Wednesday, the United Kingdom will publish its 2021 budget, after the fall budget was delayed due to the pandemic. In addition, the UK government will launch several consultations on the future of the country’s taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. strategy on March 23. Changes to the corporation tax—particularly an increase in the UK’s 19 percent corporation tax rate—are reportedly among the reforms under consideration.

While the UK is looking at ways to raise tax revenue to cover the revenue shortfalls and additional spending resulting from the COVID-19 pandemic, short- as well as long-term, investment will be crucial in getting the economy back on track and ensuring economic growth. Corporation tax policy can play a central role here; however, the focus should be on changes to the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. rather than the tax rate.

More specifically, accelerated depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. —or full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. —of capital assets would decrease the marginal effective tax rate on investment, making new investment less costly. This, in turn, could boost investment and thus economic growth. A number of OECD countries—including Australia and Germany—have already implemented accelerated depreciation for various assets in 2020 to spur investment.

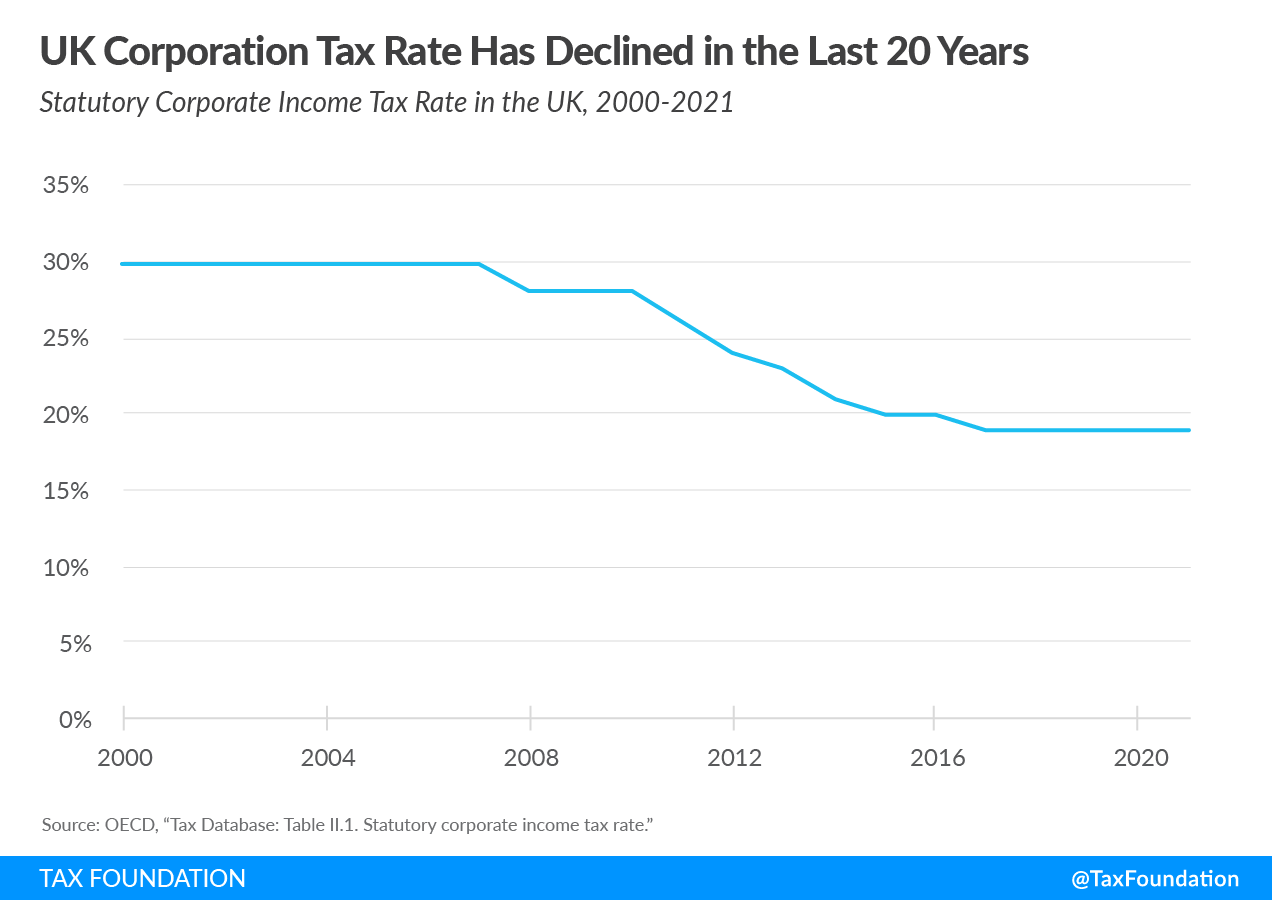

Over the past two decades, the UK has lowered its corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate from 30 percent in 2000 to 19 percent since 2017.

However, these reforms have often been paired with base-broadening measures that penalize new business investment. Between 2008 and 2013, the United Kingdom reduced the value of depreciation deductions for machines and industrial buildings. The present value deduction (the percent of the cost of an investment a company can deduct over its life) for machines fell from 83 percent to 76 percent between 2008 and 2013. Over the same period, the present value deduction for industrial buildings fell from 48 percent to zero.

Just in 2019, the UK reinstated a 2 percent annual allowance for industrial buildings, which was expanded to 3 percent in 2020, now allowing a value deduction of 62 percent. Despite this policy change, the UK’s capital allowanceA capital allowance is the amount of capital investment costs, or money directed towards a company’s long-term growth, a business can deduct each year from its revenue via depreciation. These are also sometimes referred to as depreciation allowances. s are on average still lower than in France and the U.S., and on par with Germany.

| Country | Machinery | Industrial Buildings | Patents | Weighted Average |

|---|---|---|---|---|

| France | 88% | 55% | 87% | 74% |

| United States | 100% | 35% | 63% | 68% |

| United Kingdom | 76% | 39% | 83% | 62% |

| Germany | 74% | 39% | 87% | 62% |

|

Note: Calculations assume a fixed inflation rate of 2.5 percent and fixed interest rate of 5 percent to calculate the present discounted values. The average is weighted by the capital stock’s respective share in an economy (machinery: 44 percent; industrial buildings: 41 percent; and intangibles: 15 percent). Source: Elke Asen, “Capital Cost Recovery across the OECD,” Tax Foundation, Apr. 8, 2020, https://taxfoundation.org/publications/capital-cost-recovery-across-the-oecd/. Calculations were updated to reflect the 3 percent structures and buildings allowance introduced as part of the UK’s 2020 Finance Bill. |

||||

The UK ranked 35th out of 36 countries in the OECD on the cost recoveryCost recovery is the ability of businesses to recover (deduct) the costs of their investments. It plays an important role in defining a business’ tax base and can impact investment decisions. When businesses cannot fully deduct capital expenditures, they spend less on capital, which reduces worker’s productivity and wages. portion of our 2020 International Tax Competitiveness Index. That portion includes capital allowances, as well as the tax treatment of losses, inventory costs, and equity, making it a composite measure of how pro-investment a country’s corporate tax base is.

Though the UK’s corporationAn S corporation is a business entity which elects to pass business income and losses through to its shareholders. The shareholders are then responsible for paying individual income taxes on this income. Unlike subchapter C corporations, an S corporation (S corp) is not subject to the corporate income tax (CIT). tax rate is quite competitive among developed countries, the UK has a corporate tax base that is ripe for reform. The UK could provide immediate cost recovery for all investments, allowing businesses to deduct expenses for new investments immediately rather than relying on lengthy depreciation schedules to recoup only a fraction of their costs in real terms.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe