The step-up in basis provision adjusts the value, or “cost basis,” of an inherited asset (stocks, bonds, real estate, etc.) when it is passed on, after death. This often reduces the capital gains tax owed by the recipient. The cost basis receives a “step-up” to its fair market value, or the price at which the good would be sold or purchased in a fair market. This eliminates the capital gain that occurred between the original purchase of the asset and the heir’s acquisition, reducing the heir’s tax liability.

How Does Step-Up in Basis Work?

The purchase price of an asset is typically referred to as the asset’s basis. Capital gains, or losses, refer to the difference between an asset’s purchase price (basis) and its value at the time of sale. It is not until a person realizes a capital gain (sells an asset for a profit) that capital gains taxes are due.

Some assets are held for generations and passed from their original owners to heirs. If these assets are never sold, they are never subject to capital gains taxes. If the heir chooses to sell the asset, any tax would be assessed on the new basis, meaning only appreciation after the asset had been inherited would face capital gains tax.

While the provision can help reduce the burden of the capital gains tax, it does not apply to the estate tax.

The Trade-Offs of Repealing Step-Up in Basis

Step-up in basis discourages people from realizing capital gains and reduces compliance costs for heirs because tracking cost basis of long-held assets, especially from decedents, can be difficult.

While it is less than neutral for capital gains to entirely escape taxation, as can occur due to step-up in basis, the policy also mitigates what would otherwise be a significant effective tax rate on saving by preventing taxpayers from having to pay both estate and capital gains taxes on the same inherited asset.

Repealing step-up in basis would make the tax code more progressive and would also encourage capital gains realization. As our model shows, revenues would increase and those in the top income groups would pay more relative to current law.

Economic Effects

- -0.1% Gross Domestic Product

- -0.2% Gross National Product

- -0.1% Capital Stock

- -8k Full-Time Equivalent Jobs

- -0.1% Wage Rate

Budgetary Effects

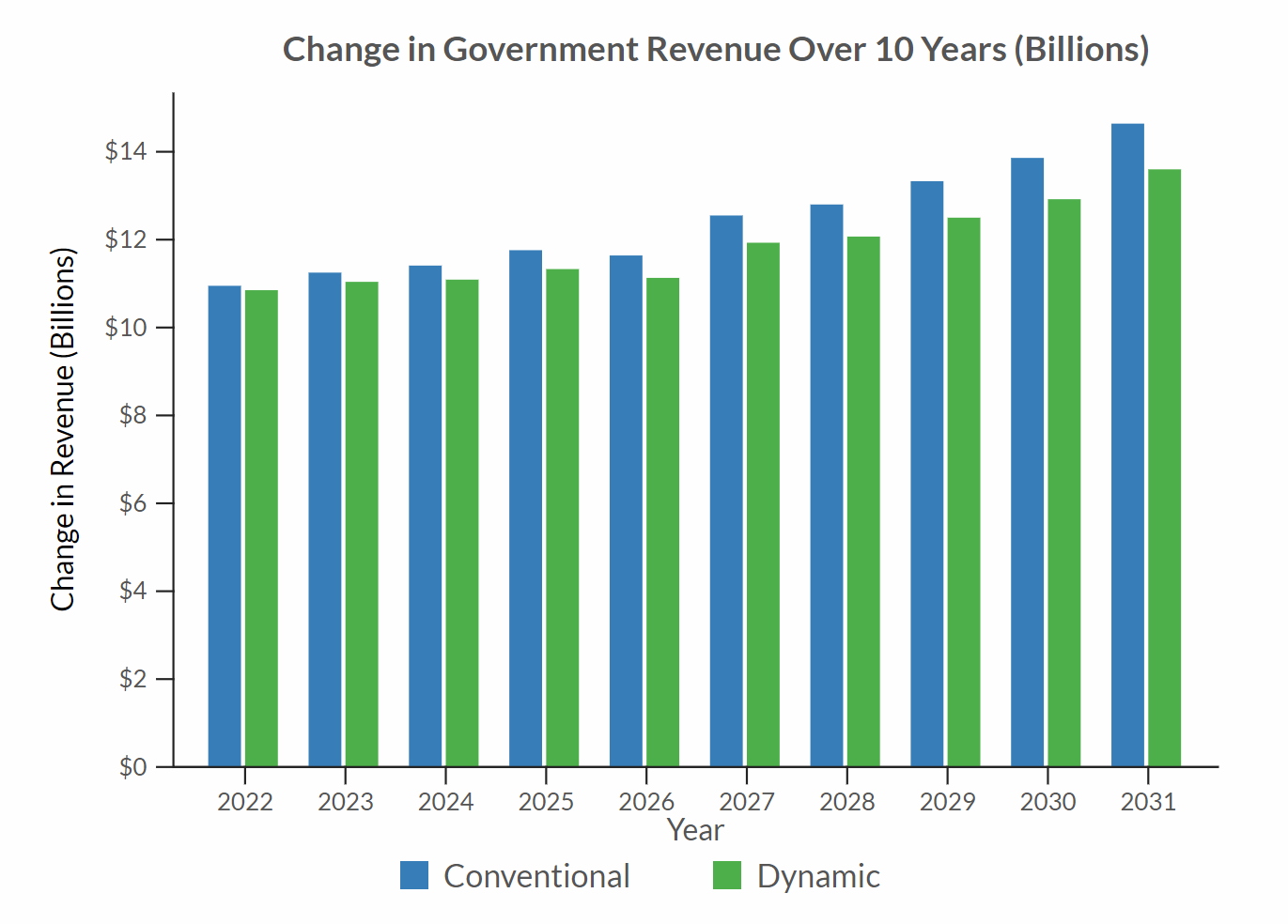

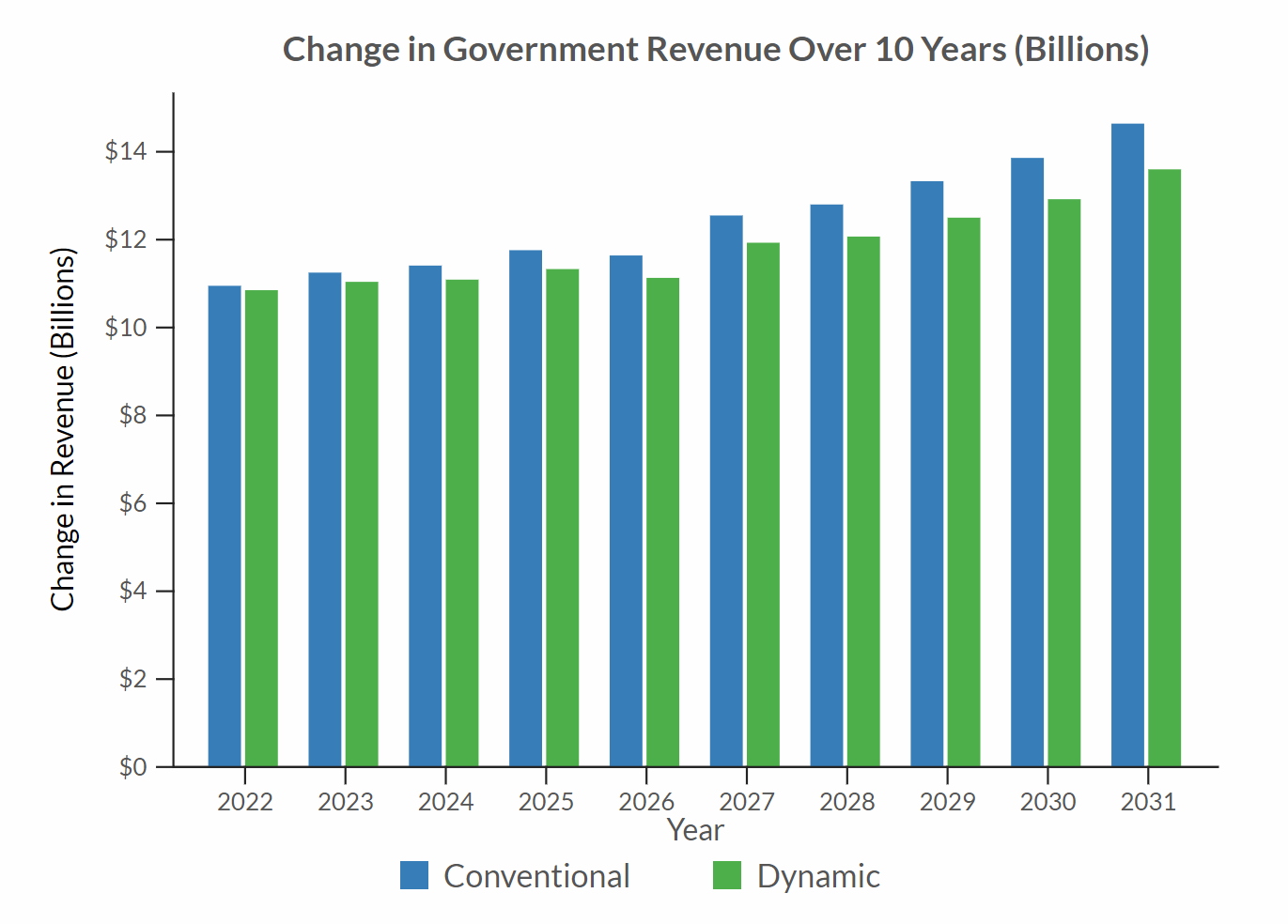

- $124.18 Billion Static 10-Year Revenue

- $118.46 Billion Dynamic 10-Year Revenue

| Income Group | Percent Change in After Tax Income | ||

|---|---|---|---|

| Conventional, 2022 | Conventional, 2031 | Long Run Dynamic | |

| 0% to 20% | 0% | 0% | -0.1% |

| 20% to 40% | 0% | 0% | -0.1% |

| 40% to 60% | 0% | 0% | -0.1% |

| 60% to 80% | 0% | 0% | -0.1% |

| 80% to 100% | -0.2% | -0.1% | -0.2% |

| 90% to 95% | 0% | 0% | -0.1% |

| 95% to 99% | < -0.05% | < -0.05% | -0.1% |

| 99% to 100% | -0.5% | -0.5% | -0.5% |

| Total | -0.1% | -0.1% | -0.1% |

| Source: Tax Foundation General Equilibrium Model, April 2021 | |||

Repealing step-up in basis would result in a larger negative effect on national income (GNP) than output (GDP) since the resulting reduction in domestic saving would attract inflow of foreign investment. After accounting for economic effects, after-tax income would drop at all income levels, with the largest effects felt by the top 1 percent.

While repealing step-up in basis would raise substantial revenue relative to current law, it would reduce national saving and total wealth, increase compliance costs for the government and taxpayers, and shift the tax code from taxing consumption—illustrating that every tax policy change comes with distinct trade-offs.

Eliminating the policy without changing the estate tax could also increase the tax burden on capital and increase compliance burdens for taxpayers.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe