Originally intended to be presented during the fall of 2020, and postponed due to the COVID-19 pandemic, a new United Kingdom budget will finally be published on March 3. Although normally most taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate changes come into effect on budget day or soon after, 2021’s tax reforms might need to wait. Consultations on policies that will define the UK’s tax strategy for the next 10 years will start on March 23, following the budget announcements. Some tax reforms might be pushed later in the year, to the fall of 2021.

In 2021 Chancellor Rishi Sunak is facing a double challenge. On one hand, the budget is expected to offer support to businesses that have been affected by the pandemic and set the foundations for economic growth. On the other hand, he needs to offer budgetary stability. And it will not be an easy task. According to the Institute of Fiscal Studies, the UK would need to raise taxes or cut spending by about 60 billion pounds (US $84 billion) in order to balance the budget. Achieving that objective may not be possible (or even desirable) in the context of a recovery from the economic fallout from the pandemic.

Although the Conservative Party’s election promise in 2019 was to not raise the main tax rates, the current economic situation might push the Chancellor to break his promise.

One of the taxes that might see an increase is the corporate tax. This measure would barely increase tax collection during an economic downturn while sending the wrong signal to businesses and investors. The increase of the corporate tax rate might be substituted by a windfall corporate tax to be applied on excess profits above a certain average and on top of the corporate tax payment. The windfall tax could also target specific sectors that have benefited from the government policies during the COVID-19 crisis. In any case, a windfall tax will deter innovation and impact economic growth while adding complexity to the tax system, making it difficult to administer and comply with.

The Digital Service Tax (DST) is also under scrutiny. Raising the tax rate, reducing the threshold to cover more businesses, and widening its base to include online sales of physical goods are some of the adjustments that the digital tax might undergo. However, a separate tax on sales of goods via the internet will translate into another layer of tax on top of the existing value-added tax (VAT).

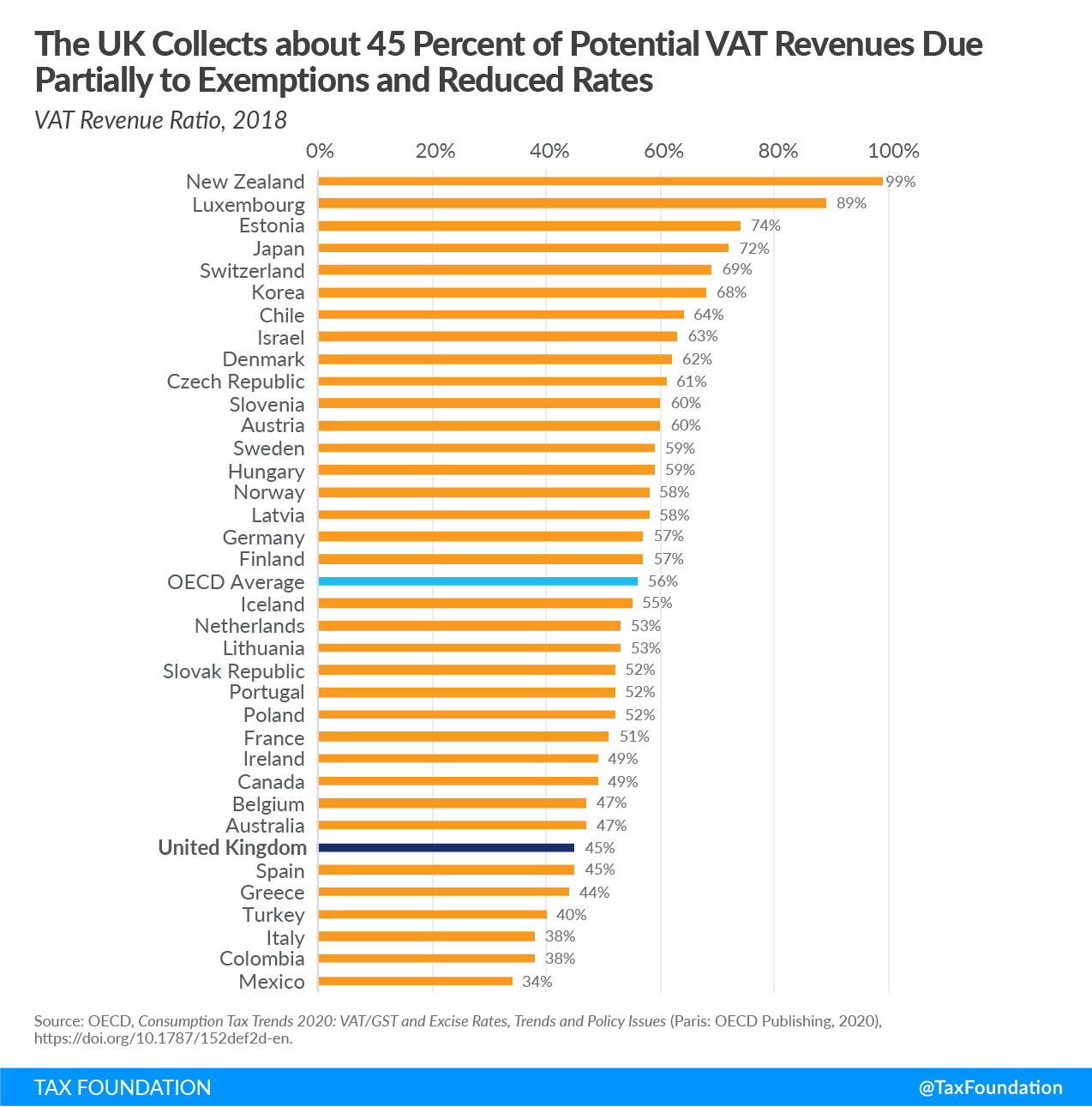

Regarding VAT, the current temporary 5 percent reduced rate (from the 20 percent standard rate) applied to hospitality and tourism might be prolonged for another year. On the other hand, the UK might benefit from reforming VAT as its revenues are less sensitive to economic downturns than income or corporate taxes. The UK has the opportunity to increase tax revenues by broadening its VAT base. The UK’s VAT Revenue Ratio sits below the OECD’s average suggesting there is room to improve tax performance. The UK’s VAT threshold is almost twice the average VAT threshold for OECD countries. Although exempting small businesses saves administrative and compliance costs, large thresholds create a distortion by favoring smaller businesses over larger ones, and negatively impacting tax collection. When looking at the UK’s actionable policy gap, VAT collection could increase by as much as 16.5 percentage points if reduced rates and exemptions are eliminated.

In order to balance the budget, some groups in the UK, like the Wealth TaxA wealth tax is imposed on an individual’s net wealth, or the market value of their total owned assets minus liabilities. A wealth tax can be narrowly or widely defined, and depending on the definition of wealth, the base for a wealth tax can vary. Commission, are recommending a one-off wealth tax. When looking at how little wealth taxes are currently collecting in other countries and the repeal of the tax in most OECD countries, perhaps the UK should not adopt one in the first place. When considering new types of taxes, it is worth accounting for the administrative costs of enforcement, and in this case strengthening enforcement on existing taxes may be a better use of resources for the UK government than bringing in a new tax altogether.

Green taxes might also be part of the 10-year tax strategy. Although fuel duties might not be raised soon, a new plastic packaging tax and levies on gas are being considered. Implementing gas levies will incentivize households to switch home heating from gas to electricity and reduce carbon emissions.

Other measures might include an increase in capital allowances, the simplification of the patent boxA patent box—also referred to as intellectual property (IP) regime—taxes business income earned from IP at a rate below the statutory corporate income tax rate, aiming to encourage local research and development. Many patent boxes around the world have undergone substantial reforms due to profit shifting concerns. regime, or a property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. reform by replacing it with a tax based on the capital value of land and buildings. The property tax reform should also ensure that businesses do not face a tax hike when they improve their properties through renovations or new constructions. Therefore, buildings, plant, and machinery should be excluded from the reformed tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. . In our 2020 International Tax Competitiveness Index (ITCI), the property tax index ranks the UK 33rd out of 36 countries while the UK ranks 22nd in the overall ITCI. Therefore, a complete reform of the property tax will directly impact the UK’s international tax competitiveness.

Tax hikes or spending cuts implemented early in the year might undermine the desirable rapid recovery of the economy. The UK should focus on implementing tax reforms that have the potential to stimulate economic recovery by supporting business investment and employment while increasing its international tax competitiveness.