Congress Passes $900 Billion Coronavirus Relief Package

The coronavirus relief package represents the second-largest recovery legislation, behind only the CARES Act, for a combined total of more than $3 trillion in support.

8 min read

The coronavirus relief package represents the second-largest recovery legislation, behind only the CARES Act, for a combined total of more than $3 trillion in support.

8 min read

The Regional Tax Competitiveness Index (RTCI) for Spain allows policymakers, businesses, and taxpayers to evaluate and measure how their regions’ tax systems compare. This Index has been designed to analyze how well regions structure their tax system. Additionally, it serves as a road map for policymakers to reform their tax systems and make their regions more competitive and attractive for entrepreneurs and residents.

7 min read

Any additional relief to address a temporary economic crisis should be temporary, targeted toward those most in need, and consistent with good long-term tax policy.

3 min read

With days left until government funding runs out, congressional lawmakers are down to the wire to fund the government and provide additional pandemic-related relief to the households and businesses trying to make it through the winter.

3 min read

While a sweeping tax policy bill is unlikely in the near future, lawmakers may be able to come together on a smaller scale. Pairing better cost recovery on a permanent basis with support for vulnerable households as well as additional pandemic-related relief would help promote a more rapid return to growth and help businesses and households weather the ongoing crisis.

4 min read

At the end of 2020, 33 temporary tax provisions are scheduled to expire at the federal level. These provisions generally fall under four categories: cost recovery, energy, individual, and other business provisions.

20 min read

President Biden and Congress should concentrate on areas of common ground, finding incremental places to improve the tax code. A bipartisan bill recently introduced to help retirement savings is a good model for what incremental reform may look like.

4 min read

See the results of the most notable state and local tax ballot measures during Election 2020 with our curated resource page.

11 min read

Over the course of the 2020 presidential election campaign, Democratic nominee Joe Biden has proposed new tax credits for health insurance, child care, elderly care, and homeownership, in addition to expansions of the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC).

3 min read

The IRS recently released the new 2021 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the annual exclusion for gifts.

6 min read

President Joe Biden’s tax plan would yield combined top marginal state and local rates in excess of 60 percent in three states: California, Hawaii, and New Jersey (also New York City).

4 min read

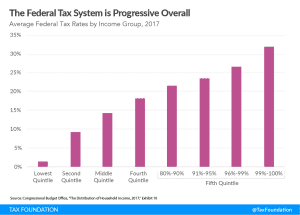

Contrary to the perceptions of some, new data indicate that (1) income earned after taxes and transfers has increased over the past several decades for all income groups; (2) the federal tax system is increasingly progressive; and (3) that system relies heavily on higher earners to raise revenue for government services and means-tested transfers.

3 min read

Making the Tax Cuts and Jobs Act’s individual provisions permanent combined with a carbon tax can be a revenue-neutral trade and increase the long-run size of the economy by 1 percent, making it a sustainable pro-growth option.

23 min read

The House Republican Study Committee released a proposal, “Reclaiming the American Dream,” which includes 118 policy recommendations to address education, labor, and welfare policy with the aim of expanding opportunity, liberty, and free enterprise for all Americans.

7 min read

What does the Senate Republican coronavirus package do? Are there better ways of providing short-run relief without making the tax code more complicated?

6 min read

One of Biden’s tax proposals that has gotten little attention is a change that would shift the benefits of tax deferral in traditional retirement accounts toward lower- and middle-income earners. The plan would reduce the tax benefit for those earning above $80,250 but under $400,000, violating Biden’s tax pledge to not raise taxes on earners below the $400,000 threshold.

5 min read

Biden’s tax vision is twofold: higher taxes on high-income earners and businesses paired with more generous provisions for specific activities and households.

4 min read

Tax credits like the ones approved in the Nebraska bill may help legislators buy some time to work toward a more permanent solution, but they are not, in and of themselves, an effective means of providing lasting relief or generating long-term economic growth.

7 min read