Improving Tax Treatment of Structures Offers Commonsense Way to Boost Competitiveness

The U.S. tax system is biased against capital investments. Ending these tax penalties would boost economic output, productivity, and employment.

4 min readErica York is Senior Economist and Research Director with Tax Foundation’s Center for Federal Tax Policy. She previously worked as an auditor at a large community bank in Kansas and interned at Tax Foundation’s Center for State Tax Policy.

Her analysis has been featured in The Wall Street Journal, The Washington Post, Politico, and other national and international media outlets. She holds a master’s degree in Economics from Wichita State University and an undergraduate degree in Business Administration and Economics from Sterling (KS) College, where she is currently an adjunct professor. Erica lives in Kansas with her husband and their two children.

The U.S. tax system is biased against capital investments. Ending these tax penalties would boost economic output, productivity, and employment.

4 min read

Policymakers actively marginalized the manufacturing sector by saddling them with cost recovery rules that prevent them from deducting the full cost of investment in physical plant and equipment. Going forward, policymakers should avoid haphazard fixes, targeted measures, and protectionism.

50 min read

By reducing the tax code’s current barriers to investment and saving and simplifying its complex rules, lawmakers would greatly enhance the ability of Americans to pursue new ideas, create more opportunities, and build financial security for themselves and their families.

40 min read

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

41 min read

Tax extenders this year can be split into three rough groups: expiring parts of the Tax Cuts and Jobs Act (TCJA), expiring parts of various COVID-19 economic relief packages, and the Island of Misfit Extenders.

8 min read

While the book minimum tax is smaller in scale than the proposed original corporate rate increases, it would introduce more complexity, inefficiency, and problems at the industry- and sector-levels that a corporate rate increase would not. Neither option is an optimal way to raise new tax revenues.

4 min readLearn more about the House Build Back Better Act, including the latest details and analysis of the Biden tax increases and reconciliation bill tax proposals.

15 min read

As lawmakers today look for ways to boost American industry and reduce costs for consumers, they should pay attention to the mountains of evidence that the Trump-Biden tariffs have harmed American consumers and businesses.

5 min read

The Build Back Better Act would raise taxes to pay for social spending programs. But the design of some of the tax increases may end up hurting private pensions, among other problems.

6 min read

One unintended consequence of the tax proposals in the Build Back Better Act is a higher potential burden on wireless spectrum investments, which could slow the build out of 5G technology as the U.S. races to compete with other countries—moving in the opposite direction of countries like China that are actively subsidizing 5G expansion.

5 min read

The IRS recently released the new inflation adjusted 2022 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the annual exclusion for gifts.

5 min read

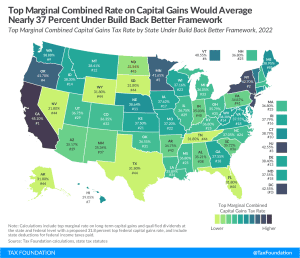

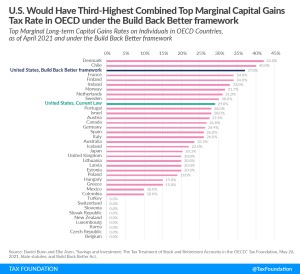

Under the Build Back Better framework, six states and D.C. would face combined top marginal capital gains tax rates of more than 40 percent, nearing the top rate among OECD countries.

2 min read

Under the new Build Back Better framework, the United States would tax capital gains at the third-highest top marginal rate among rich nations, averaging nearly 37 percent.

1 min read

Congress is debating new ways to raise revenue that would make the tax code more complex and more difficult to administer. The new proposals—imposing an alternative minimum tax on corporate book income, applying an excise tax on stock buybacks, and, at one point this week, a tax on unrealized capital gains for billionaires—are unreliable and highly complex ways to raise revenue.

10 min read

With corporate and individual rate hikes potentially out of the Build Back Better (BBB) reconciliation package, lawmakers are weighing alternative options to raise revenue. Rather than come up with untested proposals and complicated changes to the tax base, they should prioritize options that raise revenue while improving the structure of the tax code.

4 min read

President Biden expanded and fundamentally changed the Child Tax Credit (CTC) for one year in the American Rescue Plan (ARP) passed in March 2021. Policymakers are now deciding the future of the expansion as part of the proposed reconciliation package, but a wide range of estimates for the effects of a permanent expansion is confusing the debate.

7 min read

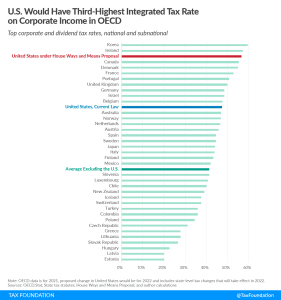

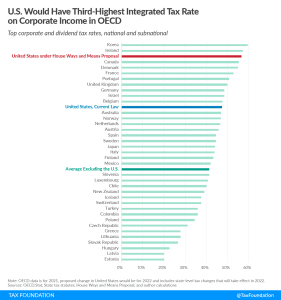

Under the House Ways and Means tax plan, the United States would tax corporate income at the third-highest integrated tax rate among rich nations, averaging 56.6 percent.

3 min read

The White House Council of Economic Advisors (CEA)’s recent report estimates the average federal individual income tax rate for the top 400 wealthiest households in the U.S to be 8.2 percent, lower than typically estimated for top earners.

4 min read

Policymakers should carefully analyze tax expenditures before categorizing one as a loophole—some tax expenditures are important structural elements of the tax code while others are unsound.

14 min read

The latest version of the Biden Build Back Better agenda, released last week by the House Ways and Means committee, is dense, with too many provisions to flesh out completely. Here’s a rundown of the good, the bad, and the ugly of it.

7 min read