All Related Articles

How Biden’s Tax Plans Could Negatively Impact Housing

While President Biden has many proposals aimed at increasing the supply of affordable housing, including tax credits, his plans to raise business taxes could hinder that goal.

4 min read

Comparing Three Financing Options for President Biden’s Spending Proposals

While Congress continues to debate how to pay for President Biden’s spending proposals in the fiscal year 2022 budget, it is useful to consider the economic impact of a range of financing options in addition to the President’s proposed tax increases.

3 min read

Dynamic Scoring of Infrastructure Spending Proposals Offsets Small Portion of the Cost

While it is good that policymakers are taking the impact of the economy on tax revenue seriously, it is important to remember that the dynamic effect of increased spending would only offset a small portion of the total spending. In other words, new spending—like tax cuts—rarely pays for itself.

3 min read

Biden Plan’s Higher Taxation of Businesses Would Boost Collections to Highest in 40-Plus Years

President Biden’s tax proposals released as part of his fiscal year 2022 budget would collect about $2 trillion in new tax revenue from businesses over 10 years. This new revenue would bring income tax collections on businesses as a portion of GDP to its highest level on a sustained basis in over 40 years.

2 min read

The Impact of the Biden Administration’s Tax Proposals by State and Congressional District

The redistribution of income from the Biden administration’s tax proposals would involve many winners and losers, not only across different types of taxpayers but also geographically across the country. Launch our new interactive map to see average tax changes by state and congressional district over the budget window from 2022 to 2031.

8 min read

Details and Analysis of President Biden’s FY 2022 Budget Proposals

Explore President Biden budget proposals, including tax and spending in American Jobs Plan and American Families Plan. See Biden tax and spending proposals.

12 min read

Tracking the 2021 Biden Tax Plan and Federal Tax Proposals

Taxes are once again at the forefront of the public policy debate as legislators grapple with how to fund new infrastructure spending, among other priorities. Our tax tracker helps you stay up-to-date as new tax plans emerge from the Biden administration and Congress.

1 min read

Expensing Is Infrastructure, Too

The Biden administration has suggested several tax increases for his infrastructure plan. Public infrastructure can help increase economic growth, but by raising taxes on private investment, the net effect on growth may be negative. However, tax options like retaining expensing for private R&D investment or making 100 percent bonus depreciation for equipment permanent would be complementary to the goals of infrastructure spending.

5 min read

Details and Analysis of President Biden’s American Jobs Plan

Details and analysis of the American Jobs Plan tax proposals. Learn more about the major tax changes in the proposed Biden infrastructure plan.

9 min read

Pleading GILTI: A Guide to the Complicated World of Global Intangible Low Tax Income

On this episode of The Deduction, we speak with Pam Olson, Tax Foundation Board Member and Consultant on Tax Policy Services at PwC, about the tax on Global Intangible Low Tax Income, or “GILTI.” In 2017, GILTI was implemented as a minimum tax designed to disincentivize U.S. companies from shifting profits overseas, but it doesn’t work how drafters intended, and now President Biden has proposed doubling it.

How Biden’s Corporate Tax Increases Could Make Tax Enforcement Harder

If Biden wants to reduce tax evasion, raising the corporate rate, increasing the incentives to engage in tax evasion, and creating a larger tax advantage to becoming a pass-through business is counterproductive.

3 min read

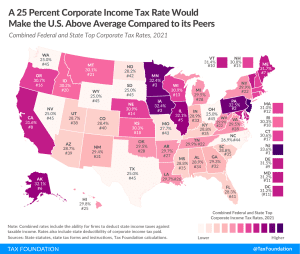

25 Percent Corporate Income Tax Rate Would Make U.S. Above Average Compared to Peers

Some lawmakers have expressed concerns about President Biden’s proposal to raise the federal corporate income tax rate from 21 percent to 28 percent, and instead suggest raising the rate to 25 percent.

3 min read

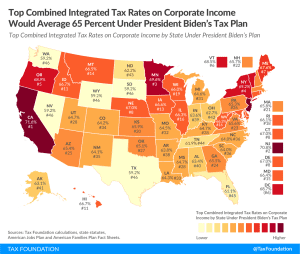

U.S. Top Combined Integrated Tax Rate on Corporate Income Would Become Highest in the OECD

Under President Biden’s tax plan, the United States would tax corporate income at the highest top rate in the industrialized world, averaging 65.1 percent.

3 min read

Reviewing Options to Raise Tax Revenue and the Trade-offs for Economic Growth and Progressivity

There’s a useful contrast between two revenue options related to President Biden’s infrastructure push. The president’s American Jobs Plan includes a proposal to raise the corporate tax rate to 28 percent. Meanwhile, historically, the gas tax is the main revenue source for transportation funding.

8 min read

Tax Policy in the First 100 Days of the Biden Administration

In his first 100 days as president, Joe Biden has proposed more than a dozen significant changes to the U.S. tax code that would raise upwards of $3 trillion in revenue and reduce incentives to invest, save, and work in the United States.

4 min read

Raising the Corporate Rate to 28 Percent Reduces GDP by $720 Billion Over Ten Years

The Options guide presents the economic effects we estimate would occur in the long term, or 20 to 30 years from now, but we can also use our model to show the cumulative effects of the policy change—providing more context, for instance, about how the effects of a higher corporate income tax rate compound over time, which we estimate would reduce GDP by a cumulative $720 billion over the next 10 years.

4 min read

President Biden’s Infrastructure Plan Raises Taxes on U.S. Production

An increase in the federal corporate tax rate to 28 percent would raise the U.S. federal-state combined tax rate to 32.34 percent, higher than every country in the OECD, the G7, and all our major trade partners and competitors including China.

6 min read

CBO Study: Benefits of Biden’s $2 Trillion Infrastructure Plan Won’t Outweigh $2 Trillion Tax Hike

The economics is clear: If Biden wants to maximize the economic benefits of his $3 trillion in new infrastructure spending, he should cut $3 trillion in other government spending to pay for it.

7 min read