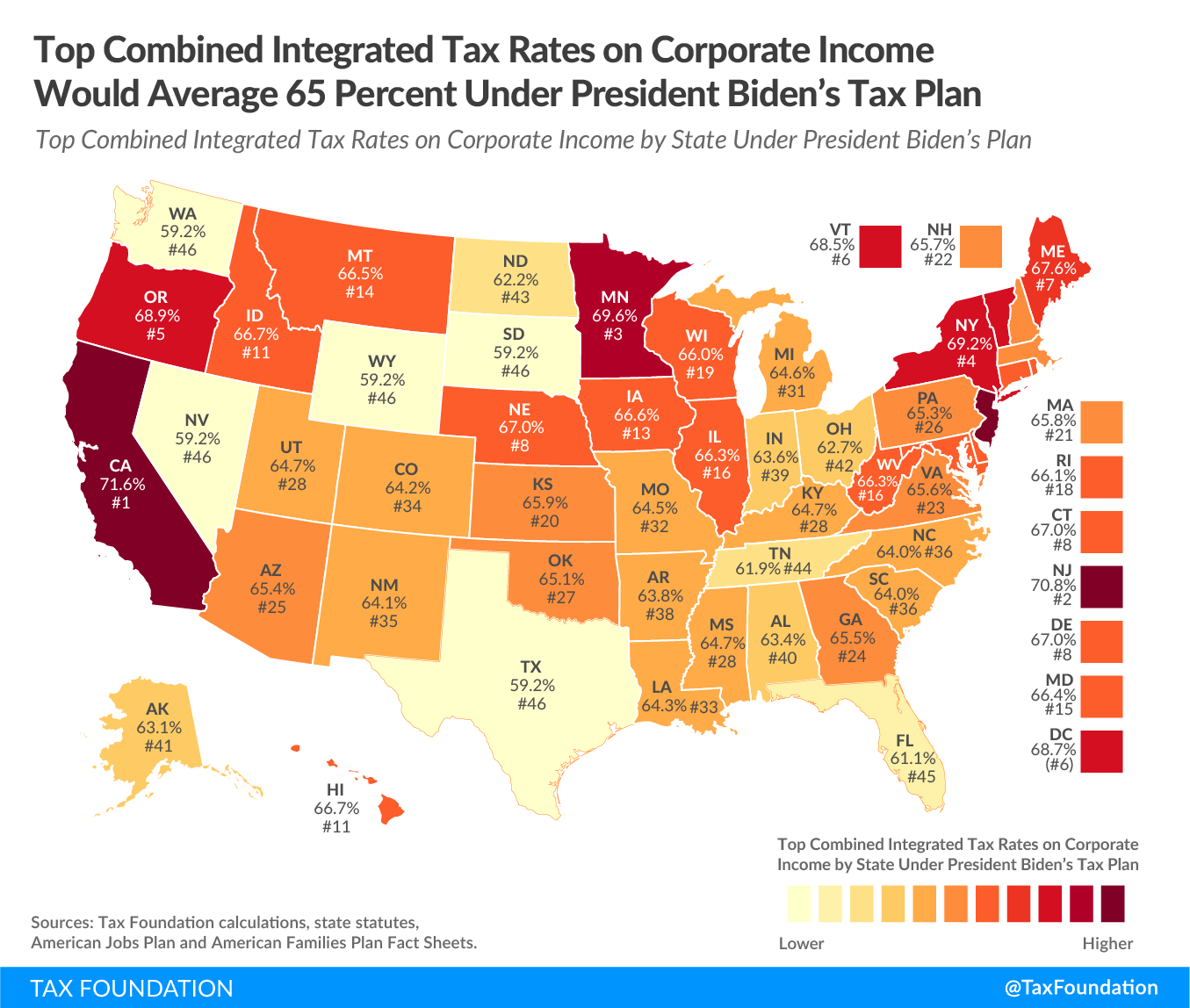

Under President Biden’s taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. plan, the United States would tax corporate income at the highest top rate in the industrialized world, averaging 65.1 percent.

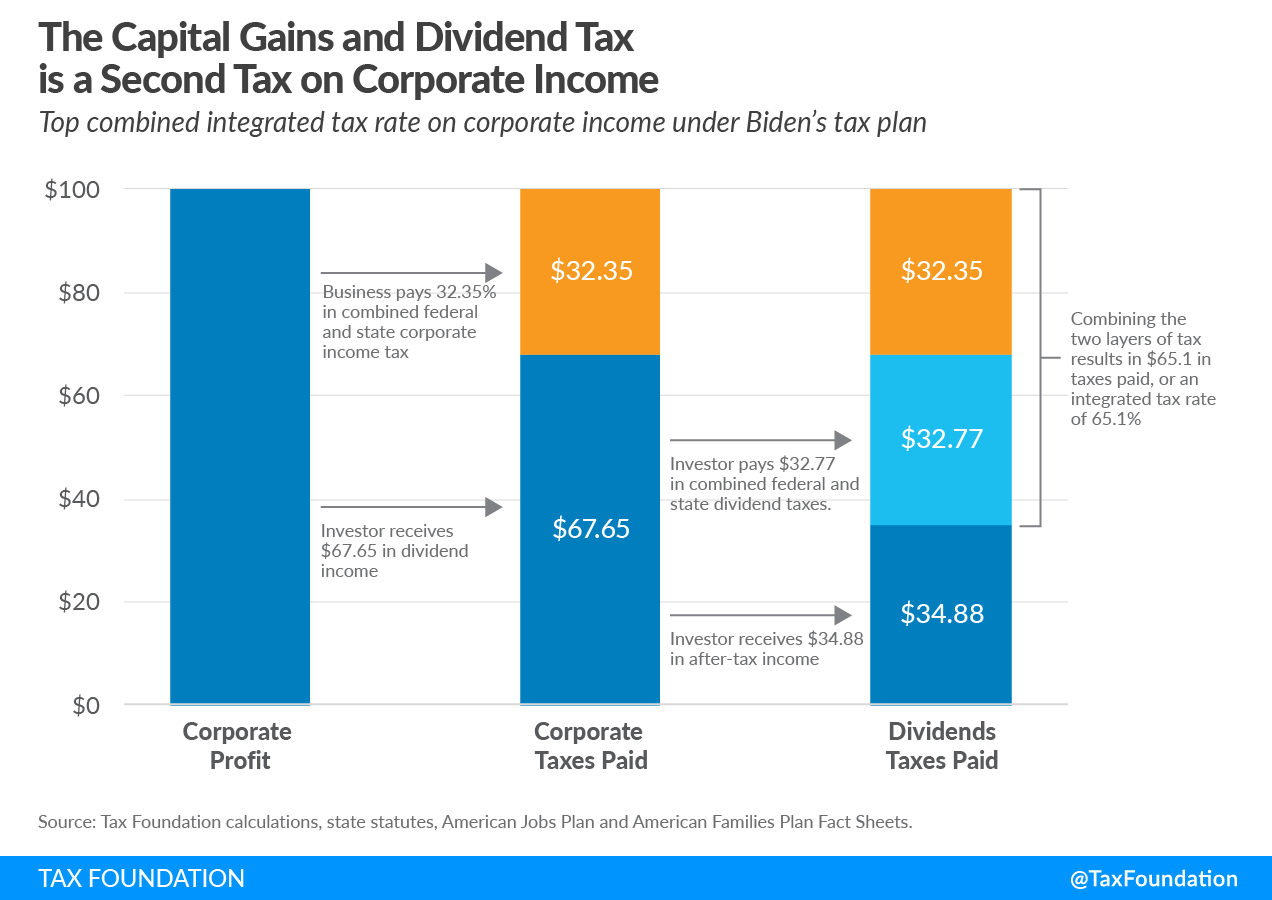

First, the federal corporate tax rate would rise to 28 percent, which together with an average of state corporate tax rates would result in a 32.4 percent combined top corporate tax rate—highest in the industrialized world. As a second layer of tax on corporate income, the top federal marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. on capital gains and dividends would rise to 43.4 percent. Combined with average top state tax rates on capital gains and dividends and integrated with the combined top corporate tax rate, Biden’s proposals would produce a top combined integrated tax rate on corporate income of 65.1 percent—compared to 47.3 percent under current law.

In addition to federal level taxes, 44 states and D.C. have corporate income taxes and most states apply individual income tax rates to capital gains and dividends. The top combined integrated rate on corporate income reflects both the top entity level tax and the top shareholder level tax that apply at federal and state levels.

Top integrated rates would surpass 60 percent in 45 states and the District of Columbia. California and New Jersey would have top combined integrated rates of more than 70 percent. Nevada, South Dakota, Texas, Washington, and Wyoming would be tied for the lowest with rates of 59.2 percent—higher than the highest top rate in the OECD currently levied, by Ireland, at 57.1 percent.

On $100 of corporate profits, under Biden’s plan a firm would owe $32.35 in combined federal and state corporate income taxes. Assuming the remaining after-tax profit of $67.65 is received as a dividend and the investor faces the top marginal combined tax rate, they would owe $32.77 in combined federal and state dividend taxes. After both layers of tax, the investor receives $34.88 in after-tax income from the original $100 in corporate profits.

A higher marginal tax rate on corporate income makes investment more costly, reducing the number of projects corporations invest in. Lower levels of investment could lead to a smaller capital stock, which in turn can mean lower worker productivity, lower wages, and less economic output. A higher marginal tax rate on saving makes it more costly to save, reducing the amount of domestic saving. Lower levels of domestic saving would reduce domestic incomes, as more of the returns to U.S. investment would accrue to foreign owners.

| U.S. Average Under Current Law (unweighted) | U.S. Average under Biden’s Plan (unweighted) | |

|---|---|---|

| Corporate Profits | $100.0 | $100.0 |

| Combined Corporate Income Tax (25.8% current law, 32.4% Biden’s plan) | $25.78 | $32.35 |

| Distributed Dividend | $74.22 | $67.65 |

| Combined Top Dividend Income Tax (29.0% current law, 48.4% Biden’s plan) | $21.53 | $32.77 |

| Total After-Tax Income | $52.69 | $34.88 |

| Integrated Tax Rate | 47.3% | 65.1% |

|

Source: Tax Foundation calculations, state statutes, American Jobs Plan and American Families Plan Fact Sheets. |

||

| Combined Top Corporate Rate | Combined Top Marginal Capital Gains Tax Rate | Combined Top Integrated Tax Rate | |

|---|---|---|---|

| Alabama | 31.70% | 46.42% | 63.40% |

| Alaska | 34.77% | 43.40% | 63.08% |

| Arizona | 31.53% | 49.40% | 65.35% |

| Arkansas | 32.46% | 46.35% | 63.77% |

| California | 34.36% | 56.70% | 71.58% |

| Colorado | 31.28% | 47.95% | 64.23% |

| Connecticut | 33.40% | 50.39% | 66.96% |

| DC | 34.26% | 52.35% | 68.68% |

| Delaware | 33.94% | 50.00% | 66.97% |

| Florida | 31.21% | 43.40% | 61.06% |

| Georgia | 32.14% | 49.15% | 65.49% |

| Hawaii | 32.61% | 50.65% | 66.74% |

| Idaho | 32.99% | 50.33% | 66.71% |

| Illinois | 34.84% | 48.35% | 66.34% |

| Indiana | 31.78% | 46.63% | 63.59% |

| Iowa | 35.06% | 48.55% | 66.59% |

| Kansas | 33.04% | 49.10% | 65.92% |

| Kentucky | 31.60% | 48.40% | 64.71% |

| Louisiana | 32.55% | 47.02% | 64.27% |

| Maine | 34.43% | 50.55% | 67.58% |

| Maryland | 33.94% | 49.15% | 66.41% |

| Massachusetts | 33.76% | 48.40% | 65.82% |

| Michigan | 32.32% | 47.65% | 64.57% |

| Minnesota | 35.06% | 53.25% | 69.64% |

| Mississippi | 31.60% | 48.40% | 64.71% |

| Missouri | 30.58% | 48.80% | 64.46% |

| Montana | 32.86% | 50.16% | 66.54% |

| Nebraska | 33.62% | 50.24% | 66.97% |

| Nevada | 28.00% | 43.40% | 59.25% |

| New Hampshire | 33.54% | 48.40% | 65.71% |

| New Jersey | 36.28% | 54.15% | 70.78% |

| New Mexico | 32.25% | 46.94% | 64.05% |

| New York | 32.68% | 54.30% | 69.23% |

| North Carolina | 29.80% | 48.65% | 63.95% |

| North Dakota | 31.10% | 45.14% | 62.20% |

| Ohio | 28.00% | 48.20% | 62.70% |

| Oklahoma | 32.32% | 48.40% | 65.08% |

| Oregon | 33.47% | 53.30% | 68.93% |

| Pennsylvania | 35.19% | 46.47% | 65.31% |

| Rhode Island | 33.04% | 49.39% | 66.11% |

| South Carolina | 31.60% | 47.32% | 63.97% |

| South Dakota | 28.00% | 43.40% | 59.25% |

| Tennessee | 32.68% | 43.40% | 61.90% |

| Texas | 28.00% | 43.40% | 59.25% |

| Utah | 31.56% | 48.35% | 64.65% |

| Vermont | 34.12% | 52.15% | 68.48% |

| Virginia | 32.32% | 49.15% | 65.58% |

| Washington | 28.00% | 43.40% | 59.25% |

| West Virginia | 32.68% | 49.90% | 66.27% |

| Wisconsin | 33.69% | 48.76% | 66.02% |

| Wyoming | 28.00% | 43.40% | 59.25% |

| Unweighted Average | 32.4% | 48.4% | 65.1% |

|

Source: Tax Foundation calculations, state statutes, American Jobs Plan and American Families Plan Fact Sheets. |

|||

Launch Resource Center: President Biden’s Tax Proposals

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe