This week, Treasury Secretary Janet Yellen will testify before the Senate Finance Committee and the House Ways and Means Committee on President Biden’s Fiscal Year 2023 Budget Proposals. Combined with the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. increases in the Build Back Better Act (BBBA), which the budget assumes becomes law, President Biden would raise revenues by $4 trillion on a gross basis over the next decade. The Biden tax increases in the budget and BBBA would come at the cost of economic growth, harming investment incentives and productive capacity at precisely the wrong time.

The major tax proposals include:

-

higher top rates for individual income, corporate income, and capital gains income;

-

ending step-up in basis by making death a taxable event;

-

expanding the base of the Net Investment Income Tax (NIIT) to apply to active pass-through income and making the active pass-through business loss limitation permanent;

-

major changes to international taxation; and,

-

a laundry list of new minimum taxes for individuals, businesses, and international corporations.

Another revenue raiser includes government-set pricing for certain prescription drugs, enforced by an excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. of 1,900 percent on drug sales.

The tax increases in BBBA alone would reduce long-run GDP by 0.5 percent, and the tax increases in the budget, including a higher corporate tax rate of 28 percent (up from the current 21 percent) and international tax changes, would further discourage domestic investment and reduce the productive capacity of the United States. For example, raising the corporate tax rate to 28 percent would reduce long-run GDP by 0.7 percent and eliminate 138,000 jobs.

The magnitude of the tax and revenue increases on the table is unprecedented. The Tax Foundation estimated BBBA would raise $1.7 trillion of gross revenue over the next decade:

- $470 billion from corporate and international tax changes;

- $516 billion from individual tax changes (excluding changes to the State and Local Tax deductionA tax deduction allows taxpayers to subtract certain deductible expenses and other items to reduce how much of their income is taxed, which reduces how much tax they owe. For individuals, some deductions are available to all taxpayers, while others are reserved only for taxpayers who itemize. For businesses, most business expenses are fully and immediately deductible in the year they occur, but others, particularly for capital investment and research and development (R&D), must be deducted over time. );

- $517 billion from other revenue increases; and,

- $148 billion from IRS enforcement.

Biden’s budget assumes the BBBA increases take effect, and would pile on another $2.5 trillion of tax increases—$1.6 trillion from corporate and international tax changes, $780 billion in individual tax changes, and $170 billion from other revenue increases.

Altogether, President Biden is proposing raising revenue by more than $4 trillion primarily from new taxes on U.S. businesses and individuals, exceeding the magnitude of his proposed tax hikes during the 2020 campaign ($3.7 trillion on a gross basis). The gross tax increase would be reduced on a net basis by increases in tax credits for certain individuals and economic activities.

| 10-Year Revenue (in billions) | |

|---|---|

| Corporate and International Tax Increases in BBBA | +$470 |

| Individual Tax Increases in BBBA (excluding SALT changes) | +$516 |

| Other Revenue Increases in BBBA (includes drug pricing provisions, misc. corporate provisions scored by JCT, and other tax provisions) | +$517 |

| Increase in Revenues from IRS Enforcement in BBBA | +$148 |

| Corporate and International Tax Increases in FY2023 Budget | +$1,600 |

| Individual Tax Increases in FY2023 Budget | +$780 |

| Other Increases in FY2023 Budget | +$170 |

| Total | +$4,201 |

|

Note: The budget assumes BBBA becomes law excluding changes to the State and Local Tax Deduction. Source: Tax Foundation, “House Build Back Better Act: Details & Analysis of Tax Provisions in the Budget Reconciliation Bill,” Dec. 2, 2021, https://www.taxfoundation.org/build-back-better-plan-reconciliation-bill-tax/#Revenue, and Committee for a Responsible Federal Budget, “Analysis of the President’s FY 2023 Budget,” Mar. 28, 2022, https://www.crfb.org/papers/analysis-presidents-fy-2023-budget. |

|

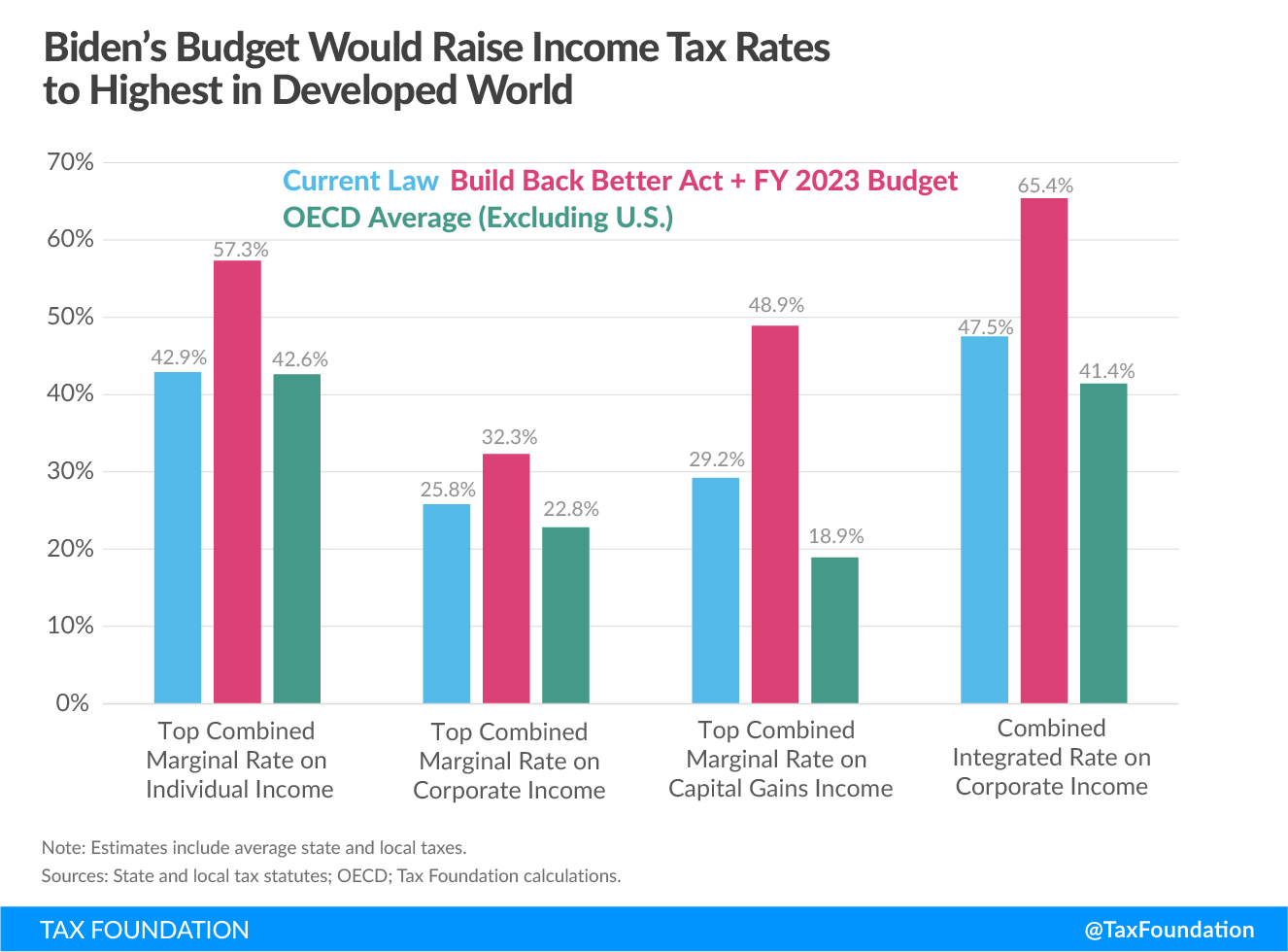

The budget proposes several new tax increases on high-income individuals and businesses, which combined with the BBBA would give the U.S. the highest top tax rates on individual and corporate income in the developed world:

- Raising the top marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. on individual income to 39.6 percent and applying an 8 percent surtaxA surtax is an additional tax levied on top of an already existing business or individual tax and can have a flat or progressive rate structure. Surtaxes are typically enacted to fund a specific program or initiative, whereas revenue from broader-based taxes, like the individual income tax, typically cover a multitude of programs and services. on MAGI above $25 million would bring the combined top marginal tax rate on individual income to 57.3 percent, up from 42.9 percent under current law and above the OECD average of 42.6 percent.

- Taxing capital gains at ordinary income tax rates would bring the combined top marginal rate in the U.S. to 48.9 percent, up from 29.2 percent under current law and well-above the OECD average of 18.9 percent. Further, Biden’s proposal for a complicated “Billionaire Minimum Tax” would bring unrealized gains into the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. on an annual basis, which is also out of step with international norms.

- Raising the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate to 28 percent would once again bring the U.S. near the top of the OECD at a combined rate of 32.3 percent, versus 25.8 percent under current law and an OECD average (excluding the U.S.) of 22.8 percent.

| Current Law | BBBA + FY 2023 Budget | OECD Average (excluding U.S.) | |

|---|---|---|---|

| Top Combined Marginal Rate on Individual Income | 42.9% | 57.3% | 42.6% |

| Top Combined Marginal Rate on Corporate Income | 25.8% | 32.3% | 22.8% |

| Top Combined Marginal Rate on Capital Gains Income | 29.2% | 48.9% | 18.9% |

| Combined Integrated Rate on Corporate Income | 47.5% | 65.4% | 41.4% |

|

Note: Estimates include average state and local taxes. Sources: State and local tax statutes; OECD; Tax Foundation calculations. |

|||

The proposed budget also creates several minimum taxes that would greatly increase complexity within the tax code, including:

- A domestic minimum book tax of 15 percent levied on corporations with income over $1 billion

- A minimum withholding tax for unrealized capital gains owned by households with a net wealth over $100 million

- A domestic minimum top-up tax that applies to foreign earnings of corporations, working in concert with an under-taxed payments rule and other changes to the existing minimum tax rules under GILTI

As our colleague Daniel Bunn has emphasized, “Minimum taxes layer additional rules on top of the already complicated foundation of the tax code. … Rather than introduce one new minimum tax after another, Congress should have the courage to fundamentally reform and strip away the complexity from our tax code.”

At a time when U.S. policy needs to prioritize expanding the productive capacity of the economy, the Biden administration’s proposals would raise more than $4 trillion in new revenue for the government at the cost of the economy, raising the tax burden on work, saving, and investment and putting us out of step with our competitors.

See updated analysis of the Inflation Reduction Act

Share this article