Revenues from Value-added Taxes (VAT) make up a significant share of total taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. revenues for many countries. Among OECD countries with a VAT, 21 percent of revenues come from that tax alone. The COVID-19 crisis has impacted tax policies in several ways, and VAT have also been affected both by reduced revenues, temporary carveouts and exemptions, and payment deferrals.

The various lockdowns and general reduction in travel and consumption outside of homes have led to a collapse in VAT revenues. In the past, consumption taxA consumption tax is typically levied on the purchase of goods or services and is paid directly or indirectly by the consumer in the form of retail sales taxes, excise taxes, tariffs, value-added taxes (VAT), or income taxes where all savings are tax-deductible. revenues have been less sensitive to economic downturns than income taxes, but VAT revenues have taken a hit, nonetheless.

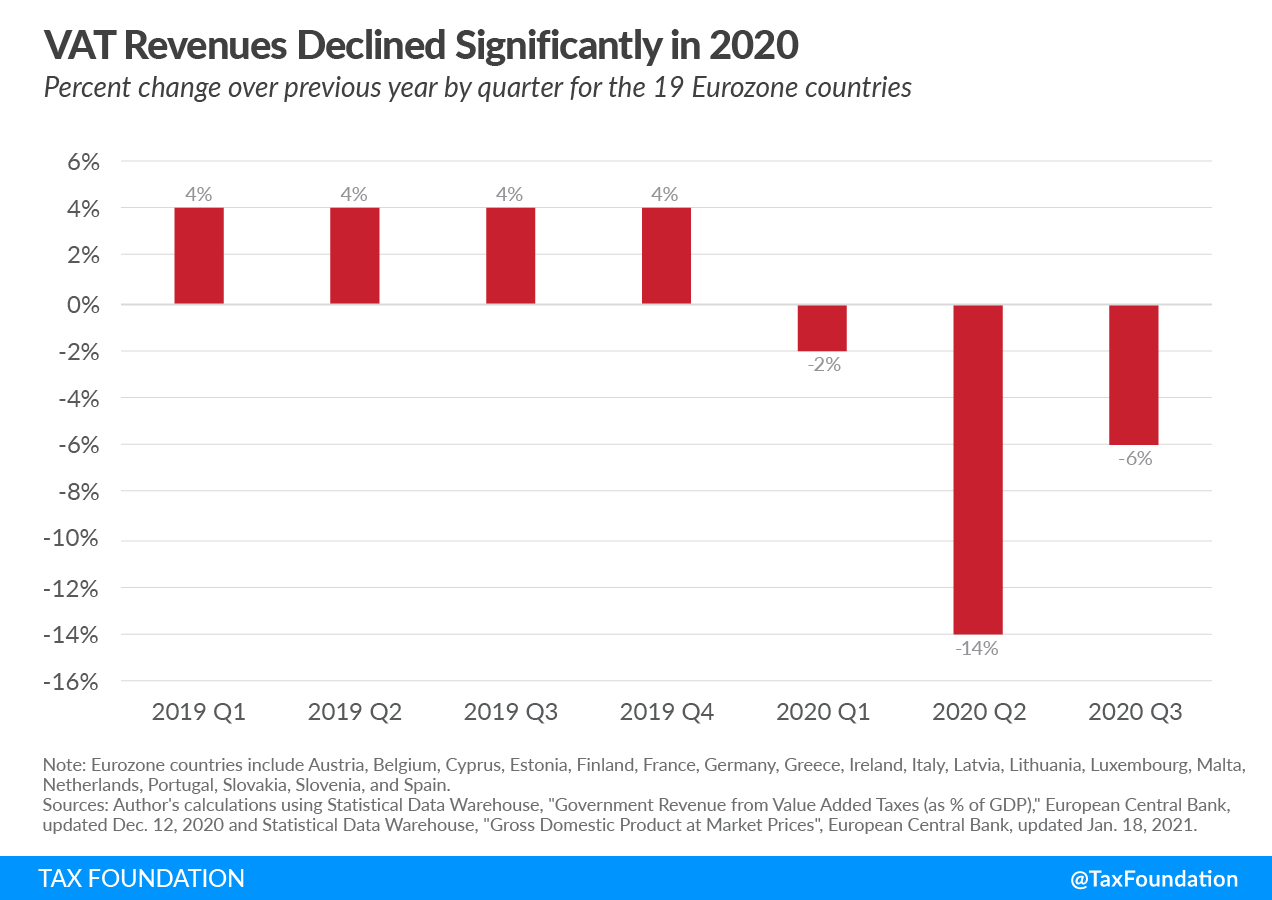

Among the 19 countries in the Eurozone, VAT revenues significantly declined year-over-year in the first three quarters of 2020. In the second quarter of 2020, VAT revenues were 14 percent lower than in the same quarter in 2019.

The main force behind reduced VAT revenues is lower levels of consumer spending. Other contributing factors were temporary VAT payment deferrals and reduced rates and exemptions. The deferrals allowed businesses more time frame to pay their VAT liabilities, and the other policy changes gave tax relief to certain types of consumption.

Germany reduced its standard and reduced VAT rates of 19 percent and 7 percent to 16 percent and 5 percent for the second half of 2020, respectively. The European Union waived VAT on imports of protective equipment, testing kits, ventilators, and other medical supplies through the end of April 2021. Ireland reduced its standard VAT rate from 23 percent to 21 percent for the period from Sept. 1, 2020 to Feb. 28, 2021.

Other countries provided targeted exemptions or selective reduced rates for accommodation, or cultural activities. The Czech Republic reduced the VAT rate on accommodation, culture, and sport transactions from 15 percent to 10 percent. The UK temporarily cut the VAT rate on tourism and hospitality from 20 percent to 15 percent (expires at the end of March 2021). Norway lowered its reduced rate of VAT on accommodation, leisure, and transport from 12 percent to 6 percent.

While these changes have reduced tax burdens on certain consumers and sectors, governments should avoid using VAT as a tool for targeted support once there is a return to normal activities when the pandemic subsides. VAT works best as a broad-based tax with few carveouts and exemptions.

Reduced rates and exemptions may provide some benefits to consumers, but because VAT is a tool for raising tax revenue, every carveout means that a higher overall VAT rate will be needed to hit revenue targets. VAT is a weak policy for providing targeted benefits. Reduced rates for food may benefit lower-income households, but benefits will accrue more to those with higher incomes who consume more. In many cases, VAT refunds targeted by income or direct spending would be superior to relief via reduced rates or VAT exemptions.

Even prior to the pandemic, many VAT systems were suboptimal. In the EU, 15.84 percent of VAT revenues were forgone due to rate reductions and certain exemptions. In order to shore up public finances in the coming years, policymakers should undertake a serious review of rate reductions and exemptions with a goal of narrowing that gap.

VAT revenues have been severely impacted by the pandemic, and an economic recovery will be paired with a recovery in VAT revenues. Many governments have chosen to use VAT as a tool to provide tax relief for consumption in various sectors throughout the pandemic, but in the long term, VAT should not be used as a tool for relief. VAT refunds or direct spending for lower-income households is likely to be more targeted and beneficial. If VAT is to continue to be a significant source of revenue in the future, policymakers will need to invest in reforming VAT systems to close gaps in ways that improve overall efficiency of tax systems.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe