Reviewing Joe Biden’s Tax Vision

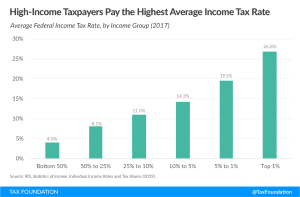

Biden’s tax vision is twofold: higher taxes on high-income earners and businesses paired with more generous provisions for specific activities and households.

4 min read

Biden’s tax vision is twofold: higher taxes on high-income earners and businesses paired with more generous provisions for specific activities and households.

4 min read

Tax credits like the ones approved in the Nebraska bill may help legislators buy some time to work toward a more permanent solution, but they are not, in and of themselves, an effective means of providing lasting relief or generating long-term economic growth.

7 min read

What tax policy ideas did Harris propose along the campaign trail, and how do they differ from Biden’s plan?

4 min read

The LIHTC has subsidized over 3 million housing units since it was established in 1986, the largest source of affordable housing financing.

24 min read