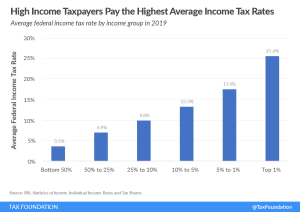

Summary of the Latest Federal Income Tax Data, 2023 Update

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

When we discuss tax policy, the conversation inevitably turns to who pays, who should pay, and how much they should pay. Unfortunately, the tax burdens debate is often missing a key point: how income transfer programs—like Social Security or Medicaid—affect households’ tax burdens.

Tax burdens rose across the country as pandemic-era economic changes caused taxable income, activities, and property values to rise faster than net national product. Tax burdens in 2020, 2021, and 2022 are all higher than in any other year since 1978.

24 min read

If ever there was a paycheck protection program, defending people from bracket creep may be the most important one ever designed.

6 min read

As Idaho attempts to further solidify its position as a growth-oriented, taxpayer-friendly state this special session, other states should look to its example and pursue similar reforms.

6 min read

Some 40 years ago, the U.S. dealt with high inflation and slow economic growth. Then as now, the solution is a long-term focus on stronger economic growth and sustainable federal budgets.

5 min read

Idaho Ballot initiative would impose an incredibly high top marginal rate that would fall on many small businesses, not just high-income earners.

7 min read

Given the state’s strong budget surplus and projected continued revenue growth, Wisconsin is in a prime position to enact pro-growth reforms to improve the state’s competitive standing for decades to come.

54 min read

The proposals share a common goal of improving incentives for households to save during a time when inflation is impacting their finances.

3 min read

Research almost invariably shows a negative relationship between income tax rates and gross domestic product (GDP). Cuts to marginal tax rates are highly correlated with decreases in the unemployment rate.

26 min read

The United States needs to grow its way out of inflation and set the economy up for continued growth—the tax code provides tools for policymakers to do just that.

3 min read

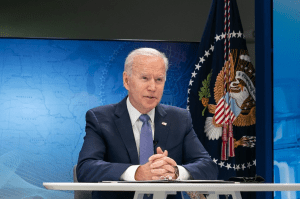

President Biden’s budget proposes several new tax increases on high-income individuals and businesses, which combined with the Build Back Better plan would give the U.S. the highest top tax rates on individual and corporate income in the developed world.

5 min read

Arizona now joins a growing cohort of states that are moving toward a flat income tax. Pending revenue triggers, the income tax rate will be reduced to 2.5 percent giving Arizona one of the lowest individual income tax rates in the country.

7 min read

As part of President Biden’s proposed budget for fiscal year 2023, the White House has once again endorsed a major tax increase on accumulated wealth, adding up to a 61 percent tax on wealth of high-earning taxpayers.

4 min read

In a letter to lawmakers, the 46th President said that his $5.8 trillion budget package would “[grow] our economy, while ensuring that the wealthiest Americans and the biggest corporations begin to pay their fair share.” We break down what the President is proposing for this upcoming fiscal year and what its impact would be on the U.S. economy in the face of record-high inflation.

After a whirlwind of cuts and reforms in 2021, it looks like 2022 might be an even bigger year for state tax codes. Republican and Democratic governors alike used their annual State of the State addresses to call for tax reform, and there is already serious momentum from state lawmakers nationwide to get the job done.

3 min read

Even if 2022 sees many tax reforms, the scope of Iowa’s tax relief measures is likely to stand out. With the most recent reform package, Iowa lawmakers have made a significant investment in a more competitive tax climate for an increasingly competitive era.

6 min read

In a time of increased mobility and tax competition, a lower rate and simpler tax structure would help Georgia stand out among states. Lawmakers would be wise to consider reforming the state’s income tax to improve the state’s competitiveness.

3 min read

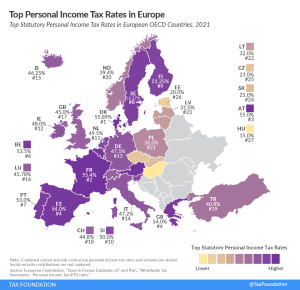

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

2 min read