What You’ll Learn

- Learn about how taxes can influence human behavior through the power of incentives.

- See how different taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. policies have impacted everything around us, including the buildings we live in, the cars we drive, and even what we eat and wear.

- Gain a deeper appreciation for the importance of designing tax policies that encourage positive economic behaviors.

Introduction

It’s one thing to talk about the impact of taxes in the abstract—how they affect the size of the economy, levels of investment, or number of jobs. But tax policy is so powerful that we can see its effects everywhere in the world around us—literally.

You need look no further than the house you live in, the car you drive, the clothes you wear, or the food you eat to see the profound influence taxes can have on human behavior.

The Impact of Tax Policy on Architecture

- As it turns out, fresh air and sunlight are weak incentives compared to the temptation of a lower tax bill. When 18th and 19th century governments in England, France, Ireland, and Scotland levied a tax on windows—intended as a crude proxy for wealth—building owners often responded by bricking over their windows.

- Have you ever noticed that the houses in Amsterdam are abnormally narrow? This is not due to a unique taste in architecture, but instead a 16th century building tax that was assessed on the width of a property’s façade.

- Paris is famous for its use of the Mansard-style roof, which was designed to shelter residents not only from the weather but also from taxes that were levied on the number of floors below the roofline.

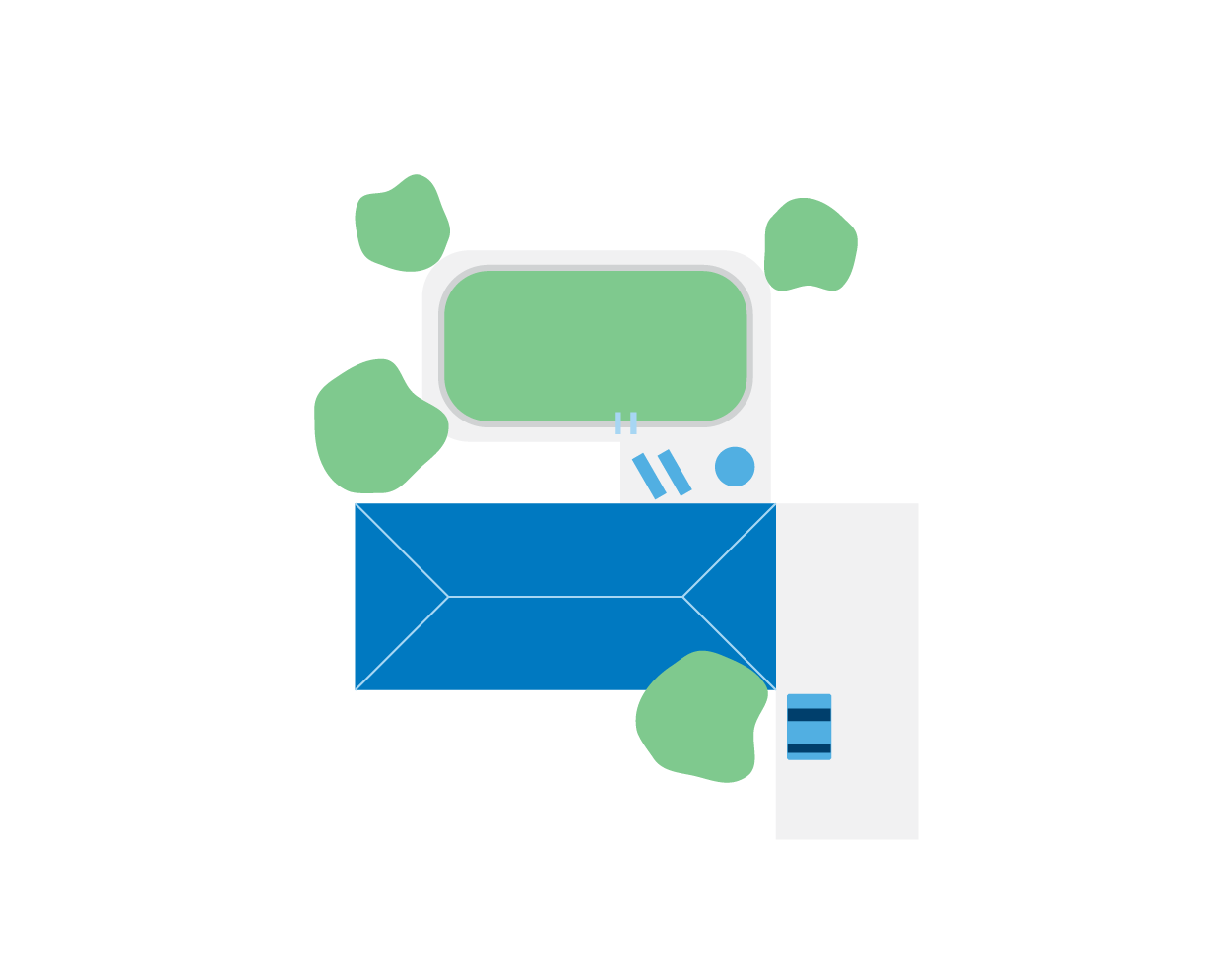

- Greece is known for its blue waters, but what about its green pools? A luxury tax has inspired Greek pool owners to purchase green coverings and even dye their water green to camouflage their pools in satellite images, hoping to fool prying tax collectors.

The Impact of Tax Policy on Consumption

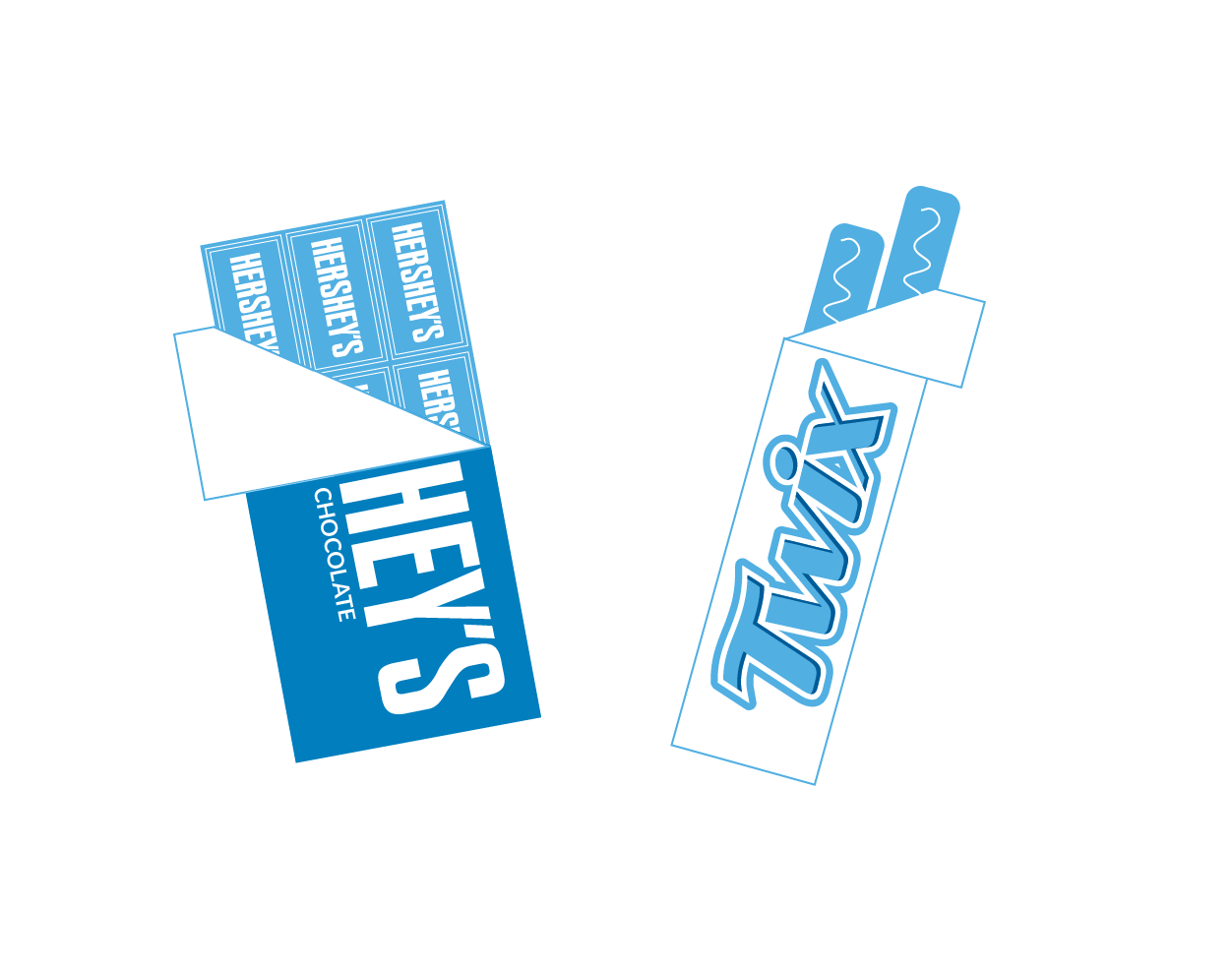

- Caramel and a cookie crunch aren’t the only things that distinguish a Twix® bar from a Hershey’s® bar. Twix® also enjoys a sweet tax deal. Because it is made with flour, an arbitrary ingredient used to determine whether an item is a “food product” vs. “candy” in the U.S., Twix® is exempt from sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding.

in the 24 states that don’t tax groceries.

- In the United Kingdom, losing a few pounds could save you a few pounds (sterling) at the cash register. That’s because children’s clothing is exempt from the value-added tax (VAT)—giving adults who can squeeze into clothes hanging on the “teen” rack a unique tax advantage.

- Prohibition didn’t prevent alcohol consumption in the U.S., it just changed how people consumed, and high cigarette taxes in the states have a similar effect today. It’s estimated that in New York, among the states with the highest excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections.

on cigarettes, over half the cigarettes being smoked are smuggled in to avoid the excise tax. That amounts to over 280 million packs a year.

- If you’ve noticed a proliferation of spiked seltzers in the alcohol aisle lately, you’re probably not alone. Tax policy is one reason products like White Claw and Truly have taken off. While you might think of them as “vodka” sodas, producers of today’s hard seltzers have found a way to make the beverage by fermenting, rather distilling, sugar. And since it’s brewed like beer, hard seltzer is taxed like it too, avoiding a relatively hefty distilled spirits excise tax in the U.S.

The Impact of Tax Policy on Transportation

- It may not look like a motorcycle, but the three-wheeled “Reliant Robin,” popularized in the UK during the 1970s, was taxed like one. In fact, Reliant was known to run ads promoting the fact that owners paid lower annual taxes than they would if driving a conventional car. The vehicle may have tipped over at high speeds, but some found that a small price to pay for saving £55 in taxes each year!

- Copenhagen is widely recognized as a cycling mecca, where half of all trips to school and work take place on a bike and less than one-third of households own a car. Part of this is cultural, part is due to the proliferation of bike lanes, but another reason so many take to the bike is because they can’t afford not to. In addition to high gas taxes, Denmark levies a 150 percent excise tax on new vehicle purchases. That means a car that would retail for $30,000 in the U.S. would cost $75,000 in Denmark.

- Despite what its name implies, the poultry industry wasn’t the only casualty in the “Chicken War” of the 1960s. In 1963, one year after Europe raised tariffs on U.S. chicken (known as the “Chicken Tax”), the U.S. responded by levying tariffs on important European exports, including pickup trucks and commercial vans. Manufacturers like Ford got around the tariffTariffs are taxes imposed by one country on goods imported from another country. Tariffs are trade barriers that raise prices, reduce available quantities of goods and services for US businesses and consumers, and create an economic burden on foreign exporters.

by fitting its commercial vans with windows, seats, and seat belts, shipping them to the U.S. as “passenger” vehicles, then ripping everything out to convert them back to light trucks. Removed parts were shredded and recycled in Ohio.

- Electric vehicles have surged in popularity in recent years, and not just because of a renewed focus on the environment. The success companies like Tesla and GM have had converting Americans to electric cars has been driven in large part by generous federal and, in some cases, state tax subsidies that make it cheaper to produce and own electric cars.

Why Does it Matter?

If taxes are powerful enough to cause an individual to board up their windows or sacrifice the comfort of their car’s AC for the seat of a bike, imagine the cumulative impact they can have on more important aspects of the economy.

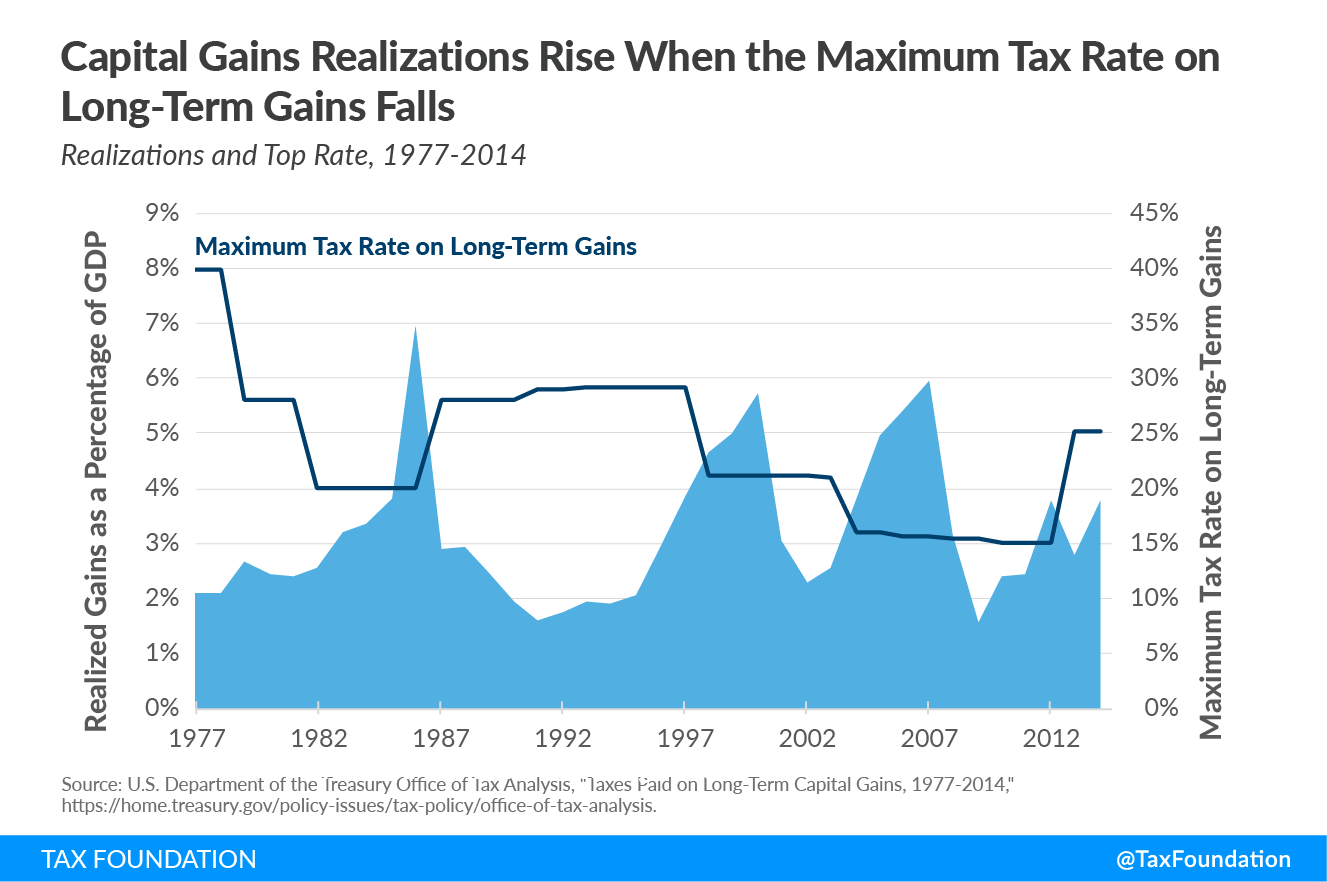

Capital gains taxes provide a stark example.

Capital assets include everything owned and used for personal purposes, pleasure, or investment, including stocks, bonds, homes, cars, jewelry, and art. Whenever one of those assets increases in value—e.g., when the price of a stock you own goes up—the result is what’s called a “capital gain.”

In places with a capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. , when a person “realizes” a capital gain—e.g., sells an asset that has increased in value—they pay tax on the profit they earn.

Because capital gains are only taxed when realized, taxpayers get to choose when they pay their capital gains taxes. That makes them extremely responsive to tax changes.

Higher capital gains taxes cause investors to sell their assets less frequently, which leads to less taxes being assessed.

This effect isn’t just theoretical—it’s borne out clearly in the data, as demonstrated by the chart below. We can see that when the capital gains tax rate was increased in 1986, realizations fell dramatically and remained low for a decade. When the tax rate on capital gains was cut in 1997, realizations rose substantially.

This should serve as a reminder to lawmakers that they ought to think carefully about the incentives they create through the tax code. Taxes don’t just impact the cars we drive and candy bars we eat—they can also have significant effects on the economy as a whole.

Confused? Boost Your Tax Knowledge with TaxEDU

Tax policy can be complex. Thankfully our resources for understanding them aren’t.

Learn more