Will the Federal Government Tax Your State Tax Rebate?

If your state issued tax rebates last year, you might have to pay federal income tax on the rebate you received. Maybe. Who knows? Unfortunately, not the IRS—at least not yet.

5 min read

If your state issued tax rebates last year, you might have to pay federal income tax on the rebate you received. Maybe. Who knows? Unfortunately, not the IRS—at least not yet.

5 min read

President Biden’s State of the Union Address outlined three tax proposals, including raising the tax on stock buybacks, imposing a billionaire minimum tax, and expanding the child tax credit.

6 min read

Done responsibly, reducing income tax rates while consolidating brackets would return excess tax collections to taxpayers and promote long-term economic growth in Nebraska.

Forty-three states adopted tax relief in 2021 or 2022—often in both years—and of those, 21 cut state income tax rates. It’s been a remarkable trend, driven by robust state revenues and an increasingly competitive tax environment.

4 min read

At the end of 2022, prices were 14.6 percent higher than they were two years prior. That’s the fastest inflation rate over any two calendar years since the stagflation era of the late 1970s. State policymakers are understandably interested in bringing any tools at their disposal to bear on the problem. And many of them are reaching for tax policy solutions.

7 min read

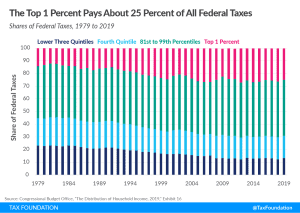

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

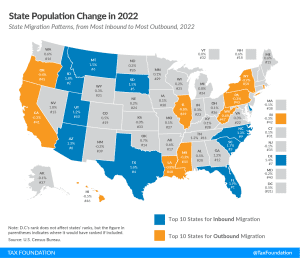

Since 2021, 43 states have provided substantial tax relief for taxpayers and businesses. But this year, a new trend has emerged in the opposite direction: a push for states to tax investment. Jared Walczak joins Jesse to discuss how wealth tax proposals to higher capital gains income taxes would affect investment, job creation, and migration between states—and why they’re happening now.

The FairTax is a proposal to replace all major sources of the federal government’s revenue—the individual income tax, corporate income tax, estate and gift taxes, and payroll tax—with a national sales tax and rebate, abolishing the IRS in the process.

7 min read

West Virginia is one of only seven states that hasn’t offered any significant tax relief since 2021—and five of the other six forgo an individual income tax.

6 min read

By shifting to a flat income tax, Georgia has already made an important commitment to tax competitiveness. Although the state’s top rate threshold is already very low, a true single-rate income tax will help protect taxpayers from inflation-related tax increases and provide a buffer against rising tax rates in the future. To combine responsible rate reductions with these benefits, Georgia should create tax triggers that empower the state to keep pace with its competition.

3 min read

A combination of long-standing IRS operational deficiencies, the agency’s temporary closure due to the pandemic, and the now-expired pandemic relief produced a perfect recipe for a paper backlog.

4 min read

In a coordinated effort, lawmakers in seven states that collectively house about 60 percent of the nation’s wealth—California, Connecticut, Hawaii, Illinois, Maryland, New York, and Washington—are introducing wealth tax legislation on Thursday.

7 min read

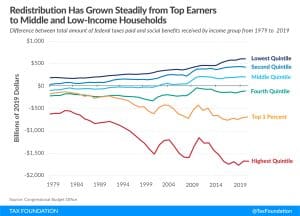

Newly published data from the CBO indicates in 2019, before the onset of the pandemic, American incomes continued to rise as part of a broad economic expansion. It also shows that, contrary to common perceptions, the federal tax system is progressive.

4 min read

The pandemic has accelerated changes to the way we live and work, making it far easier for people to move—and they have. As states work to maintain their competitive advantage, they should pay attention to where people are moving, and try to understand why.

5 min read

Most of the 2023 state tax changes represent net tax reductions, the result of an unprecedented wave of rate reductions and other tax cuts in the past two years as states respond to burgeoning revenues, greater tax competition in an era of enhanced mobility, and the impact of high inflation on residents.

20 min read

Over the long run, tax policies that grow after-tax incomes and the economy do more to boost charitable giving than policies that try to incentivize people to be charitable.

9 min read

New CBO data shows that the current U.S. fiscal system—both taxes and direct federal benefits—is very progressive and very redistributive.

7 min read

As Chile looks to the future, the accelerated deductions for capital investment costs should be extended and made permanent while unnecessary tax hikes on individuals and capital should be avoided. Policymakers should focus on growth-oriented tax policy that encourages investment, savings, and entrepreneurial activity, increasing Chile’s international tax competitiveness.

4 min read