Doing Tax Policy at the Ballot Is Not for the Faint of Heart

Some tax ballot initiatives will be straightforward, some will be complex, and—let’s be honest—some will be a drafting nightmare.

5 min read

Some tax ballot initiatives will be straightforward, some will be complex, and—let’s be honest—some will be a drafting nightmare.

5 min read

Massachusetts’ competitive tax advantage in New England is driven primarily by its competitive individual income tax rate and its sales and use tax structure. If the Commonwealth changes its tax code in ways that narrow the base or increase the rate, it cedes greater tax competitiveness to other states, regionally and nationally.

34 min read

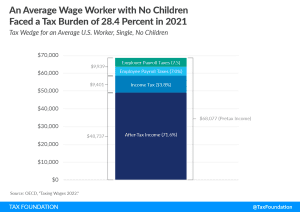

If ever there was a paycheck protection program, defending people from bracket creep may be the most important one ever designed.

6 min read

In an already-challenging economic environment, new UK Prime Minister Liz Truss must get tax rates correct to avoid over-burdening a population and business sector facing immense uncertainty. Focusing only on rates while ignoring the base misses an opportunity for real, pro-growth reform.

4 min read

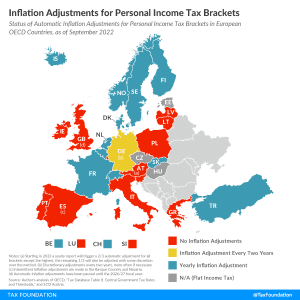

With continued concerns over inflation, individuals may be wondering how their tax bills will be impacted. Less than half of OECD countries in Europe automatically adjust income tax brackets for inflation every year.

3 min read

As Idaho attempts to further solidify its position as a growth-oriented, taxpayer-friendly state this special session, other states should look to its example and pursue similar reforms.

6 min read

Every change to a state’s tax system makes its business tax climate more or less competitive compared to other states and makes the state more or less attractive to business.

7 min read

As Missouri legislators head into a special session, they should consider making a pro-growth change that the state is already so close to achieving: creating a flat income tax.

4 min read

The mix of tax sources states choose can have important implications for both revenue stability and economic growth, and the many variations across states are indicative of the different ways states weigh competing policy goals.

29 min read

Arkansas recently became the 13th state to authorize an individual income tax rate reduction this year. This round of tax cuts accelerated reforms enacted eight months ago.

7 min read

The Japanese tax and benefit system comes with trade-offs that policymakers must keep in mind when planning to reform the tax policy.

7 min read

While the tax and benefit system can be successful in keeping low-income working households out of poverty and encouraging workforce participation, high marginal tax rates like the one observed in the case of this Australian working parent act as barriers to upward mobility.

6 min read

Expediting income tax rate reductions and indexing major income tax provisions for inflation are two of the most important tax policy changes policymakers could make to provide meaningful tax relief to Hoosiers both now and in the years to come.

4 min read

Canadian workers could face up to two important marginal tax rate spikes and lose 60 percent of additional earnings to the provincial health-care premium.

4 min read

Some 40 years ago, the U.S. dealt with high inflation and slow economic growth. Then as now, the solution is a long-term focus on stronger economic growth and sustainable federal budgets.

5 min read

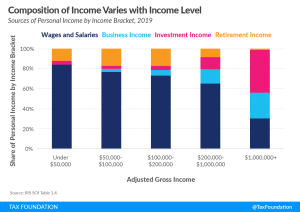

Reviewing reported income helps to understand the composition of the federal government’s revenue base and how Americans earn their taxable income. The individual income tax, the federal government’s largest source of revenue, is largely a tax on labor.

10 min read

Reshaping some of these policies to generate a smoother variation of marginal tax rates over different income levels would likely raise labor supply and encourage the upward mobility of workers and especially that of average-income workers.

5 min read