | 402,603 | 258,800 | 205,835 | 176,455 | 157,390 | 112,016 | 77,776 | 67,291 | 58,505 | 44,748 | 34,417 |

| 2007 | N/A | 62,955,875 | 12,747,384 | 2,251,017 | 426,439 | 270,440 | 214,832 | 184,473 | 164,883 | 116,396 | 80,723 | 69,559 | 60,617 | 46,200 | 35,541 |

| 2008 | N/A | 49,546,782 | 10,097,827 | 1,867,652 | 392,513 | 260,381 | 209,750 | 181,624 | 163,512 | 116,813 | 80,886 | 69,813 | 60,535 | 46,120 | 35,340 |

| 2009 | N/A | 34,381,494 | 7,206,540 | 1,469,393 | 351,968 | 243,096 | 198,731 | 174,432 | 157,342 | 114,181 | 79,237 | 68,216 | 58,876 | 44,529 | 34,156 |

| 2010 | N/A | 45,039,369 | 8,762,618 | 1,634,386 | 369,691 | 252,785 | 205,942 | 179,023 | 161,579 | 116,623 | 80,462 | 69,126 | 59,512 | 44,895 | 34,338 |

| 2011 | N/A | 41,965,258 | 8,830,028 | 1,717,675 | 388,905 | 262,933 | 213,441 | 185,812 | 167,728 | 120,136 | 82,241 | 70,492 | 60,789 | 45,722 | 34,823 |

| 2012 | N/A | 62,068,187 | 12,104,014 | 2,161,175 | 434,682 | 285,908 | 227,923 | 196,416 | 175,817 | 125,195 | 85,440 | 73,354 | 63,222 | 47,475 | 36,055 |

| 2013 | N/A | 45,097,112 | 9,460,540 | 1,860,848 | 428,713 | 287,018 | 231,507 | 200,472 | 179,760 | 127,695 | 87,434 | 74,955 | 64,650 | 48,463 | 36,841 |

| 2014 | N/A | 56,981,718 | 11,407,987 | 2,136,762 | 465,626 | 306,650 | 245,902 | 211,261 | 188,996 | 133,445 | 90,606 | 77,714 | 66,868 | 50,083 | 38,173 |

| 2015 | N/A | 59,380,503 | 11,930,649 | 2,220,264 | 480,930 | 316,913 | 253,979 | 218,911 | 195,778 | 138,031 | 93,212 | 79,655 | 68,632 | 51,571 | 39,275 |

| 2016 | N/A | 53,052,900 | 10,963,921 | 2,124,117 | 480,804 | 319,796 | 256,673 | 221,381 | 197,651 | 139,713 | 94,620 | 80,921 | 69,581 | 52,529 | 40,078 |

| 2017 | N/A | 63,430,119 | 12,899,070 | 2,374,937 | 515,371 | 339,478 | 271,182 | 232,955 | 208,053 | 145,135 | 97,870 | 83,682 | 72,268 | 54,672 | 41,740 |

| 2018 | N/A | 68,934,261 | 13,576,286 | 2,514,209 | 540,009 | 359,368 | 286,106 | 245,050 | 217,913 | 151,935 | 101,765 | 87,044 | 75,083 | 57,092 | 43,614 |

| 2019 | N/A | 60,658,598 | 12,623,539 | 2,458,432 | 546,434 | 364,693 | 291,384 | 249,320 | 221,572 | 154,589 | 103,012 | 87,917 | 75,991 | 57,685 | 44,269 |

| 2020 | N/A | 77,008,517 | 14,757,246 | 2,614,565 | 548,336 | 366,358 | 290,860 | 248,513 | 220,521 | 152,321 | 100,723 | 85,853 | 73,572 | 55,213 | 42,184 |

| Adjusted gross income floor on percentiles (constant dollars): [1] | |||||||||||||||

| 2001 | N/A | 23,122,756 | 5,070,075 | 1,028,574 | 226,299 | 153,204 | 123,829 | 107,503 | 97,477 | 70,960 | 50,050 | 43,562 | 38,275 | 29,737 | 23,187 |

| 2002 | N/A | 18,838,286 | 4,281,406 | 905,052 | 215,257 | 145,824 | 119,483 | 105,069 | 95,022 | 69,549 | 49,366 | 42,926 | 37,588 | 29,123 | 22,746 |

| 2003 | N/A | 20,233,778 | 4,535,617 | 935,432 | 217,286 | 145,998 | 119,494 | 104,497 | 94,987 | 69,226 | 49,222 | 42,540 | 37,183 | 28,681 | 22,335 |

| 2004 | N/A | 26,837,716 | 5,851,285 | 1,119,666 | 235,289 | 155,239 | 125,347 | 108,419 | 97,410 | 70,476 | 49,875 | 43,456 | 37,900 | 29,122 | 22,576 |

| 2005 | N/A | 34,000,331 | 7,187,997 | 1,297,306 | 253,856 | 164,252 | 130,339 | 111,969 | 99,877 | 71,529 | 50,060 | 43,388 | 37,873 | 29,023 | 22,412 |

| 2006 | N/A | 35,450,947 | 7,554,773 | 1,377,837 | 261,091 | 167,834 | 133,486 | 114,433 | 102,069 | 72,643 | 50,438 | 43,639 | 37,941 | 29,019 | 22,320 |

| 2007 | N/A | 39,694,751 | 8,037,443 | 1,419,305 | 268,877 | 170,517 | 135,455 | 116,313 | 103,962 | 73,390 | 50,897 | 43,858 | 38,220 | 29,130 | 22,409 |

| 2008 | N/A | 30,083,049 | 6,131,043 | 1,133,972 | 238,320 | 158,094 | 127,353 | 110,276 | 99,279 | 70,925 | 49,111 | 42,388 | 36,755 | 28,002 | 21,457 |

| 2009 | N/A | 20,951,550 | 4,391,554 | 895,425 | 214,484 | 148,139 | 121,104 | 106,296 | 95,882 | 69,580 | 48,286 | 41,570 | 35,878 | 27,135 | 20,814 |

| 2010 | N/A | 27,002,020 | 5,253,368 | 979,848 | 221,637 | 151,550 | 123,466 | 107,328 | 96,870 | 69,918 | 48,239 | 41,442 | 35,679 | 26,915 | 20,586 |

| 2011 | N/A | 24,384,229 | 5,130,754 | 998,068 | 225,976 | 152,779 | 124,021 | 107,967 | 97,460 | 69,806 | 47,787 | 40,960 | 35,322 | 26,567 | 20,234 |

| 2012 | N/A | 35,346,348 | 6,892,946 | 1,230,737 | 247,541 | 162,818 | 129,797 | 111,854 | 100,124 | 71,296 | 48,656 | 41,773 | 36,003 | 27,036 | 20,532 |

| 2013 | N/A | 25,301,633 | 5,307,815 | 1,044,025 | 240,528 | 161,031 | 129,886 | 112,474 | 100,854 | 71,643 | 49,055 | 42,053 | 36,272 | 27,190 | 20,670 |

| 2014 | N/A | 31,464,229 | 6,299,275 | 1,179,880 | 257,110 | 169,326 | 135,782 | 116,654 | 104,360 | 73,686 | 50,031 | 42,912 | 36,923 | 27,655 | 21,078 |

| 2015 | N/A | 32,752,622 | 6,580,612 | 1,224,635 | 265,268 | 174,800 | 140,088 | 120,745 | 107,986 | 76,134 | 51,413 | 43,935 | 37,855 | 28,445 | 21,663 |

| 2016 | N/A | 28,895,915 | 5,971,635 | 1,156,926 | 261,876 | 174,181 | 139,800 | 120,578 | 107,653 | 76,096 | 51,536 | 44,075 | 37,898 | 28,611 | 21,829 |

| 2017 | N/A | 33,829,397 | 6,879,504 | 1,266,633 | 274,865 | 181,055 | 144,630 | 124,243 | 110,962 | 77,405 | 52,197 | 44,630 | 38,543 | 29,158 | 22,261 |

| 2018 | N/A | 35,884,571 | 7,067,301 | 1,308,802 | 281,108 | 187,073 | 148,936 | 127,564 | 113,437 | 79,092 | 52,975 | 45,312 | 39,085 | 29,720 | 22,704 |

| 2019 | N/A | 31,011,553 | 6,453,752 | 1,256,867 | 279,363 | 186,448 | 148,969 | 127,464 | 113,278 | 79,033 | 52,665 | 44,947 | 38,850 | 29,491 | 22,632 |

| 2020 | N/A | 38,893,190 | 7,453,155 | 1,320,487 | 276,937 | 185,029 | 146,899 | 125,512 | 111,374 | 76,930 | 50,870 | 43,360 | 37,158 | 27,885 | 21,305 |

| Adjusted gross income (millions of dollars): | |||||||||||||||

| 2001 | 6,116,274 | 84,705 | 216,684 | 492,437 | 1,064,928 | 1,360,872 | 1,582,562 | 1,768,355 | 1,933,563 | 2,599,650 | 3,555,692 | 3,933,186 | 4,263,535 | 4,810,102 | 5,235,273 |

| 2002 | 5,982,260 | 68,565 | 179,420 | 420,987 | 960,352 | 1,247,308 | 1,463,587 | 1,647,849 | 1,812,094 | 2,472,326 | 3,431,568 | 3,811,534 | 4,143,048 | 4,689,683 | 5,114,828 |

| 2003 | 6,156,994 | 83,238 | 206,010 | 465,594 | 1,030,178 | 1,327,075 | 1,549,825 | 1,738,945 | 1,907,837 | 2,586,777 | 3,572,674 | 3,961,657 | 4,300,174 | 4,855,774 | 5,286,949 |

| 2004 | 6,734,554 | 111,932 | 280,449 | 615,494 | 1,278,879 | 1,610,803 | 1,855,778 | 2,061,398 | 2,243,098 | 2,968,169 | 4,010,897 | 4,423,150 | 4,782,507 | 5,371,578 | 5,826,206 |

| 2005 | 7,365,689 | 143,370 | 362,581 | 783,762 | 1,560,659 | 1,932,055 | 2,202,354 | 2,426,492 | 2,623,077 | 3,400,596 | 4,506,197 | 4,940,249 | 5,317,903 | 5,936,944 | 6,412,897 |

| 2006 | 7,969,813 | 170,567 | 418,573 | 895,044 | 1,761,119 | 2,166,188 | 2,460,559 | 2,704,549 | 2,918,422 | 3,759,733 | 4,947,104 | 5,412,038 | 5,815,385 | 6,474,937 | 6,980,130 |

| 2007 | 8,621,963 | 219,494 | 503,678 | 1,030,091 | 1,971,021 | 2,411,916 | 2,729,468 | 2,992,467 | 3,223,396 | 4,128,240 | 5,401,825 | 5,898,437 | 6,329,354 | 7,032,507 | 7,571,084 |

| 2008 | 8,206,158 | 173,257 | 397,957 | 825,898 | 1,656,771 | 2,072,196 | 2,380,698 | 2,639,100 | 2,867,730 | 3,772,889 | 5,055,298 | 5,554,583 | 5,986,923 | 6,690,342 | 7,228,036 |

| 2009 | 7,578,641 | 126,242 | 281,687 | 601,504 | 1,304,627 | 1,684,139 | 1,973,637 | 2,219,853 | 2,439,146 | 3,317,402 | 4,570,256 | 5,057,761 | 5,478,063 | 6,159,780 | 6,678,194 |

| 2010 | 8,039,779 | 166,727 | 366,563 | 742,989 | 1,517,146 | 1,922,058 | 2,228,360 | 2,486,918 | 2,716,199 | 3,631,364 | 4,927,262 | 5,430,952 | 5,864,278 | 6,564,169 | 7,095,680 |

| 2011 | 8,317,188 | 144,984 | 342,338 | 737,251 | 1,555,701 | 1,984,960 | 2,306,674 | 2,578,137 | 2,818,879 | 3,774,978 | 5,120,188 | 5,640,585 | 6,088,552 | 6,810,489 | 7,356,627 |

| 2012 | 9,041,744 | 219,067 | 501,374 | 1,017,057 | 1,976,738 | 2,446,464 | 2,791,205 | 3,078,337 | 3,330,944 | 4,327,899 | 5,722,980 | 6,261,677 | 6,725,553 | 7,473,507 | 8,037,800 |

| 2013 | 9,033,840 | 168,992 | 384,881 | 815,662 | 1,719,794 | 2,195,723 | 2,550,046 | 2,847,179 | 3,109,388 | 4,143,498 | 5,591,750 | 6,151,678 | 6,633,611 | 7,409,491 | 7,995,603 |

| 2014 | 9,708,663 | 207,145 | 475,714 | 986,078 | 1,997,819 | 2,514,973 | 2,895,712 | 3,212,471 | 3,490,867 | 4,583,416 | 6,104,146 | 6,690,287 | 7,193,799 | 8,002,581 | 8,614,544 |

| 2015 | 10,142,620 | 214,647 | 495,201 | 1,033,473 | 2,094,906 | 2,636,987 | 3,034,889 | 3,366,920 | 3,658,556 | 4,803,327 | 6,389,094 | 6,997,737 | 7,519,683 | 8,360,826 | 8,998,075 |

| 2016 | 10,156,612 | 204,934 | 460,894 | 966,465 | 2,003,066 | 2,544,904 | 2,946,100 | 3,280,595 | 3,574,828 | 4,729,405 | 6,333,469 | 6,950,051 | 7,479,129 | 8,331,664 | 8,979,705 |

| 2017 | 10,936,500 | 256,250 | 565,453 | 1,150,471 | 2,301,449 | 2,889,391 | 3,321,003 | 3,680,328 | 3,995,037 | 5,220,949 | 6,913,130 | 7,561,368 | 8,118,508 | 9,019,611 | 9,706,054 |

| 2018 | 11,563,883 | 241,954 | 570,189 | 1,196,670 | 2,420,025 | 3,044,552 | 3,503,876 | 3,884,856 | 4,217,996 | 5,511,117 | 7,289,834 | 7,969,121 | 8,552,653 | 9,499,838 | 10,221,814 |

| 2019 | 11,882,850 | 214,487 | 522,449 | 1,140,517 | 2,393,383 | 3,042,810 | 3,523,664 | 3,921,774 | 4,269,727 | 5,621,027 | 7,472,188 | 8,177,266 | 8,783,586 | 9,766,007 | 10,517,131 |

| 2020 | 12,533,102 | 298,180 | 693,109 | 1,419,047 | 2,780,754 | 3,474,592 | 3,985,645 | 4,407,989 | 4,775,995 | 6,198,022 | 8,130,111 | 8,862,578 | 9,488,648 | 10,494,409 | 11,257,092 |

| Total income tax (millions of dollars): [2] | |||||||||||||||

| 2001 | 884,931 | 20,363 | 57,329 | 138,735 | 293,968 | 358,761 | 401,189 | 434,411 | 462,288 | 563,525 | 681,732 | 721,756 | 755,307 | 807,098 | 841,587 |

| 2002 | 794,282 | 16,728 | 48,388 | 119,894 | 262,820 | 323,052 | 362,355 | 393,407 | 419,871 | 513,320 | 620,746 | 656,602 | 687,111 | 731,873 | 760,808 |

| 2003 | 745,514 | 17,169 | 47,192 | 114,559 | 251,146 | 308,878 | 345,930 | 374,786 | 399,176 | 483,792 | 582,130 | 617,015 | 645,885 | 688,113 | 715,163 |

| 2004 | 829,096 | 21,437 | 59,739 | 141,937 | 300,802 | 367,392 | 409,259 | 440,979 | 467,165 | 558,007 | 659,803 | 694,983 | 724,830 | 769,074 | 797,040 |

| 2005 | 931,693 | 27,171 | 75,151 | 176,152 | 361,264 | 437,452 | 485,042 | 520,483 | 549,068 | 647,115 | 755,252 | 792,545 | 823,488 | 869,272 | 898,262 |

| 2006 | 1,020,438 | 30,860 | 83,499 | 196,358 | 401,610 | 485,109 | 536,823 | 575,603 | 607,088 | 715,108 | 832,153 | 872,385 | 905,569 | 954,823 | 985,657 |

| 2007 | 1,111,872 | 38,587 | 97,979 | 220,636 | 442,633 | 534,150 | 590,292 | 631,830 | 666,021 | 782,903 | 909,392 | 952,964 | 988,633 | 1,041,166 | 1,074,502 |

| 2008 | 1,028,669 | 33,136 | 83,085 | 187,200 | 385,857 | 470,285 | 523,500 | 563,684 | 597,246 | 711,873 | 837,561 | 880,244 | 915,035 | 965,691 | 996,815 |

| 2009 | 863,486 | 26,328 | 64,253 | 146,030 | 313,826 | 387,828 | 435,662 | 472,299 | 502,274 | 603,504 | 712,700 | 749,022 | 777,801 | 818,789 | 842,286 |

| 2010 | 949,144 | 31,453 | 76,390 | 169,734 | 354,810 | 436,043 | 488,303 | 528,045 | 560,649 | 670,319 | 787,407 | 826,796 | 858,000 | 901,560 | 926,782 |

| 2011 | 1,042,571 | 26,488 | 70,545 | 168,222 | 365,518 | 453,679 | 510,000 | 553,220 | 588,967 | 711,663 | 846,579 | 892,616 | 929,529 | 981,800 | 1,012,460 |

| 2012 | 1,184,978 | 38,563 | 97,902 | 220,414 | 451,328 | 550,934 | 613,192 | 660,121 | 698,543 | 831,445 | 975,377 | 1,024,046 | 1,063,388 | 1,119,368 | 1,152,063 |

| 2013 | 1,231,911 | 40,764 | 100,868 | 227,623 | 465,705 | 567,786 | 631,900 | 680,817 | 721,242 | 859,863 | 1,011,220 | 1,062,798 | 1,104,510 | 1,163,238 | 1,197,603 |

| 2014 | 1,374,379 | 49,740 | 123,288 | 272,826 | 542,640 | 656,229 | 727,556 | 780,687 | 824,153 | 974,124 | 1,137,716 | 1,192,679 | 1,236,678 | 1,299,383 | 1,336,637 |

| 2015 | 1,454,325 | 51,375 | 127,236 | 283,577 | 567,697 | 688,137 | 763,764 | 820,335 | 866,447 | 1,026,601 | 1,201,501 | 1,259,698 | 1,306,271 | 1,373,073 | 1,413,200 |

| 2016 | 1,442,385 | 46,845 | 115,384 | 261,423 | 538,257 | 658,950 | 735,763 | 793,331 | 839,898 | 1,002,072 | 1,180,713 | 1,240,010 | 1,288,231 | 1,356,952 | 1,398,523 |

| 2017 | 1,601,309 | 61,750 | 143,024 | 309,765 | 615,979 | 748,944 | 833,142 | 895,962 | 946,954 | 1,122,158 | 1,314,957 | 1,378,757 | 1,430,369 | 1,505,513 | 1,551,537 |

| 2018 | 1,536,178 | 55,455 | 139,455 | 310,631 | 615,716 | 737,900 | 815,821 | 876,470 | 926,367 | 1,096,343 | 1,279,036 | 1,336,041 | 1,382,868 | 1,450,202 | 1,491,041 |

| 2019 | 1,578,661 | 49,185 | 128,817 | 297,920 | 612,027 | 739,896 | 822,470 | 886,070 | 938,429 | 1,117,856 | 1,308,416 | 1,367,843 | 1,416,809 | 1,487,163 | 1,530,288 |

| 2020 | 1,708,081 | 70,771 | 174,466 | 376,728 | 722,732 | 860,441 | 948,113 | 1,016,226 | 1,071,681 | 1,258,335 | 1,450,659 | 1,511,786 | 1,560,458 | 1,628,375 | 1,668,410 |

| Average tax rate (percentage): [3] | |||||||||||||||

| 2001 | 14.47 | 24.04 | 26.46 | 28.17 | 27.60 | 26.36 | 25.35 | 24.57 | 23.91 | 21.68 | 19.17 | 18.35 | 17.72 | 16.78 | 16.08 |

| 2002 | 13.28 | 24.40 | 26.97 | 28.48 | 27.37 | 25.90 | 24.76 | 23.87 | 23.17 | 20.76 | 18.09 | 17.23 | 16.58 | 15.61 | 14.87 |

| 2003 | 12.11 | 20.63 | 22.91 | 24.60 | 24.38 | 23.28 | 22.32 | 21.55 | 20.92 | 18.70 | 16.29 | 15.57 | 15.02 | 14.17 | 13.53 |

| 2004 | 12.31 | 19.15 | 21.30 | 23.06 | 23.52 | 22.81 | 22.05 | 21.39 | 20.83 | 18.80 | 16.45 | 15.71 | 15.16 | 14.32 | 13.68 |

| 2005 | 12.65 | 18.95 | 20.73 | 22.48 | 23.15 | 22.64 | 22.02 | 21.45 | 20.93 | 19.03 | 16.76 | 16.04 | 15.49 | 14.64 | 14.01 |

| 2006 | 12.80 | 18.09 | 19.95 | 21.94 | 22.80 | 22.39 | 21.82 | 21.28 | 20.80 | 19.02 | 16.82 | 16.12 | 15.57 | 14.75 | 14.12 |

| 2007 | 12.90 | 17.58 | 19.45 | 21.42 | 22.46 | 22.15 | 21.63 | 21.11 | 20.66 | 18.96 | 16.83 | 16.16 | 15.62 | 14.81 | 14.19 |

| 2008 | 12.54 | 19.13 | 20.88 | 22.67 | 23.29 | 22.70 | 21.99 | 21.36 | 20.83 | 18.87 | 16.57 | 15.85 | 15.28 | 14.43 | 13.79 |

| 2009 | 11.39 | 20.86 | 22.81 | 24.28 | 24.05 | 23.03 | 22.07 | 21.28 | 20.59 | 18.19 | 15.59 | 14.81 | 14.20 | 13.29 | 12.61 |

| 2010 | 11.81 | 18.87 | 20.84 | 22.84 | 23.39 | 22.69 | 21.91 | 21.23 | 20.64 | 18.46 | 15.98 | 15.22 | 14.63 | 13.73 | 13.06 |

| 2011 | 12.54 | 18.27 | 20.61 | 22.82 | 23.50 | 22.86 | 22.11 | 21.46 | 20.89 | 18.85 | 16.53 | 15.82 | 15.27 | 14.42 | 13.76 |

| 2012 | 13.11 | 17.60 | 19.53 | 21.67 | 22.83 | 22.52 | 21.97 | 21.44 | 20.97 | 19.21 | 17.04 | 16.35 | 15.81 | 14.98 | 14.33 |

| 2013 | 13.64 | 24.12 | 26.21 | 27.91 | 27.08 | 25.86 | 24.78 | 23.91 | 23.20 | 20.75 | 18.08 | 17.28 | 16.65 | 15.70 | 14.98 |

| 2014 | 14.16 | 24.01 | 25.92 | 27.67 | 27.16 | 26.09 | 25.13 | 24.30 | 23.61 | 21.25 | 18.64 | 17.83 | 17.19 | 16.24 | 15.52 |

| 2015 | 14.34 | 23.93 | 25.69 | 27.44 | 27.10 | 26.10 | 25.17 | 24.36 | 23.68 | 21.37 | 18.81 | 18.00 | 17.37 | 16.42 | 15.71 |

| 2016 | 14.20 | 22.86 | 25.03 | 27.05 | 26.87 | 25.89 | 24.97 | 24.18 | 23.49 | 21.19 | 18.64 | 17.84 | 17.22 | 16.29 | 15.57 |

| 2017 | 14.64 | 24.10 | 25.29 | 26.93 | 26.76 | 25.92 | 25.09 | 24.34 | 23.70 | 21.49 | 19.02 | 18.23 | 17.62 | 16.69 | 15.99 |

| 2018 | 13.28 | 22.92 | 24.46 | 25.96 | 25.44 | 24.24 | 23.28 | 22.56 | 21.96 | 19.89 | 17.55 | 16.77 | 16.17 | 15.27 | 14.59 |

| 2019 | 13.29 | 22.93 | 24.66 | 26.12 | 25.57 | 24.32 | 23.34 | 22.59 | 21.98 | 19.89 | 17.51 | 16.73 | 16.13 | 15.23 | 14.55 |

| 2020 | 13.63 | 23.73 | 25.17 | 26.55 | 25.99 | 24.76 | 23.79 | 23.05 | 22.44 | 20.30 | 17.84 | 17.06 | 16.45 | 15.52 | 14.82 |

| Adjusted gross income share (percentage): | |||||||||||||||

| 2001 | 100.00 | 1.38 | 3.54 | 8.05 | 17.41 | 22.25 | 25.87 | 28.91 | 31.61 | 42.50 | 58.13 | 64.31 | 69.71 | 78.64 | 85.60 |

| 2002 | 100.00 | 1.15 | 3.00 | 7.04 | 16.05 | 20.85 | 24.47 | 27.55 | 30.29 | 41.33 | 57.36 | 63.71 | 69.26 | 78.39 | 85.50 |

| 2003 | 100.00 | 1.35 | 3.35 | 7.56 | 16.73 | 21.55 | 25.17 | 28.24 | 30.99 | 42.01 | 58.03 | 64.34 | 69.84 | 78.87 | 85.87 |

| 2004 | 100.00 | 1.66 | 4.16 | 9.14 | 18.99 | 23.92 | 27.56 | 30.61 | 33.31 | 44.07 | 59.56 | 65.68 | 71.01 | 79.76 | 86.51 |

| 2005 | 100.00 | 1.95 | 4.92 | 10.64 | 21.19 | 26.23 | 29.90 | 32.94 | 35.61 | 46.17 | 61.18 | 67.07 | 72.20 | 80.60 | 87.06 |

| 2006 | 100.00 | 2.14 | 5.25 | 11.23 | 22.10 | 27.18 | 30.87 | 33.93 | 36.62 | 47.17 | 62.07 | 67.91 | 72.97 | 81.24 | 87.58 |

| 2007 | 100.00 | 2.55 | 5.84 | 11.95 | 22.86 | 27.97 | 31.66 | 34.71 | 37.39 | 47.88 | 62.65 | 68.41 | 73.41 | 81.57 | 87.81 |

| 2008 | 100.00 | 2.11 | 4.85 | 10.06 | 20.19 | 25.25 | 29.01 | 32.16 | 34.95 | 45.98 | 61.60 | 67.69 | 72.96 | 81.53 | 88.08 |

| 2009 | 100.00 | 1.67 | 3.72 | 7.94 | 17.21 | 22.22 | 26.04 | 29.29 | 32.18 | 43.77 | 60.30 | 66.74 | 72.28 | 81.28 | 88.12 |

| 2010 | 100.00 | 2.07 | 4.56 | 9.24 | 18.87 | 23.91 | 27.72 | 30.93 | 33.78 | 45.17 | 61.29 | 67.55 | 72.94 | 81.65 | 88.26 |

| 2011 | 100.00 | 1.74 | 4.12 | 8.86 | 18.70 | 23.87 | 27.73 | 31.00 | 33.89 | 45.39 | 61.56 | 67.82 | 73.20 | 81.88 | 88.45 |

| 2012 | 100.00 | 2.42 | 5.55 | 11.25 | 21.86 | 27.06 | 30.87 | 34.05 | 36.84 | 47.87 | 63.30 | 69.25 | 74.38 | 82.66 | 88.90 |

| 2013 | 100.00 | 1.87 | 4.26 | 9.03 | 19.04 | 24.31 | 28.23 | 31.52 | 34.42 | 45.87 | 61.90 | 68.10 | 73.43 | 82.02 | 88.51 |

| 2014 | 100.00 | 2.13 | 4.90 | 10.16 | 20.58 | 25.90 | 29.83 | 33.09 | 35.96 | 47.21 | 62.87 | 68.91 | 74.10 | 82.43 | 88.73 |

| 2015 | 100.00 | 2.12 | 4.88 | 10.19 | 20.65 | 26.00 | 29.92 | 33.20 | 36.07 | 47.36 | 62.99 | 68.99 | 74.14 | 82.43 | 88.72 |

| 2016 | 100.00 | 2.02 | 4.54 | 9.52 | 19.72 | 25.06 | 29.01 | 32.30 | 35.20 | 46.56 | 62.36 | 68.43 | 73.64 | 82.03 | 88.41 |

| 2017 | 100.00 | 2.34 | 5.17 | 10.52 | 21.04 | 26.42 | 30.37 | 33.65 | 36.53 | 47.74 | 63.21 | 69.14 | 74.23 | 82.47 | 88.75 |

| 2018 | 100.00 | 2.09 | 4.93 | 10.35 | 20.93 | 26.33 | 30.30 | 33.59 | 36.48 | 47.66 | 63.04 | 68.91 | 73.96 | 82.15 | 88.39 |

| 2019 | 100.00 | 1.81 | 4.40 | 9.60 | 20.14 | 25.61 | 29.65 | 33.00 | 35.93 | 47.30 | 62.88 | 68.82 | 73.92 | 82.19 | 88.51 |

| 2020 | 100.00 | 2.38 | 5.53 | 11.32 | 22.19 | 27.72 | 31.80 | 35.17 | 38.11 | 49.45 | 64.87 | 70.71 | 75.71 | 83.73 | 89.82 |

| Total income tax share (percentage): | |||||||||||||||

| 2001 | 100.00 | 2.30 | 6.48 | 15.68 | 33.22 | 40.54 | 45.34 | 49.09 | 52.24 | 63.68 | 77.04 | 81.56 | 85.35 | 91.20 | 95.10 |

| 2002 | 100.00 | 2.11 | 6.09 | 15.09 | 33.09 | 40.67 | 45.62 | 49.53 | 52.86 | 64.63 | 78.15 | 82.67 | 86.51 | 92.14 | 95.79 |

| 2003 | 100.00 | 2.30 | 6.33 | 15.37 | 33.69 | 41.43 | 46.40 | 50.27 | 53.54 | 64.89 | 78.08 | 82.76 | 86.64 | 92.30 | 95.93 |

| 2004 | 100.00 | 2.59 | 7.21 | 17.12 | 36.28 | 44.31 | 49.36 | 53.19 | 56.35 | 67.30 | 79.58 | 83.82 | 87.42 | 92.76 | 96.13 |

| 2005 | 100.00 | 2.92 | 8.07 | 18.91 | 38.78 | 46.95 | 52.06 | 55.86 | 58.93 | 69.46 | 81.06 | 85.07 | 88.39 | 93.30 | 96.41 |

| 2006 | 100.00 | 3.02 | 8.18 | 19.24 | 39.36 | 47.54 | 52.61 | 56.41 | 59.49 | 70.08 | 81.55 | 85.49 | 88.74 | 93.57 | 96.59 |

| 2007 | 100.00 | 3.47 | 8.81 | 19.84 | 39.81 | 48.04 | 53.09 | 56.83 | 59.90 | 70.41 | 81.79 | 85.71 | 88.92 | 93.64 | 96.64 |

| 2008 | 100.00 | 3.22 | 8.08 | 18.20 | 37.51 | 45.72 | 50.89 | 54.80 | 58.06 | 69.20 | 81.42 | 85.57 | 88.95 | 93.88 | 96.90 |

| 2009 | 100.00 | 3.05 | 7.44 | 16.91 | 36.34 | 44.91 | 50.45 | 54.70 | 58.17 | 69.89 | 82.54 | 86.74 | 90.08 | 94.82 | 97.54 |

| 2010 | 100.00 | 3.31 | 8.05 | 17.88 | 37.38 | 45.94 | 51.45 | 55.63 | 59.07 | 70.62 | 82.96 | 87.11 | 90.40 | 94.99 | 97.64 |

| 2011 | 100.00 | 2.54 | 6.77 | 16.14 | 35.06 | 43.52 | 48.92 | 53.06 | 56.49 | 68.26 | 81.20 | 85.62 | 89.16 | 94.17 | 97.11 |

| 2012 | 100.00 | 3.25 | 8.26 | 18.60 | 38.09 | 46.49 | 51.75 | 55.71 | 58.95 | 70.17 | 82.31 | 86.42 | 89.74 | 94.46 | 97.22 |

| 2013 | 100.00 | 3.31 | 8.19 | 18.48 | 37.80 | 46.09 | 51.29 | 55.27 | 58.55 | 69.80 | 82.09 | 86.27 | 89.66 | 94.43 | 97.22 |

| 2014 | 100.00 | 3.62 | 8.97 | 19.85 | 39.48 | 47.75 | 52.94 | 56.80 | 59.97 | 70.88 | 82.78 | 86.78 | 89.98 | 94.54 | 97.25 |

| 2015 | 100.00 | 3.53 | 8.75 | 19.50 | 39.04 | 47.32 | 52.52 | 56.41 | 59.58 | 70.59 | 82.62 | 86.62 | 89.82 | 94.41 | 97.17 |

| 2016 | 100.00 | 3.25 | 8.00 | 18.12 | 37.32 | 45.68 | 51.01 | 55.00 | 58.23 | 69.47 | 81.86 | 85.97 | 89.31 | 94.08 | 96.96 |

| 2017 | 100.00 | 3.86 | 8.93 | 19.34 | 38.47 | 46.77 | 52.03 | 55.95 | 59.14 | 70.08 | 82.12 | 86.10 | 89.33 | 94.02 | 96.89 |

| 2018 | 100.00 | 3.61 | 9.08 | 20.22 | 40.08 | 48.03 | 53.11 | 57.06 | 60.30 | 71.37 | 83.26 | 86.97 | 90.02 | 94.40 | 97.06 |

| 2019 | 100.00 | 3.12 | 8.16 | 18.87 | 38.77 | 46.87 | 52.10 | 56.13 | 59.44 | 70.81 | 82.88 | 86.65 | 89.75 | 94.20 | 96.94 |

| 2020 | 100.00 | 4.14 | 10.21 | 22.06 | 42.31 | 50.37 | 55.51 | 59.50 | 62.74 | 73.67 | 84.93 | 88.51 | 91.36 | 95.33 | 97.68 |

|

Notes: N/A– Not applicable. [1] For Table 4.1, constant dollars were calculated using the U.S. Bureau of Labor Statistics’ consumer price index for urban consumers (CPI-U, 1990=100). For 2019 the CPI-U = 255.657. [2] Total income tax was the sum of income tax after credits (including the subtraction of excess advance premium tax credit repayment, the earned income credit, American opportunity credit, health coverage tax credit, and the regulated investment credit credit) limited to zero plus net investment income tax from Form 8960 and the tax fromForm 4970, Tax on Accumulation Distribution of Trusts. It does not include any refundable portions of these credits. [3] The average tax rate was computed by dividing total income tax (see footnote 2) by adjusted gross income. [4] The total number of returns does not include the returns filed by individuals to only receive the economic stimulus payment and who had no other reason to file. Source: IRS, Statistics of Income Division, Publication 1304, November 2021 |

|||||||||||||||

| [All figures are estimates based on samples] | ||||||

|---|---|---|---|---|---|---|

| Item, tax year | Total | Ascending cumulative percentiles | ||||

| Bottom 50 percent | Bottom 75 percent | Bottom 90 percent | Bottom 95 percent | Bottom 99 Percent | ||

| Number of returns: | ||||||

| 2001 | 119,370,886 | 59,685,443 | 89,528,165 | 107,433,797 | 113,402,342 | 118,177,177 |

| 2002 | 119,850,561 | 59,925,281 | 89,887,921 | 107,865,505 | 113,858,033 | 118,652,055 |

| 2003 | 120,758,947 | 60,379,474 | 90,569,210 | 108,683,052 | 114,721,000 | 119,551,358 |

| 2004 | 122,509,974 | 61,254,987 | 91,882,481 | 110,258,977 | 116,384,475 | 121,284,874 |

| 2005 | 124,673,055 | 62,336,528 | 93,504,791 | 112,205,750 | 118,439,402 | 123,426,324 |

| 2006 | 128,441,165 | 64,220,583 | 96,330,874 | 115,597,049 | 122,019,107 | 127,156,753 |

| 2007 | [3] 132,654,911 | 66,327,456 | 99,491,183 | 119,389,420 | 126,022,165 | 131,328,362 |

| 2008 | 132,891,770 | 66,445,885 | 99,668,828 | 119,602,593 | 126,247,182 | 131,562,852 |

| 2009 | 132,619,936 | 66,309,968 | 99,464,952 | 119,357,942 | 125,988,939 | 131,293,737 |

| 2010 | 135,033,492 | 67,516,746 | 101,275,119 | 121,530,143 | 128,281,817 | 133,683,157 |

| 2011 | 136,585,712 | 68,292,856 | 102,439,284 | 122,927,141 | 129,756,426 | 135,219,855 |

| 2012 | 136,080,353 | 68,040,177 | 102,060,265 | 122,472,318 | 129,276,335 | 134,719,549 |

| 2013 | 138,313,155 | 69,156,578 | 103,734,866 | 124,481,840 | 131,397,497 | 136,930,023 |

| 2014 | 139,562,034 | 69,781,017 | 104,671,526 | 125,605,831 | 132,583,932 | 138,166,414 |

| 2015 | 141,204,625 | 70,602,313 | 105,903,469 | 127,084,163 | 134,144,394 | 139,792,579 |

| 2016 | 140,888,785 | 70,444,393 | 105,666,589 | 126,799,907 | 133,844,346 | 139,479,897 |

| 2017 | 143,295,160 | 71,647,580 | 107,471,370 | 128,965,644 | 136,130,402 | 141,862,208 |

| 2018 | 144,317,866 | 72,158,933 | 108,238,400 | 129,886,079 | 137,101,973 | 142,874,687 |

| 2019 | 148,245,929 | 74,122,965 | 111,184,447 | 133,421,336 | 140,833,633 | 146,763,470 |

| 2020 | 157,494,242 | 78,747,121 | 118,120,682 | 141,744,818 | 149,619,530 | 155,919,300 |

| Adjusted gross income (millions of dollars): | ||||||

| 2001 | 6,116,274 | 881,001 | 2,183,088 | 3,516,624 | 4,182,711 | 5,051,346 |

| 2002 | 5,982,260 | 867,431 | 2,170,726 | 3,509,933 | 4,170,166 | 5,021,907 |

| 2003 | 6,156,994 | 870,045 | 2,195,336 | 3,570,217 | 4,249,157 | 5,126,816 |

| 2004 | 6,734,554 | 908,348 | 2,311,404 | 3,766,385 | 4,491,456 | 5,455,674 |

| 2005 | 7,365,689 | 952,792 | 2,425,440 | 3,965,094 | 4,742,612 | 5,805,030 |

| 2006 | 7,969,813 | 989,682 | 2,557,775 | 4,210,079 | 5,051,390 | 6,208,693 |

| 2007 | 8,621,963 | 1,050,879 | 2,723,525 | 4,493,722 | 5,398,566 | 6,650,942 |

| 2008 | 8,206,158 | 978,122 | 2,651,575 | 4,433,269 | 5,338,428 | 6,549,387 |

| 2009 | 7,578,641 | 900,447 | 2,520,880 | 4,261,239 | 5,139,495 | 6,274,014 |

| 2010 | 8,039,779 | 944,099 | 2,608,826 | 4,408,415 | 5,323,580 | 6,522,633 |

| 2011 | 8,317,188 | 960,561 | 2,676,602 | 4,542,210 | 5,498,309 | 6,761,487 |

| 2012 | 9,041,744 | 1,003,944 | 2,780,067 | 4,713,845 | 5,710,800 | 7,065,006 |

| 2013 | 9,033,840 | 1,038,237 | 2,882,162 | 4,890,343 | 5,924,452 | 7,314,046 |

| 2014 | 9,708,663 | 1,094,119 | 3,018,376 | 5,125,247 | 6,217,796 | 7,710,844 |

| 2015 | 10,142,620 | 1,144,545 | 3,144,883 | 5,339,293 | 6,484,064 | 8,047,714 |

| 2016 | 10,156,612 | 1,176,907 | 3,206,562 | 5,427,208 | 6,581,784 | 8,153,546 |

| 2017 | 10,936,500 | 1,230,446 | 3,375,132 | 5,715,551 | 6,941,463 | 8,635,051 |

| 2018 | 11,563,883 | 1,342,069 | 3,594,762 | 6,052,766 | 7,345,887 | 9,143,858 |

| 2019 | 11,882,850 | 1,365,719 | 3,705,584 | 6,261,823 | 7,613,122 | 9,489,467 |

| 2020 | 12,533,102 | 1,276,009 | 3,670,524 | 6,335,079 | 7,757,107 | 9,752,348 |

| Total income tax (millions of dollars): [1] | ||||||

| 2001 | 884,931 | 43,344 | 163,175 | 321,406 | 422,643 | 590,963 |

| 2002 | 794,282 | 33,474 | 137,679 | 280,962 | 374,411 | 531,462 |

| 2003 | 745,514 | 30,351 | 128,499 | 261,722 | 346,338 | 494,368 |

| 2004 | 829,096 | 32,054 | 134,114 | 271,089 | 361,932 | 528,294 |

| 2005 | 931,693 | 33,431 | 139,143 | 284,578 | 382,625 | 570,430 |

| 2006 | 1,020,438 | 34,781 | 148,053 | 305,330 | 413,350 | 618,828 |

| 2007 | 1,111,872 | 37,371 | 158,909 | 328,969 | 445,851 | 669,239 |

| 2008 | 1,028,669 | 31,857 | 148,425 | 316,797 | 431,423 | 642,812 |

| 2009 | 863,486 | 21,200 | 114,465 | 259,982 | 361,213 | 549,660 |

| 2010 | 949,144 | 22,363 | 122,347 | 278,824 | 388,495 | 594,333 |

| 2011 | 1,042,571 | 30,109 | 149,953 | 330,907 | 453,605 | 677,052 |

| 2012 | 1,184,978 | 32,915 | 160,934 | 353,533 | 486,435 | 733,650 |

| 2013 | 1,231,911 | 34,307 | 169,113 | 372,048 | 510,669 | 766,206 |

| 2014 | 1,374,379 | 37,740 | 181,700 | 400,255 | 550,226 | 831,738 |

| 2015 | 1,454,325 | 41,125 | 194,628 | 427,723 | 587,879 | 886,628 |

| 2016 | 1,442,385 | 43,863 | 202,378 | 440,313 | 602,487 | 904,128 |

| 2017 | 1,601,309 | 49,772 | 222,552 | 479,151 | 654,355 | 985,330 |

| 2018 | 1,536,178 | 45,137 | 200,137 | 439,835 | 609,811 | 920,462 |

| 2019 | 1,578,661 | 48,373 | 210,818 | 460,789 | 640,232 | 966,634 |

| 2020 | 1,708,081 | 39,671 | 196,295 | 449,746 | 636,400 | 985,349 |

| Average tax rate (percentage): [2] | ||||||

| 2001 | 14.47 | 4.92 | 7.47 | 9.14 | 10.10 | 11.70 |

| 2002 | 13.28 | 3.86 | 6.34 | 8.00 | 8.98 | 10.58 |

| 2003 | 12.11 | 3.49 | 5.85 | 7.33 | 8.15 | 9.64 |

| 2004 | 12.31 | 3.53 | 5.80 | 7.20 | 8.06 | 9.68 |

| 2005 | 12.65 | 3.51 | 5.74 | 7.18 | 8.07 | 9.83 |

| 2006 | 12.80 | 3.51 | 5.79 | 7.25 | 8.18 | 9.97 |

| 2007 | 12.90 | 3.56 | 5.83 | 7.32 | 8.26 | 10.06 |

| 2008 | 12.54 | 3.26 | 5.60 | 7.15 | 8.08 | 9.81 |

| 2009 | 11.39 | 2.35 | 4.54 | 6.10 | 7.03 | 8.76 |

| 2010 | 11.81 | 2.37 | 4.69 | 6.32 | 7.30 | 9.11 |

| 2011 | 12.54 | 3.13 | 5.60 | 7.29 | 8.25 | 10.01 |