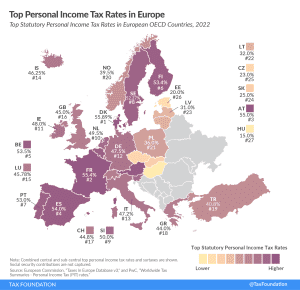

Top Personal Income Tax Rates in Europe, 2023

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

2 min read

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

2 min read

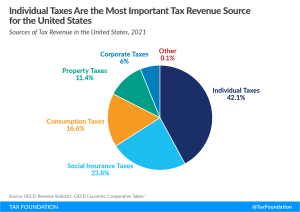

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

4 min read

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

5 min read

Most states avoid municipal income taxes for good reason. These taxes are more volatile and less economically competitive than other forms of taxation available to local governments, and add substantial complexity for governments and taxpayers alike.

23 min read

Levied in thousands of cities, counties, school districts, and other localities, local income taxes are often used to either lower other taxes (like property taxes) or raise more revenue for local services. While they may make sense on paper, local income taxes come with more challenges than other local revenue sources.

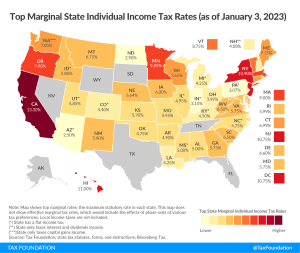

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections:

9 min read

Immediately balancing the $20 trillion budget shortfall would take drastic, unwanted policy changes. Instead, lawmakers should target a more achievable goal, such as stabilizing debt and deficits with an eye toward comprehensive tax reform that can produce sufficient revenue with minimal economic harm.

4 min read

While hoping for inflation’s continued decline, policymakers should finish the job and index the tax code to prepare for future bouts of high inflation and as a contingency in case it takes longer to defeat elevated inflation than expected.

4 min read

Despite robust revenues, some state lawmakers are champing at the bit to raise taxes on higher-income households, sometimes to extraordinary levels.

7 min read

When peeling back layers of the JCT report, it becomes clear that many tax expenditures are not “loopholes” or benefits for narrow special interests, but important structural elements of the tax code.

6 min read

President Biden shared his policy aspirations during the State of the Union address, outlining three tax proposals in his remarks: quadrupling the brand-new excise tax on stock buybacks, instituting a “billionaire minimum tax,” and extending the now-lapsed expanded Child Tax Credit. We discuss the prospects of major tax changes becoming law in a divided government and what these proposals signal about how President Biden thinks about tax policy as he enters the latter half of his first term.

If your state issued tax rebates last year, you might have to pay federal income tax on the rebate you received. Maybe. Who knows? Unfortunately, not the IRS—at least not yet.

5 min read

President Biden’s State of the Union Address outlined three tax proposals, including raising the tax on stock buybacks, imposing a billionaire minimum tax, and expanding the child tax credit.

6 min read

Done responsibly, reducing income tax rates while consolidating brackets would return excess tax collections to taxpayers and promote long-term economic growth in Nebraska.

Forty-three states adopted tax relief in 2021 or 2022—often in both years—and of those, 21 cut state income tax rates. It’s been a remarkable trend, driven by robust state revenues and an increasingly competitive tax environment.

4 min read

At the end of 2022, prices were 14.6 percent higher than they were two years prior. That’s the fastest inflation rate over any two calendar years since the stagflation era of the late 1970s. State policymakers are understandably interested in bringing any tools at their disposal to bear on the problem. And many of them are reaching for tax policy solutions.

7 min read

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

Since 2021, 43 states have provided substantial tax relief for taxpayers and businesses. But this year, a new trend has emerged in the opposite direction: a push for states to tax investment. Jared Walczak joins Jesse to discuss how wealth tax proposals to higher capital gains income taxes would affect investment, job creation, and migration between states—and why they’re happening now.

The FairTax is a proposal to replace all major sources of the federal government’s revenue—the individual income tax, corporate income tax, estate and gift taxes, and payroll tax—with a national sales tax and rebate, abolishing the IRS in the process.

7 min read

West Virginia is one of only seven states that hasn’t offered any significant tax relief since 2021—and five of the other six forgo an individual income tax.

6 min read