All Related Articles

2024 State Business Tax Climate Index

In recognition of the fact that there are better and worse ways to raise revenue, our Index focuses on how state tax revenue is raised, not how much. The rankings, therefore, reflect how well states structure their tax systems.

111 min read

Testimony: Considerations for Improving Indiana’s Tax Structure and Competitiveness

Indiana’s tax code is structured in a relatively sound and economically efficient manner overall, but additional improvements should be considered to make the state even more economically competitive.

International Tax Competitiveness Index 2023

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

88 min read

Most Successful Fiscal Consolidations Do Not Rely Solely on Tax Hikes

If tax increases are included in a package, international experience points toward raising consumption taxes, rationalizing tax expenditures, and broadening the tax base—not hiking income taxes.

6 min read

Federal Deficit Grew to $2 Trillion in FY 2023

Outside of the pandemic years, this year’s federal deficit is the highest in U.S. history. While tax revenue has increased about 28 percent since the pre-pandemic year 2019, spending has increased about 46 percent. Annual deficits are headed towards $3 trillion over the next few years.

3 min read

How Taxing Consumption Would Improve Long-Term Opportunity and Well-Being for Families and Children

Income taxes impose steeper economic costs, and often steeper administrative and compliance costs, than consumption taxes. Moving to a consumption tax would end the tax bias against saving and investment and provide an opportunity to greatly simplify anti-poverty programs embedded in the tax code.

45 min read

Nikki Haley’s Plan to Eliminate the Federal Gas Tax Would Be a Mistake

At the most recent Republican primary debate, former governor and United Nations ambassador Nikki Haley (R-SC) proposed eliminating the federal gas tax to lower fuel prices for consumers.

3 min read

The Warning Signs Are Flashing Red on US Debt

Bond markets are screaming for a return to deficit reduction politics. Unfortunately, most policymakers are failing to listen to what the markets are telling them.

The Future of Arkansas Tax Reform: Next Steps on the Road Map to Competitiveness

Responsible pro-growth reforms to Arkansas’s tax code can help ensure that the Natural State is indeed a Land of Opportunity.

9 min read

2023 Spanish Regional Tax Competitiveness Index

The 2023 Spanish Regional Tax Competitiveness Index allows policymakers and taxpayers to evaluate and measure how their regions’ tax systems compare.

6 min read

Tax Trends in European Countries

In recent years, European countries have undertaken a series of tax reforms designed to maintain tax revenue levels while protecting households and businesses from high inflation.

8 min read

Labor Share of Net Income is Within Its Historical Range

As increased political attention focuses on the state of the American worker, expect to see a resurgence of the argument that the labor share of income is in decline.

5 min read

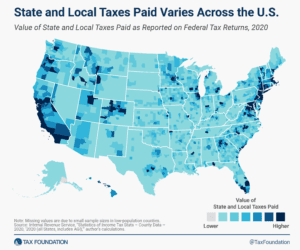

County Data Shows Repealing SALT Cap Would Benefit High-Income Earners

Any move to repeal the cap or enhance the deduction would disproportionately benefit higher earners, making the tax code more regressive.

5 min read

How to Rein in the National Debt

Now is the time for lawmakers to focus on long-term fiscal sustainability, as further delay will only make an eventual fiscal reckoning that much harder and more painful. Congressional leaders should follow through on convening a fiscal commission to deal with the long-term budgetary challenges facing the country.

35 min read

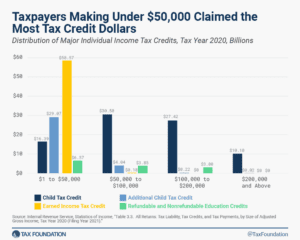

Summary of the Tax Credits Claimed on the Form 1040, Tax Year 2020

In tax year 2020, taxpayers claimed more than 159 million tax credits on their individual income tax returns worth a total of more than $277 billion. That was an increase of $35.3 billion from tax year 2019, largely due to an influx of pandemic relief administered through the tax code in 2020.

6 min read

Inconsistent Tax Treatment of Student Loan Debt Forgiveness Creates Confusion

Starting on September 1st, federal student loan payments will resume after a three-and-a-half-year pause on payments and accrued interest following the onset of the COVID-19 pandemic.

6 min read

The Wealth Tax Discussion Is Back

Given that wealth taxes collect little revenue and have the potential to disincentivize entrepreneurship and investment, perhaps European countries should repeal them rather than implement one across the continent.

4 min read

From Temples to Tax Forms—Indiana Jones’s Guide to Taxing Treasures

As fans around the world anticipate the final adventure of Indiana Jones, let’s embark on our own excursion to unravel the mysteries of taxing treasure.

3 min read

A Tax Reform Plan for Growth and Opportunity: Details & Analysis

This tax reform plan would boost long-run GDP by 2.5%, grow wages by 1.4%, and add 1.3M jobs, all while collecting a similar amount of tax revenue as the current code and reducing the long-run debt burden.

38 min read