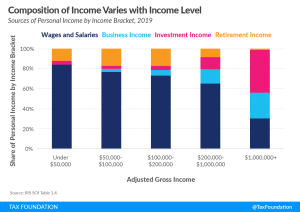

America’s Progressive Tax and Transfer System: Federal, State, and Local Tax and Transfer Distributions

The overall U.S. tax and transfer system is overwhelmingly progressive, and understanding the extent—and source—of that progressivity is essential for lawmakers considering the trade-offs associated with each tax policy decision.

23 min read