Summary of the Latest Federal Income Tax Data, 2023 Update

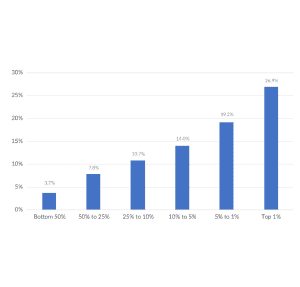

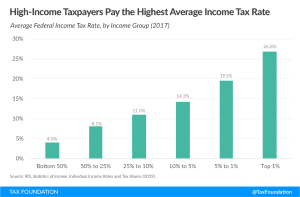

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

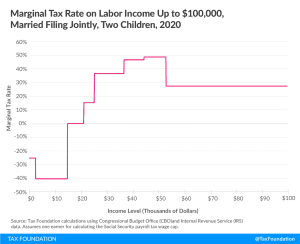

When we discuss tax policy, the conversation inevitably turns to who pays, who should pay, and how much they should pay. Unfortunately, the tax burdens debate is often missing a key point: how income transfer programs—like Social Security or Medicaid—affect households’ tax burdens.

Tax burdens rose across the country as pandemic-era economic changes caused taxable income, activities, and property values to rise faster than net national product. Tax burdens in 2020, 2021, and 2022 are all higher than in any other year since 1978.

24 min read

While it is important that Peru find ways to offset its deficit spending, a temporary wealth tax may introduce more problems than it solves.

5 min read

Identify some of the most common tax myths and tax policy misconceptions and learn how to separate fact from fiction. Discover why tax refunds shouldn’t be celebrated, why you should pay your income tax bill, and why certain deductions are wrongly labeled “loopholes,” among other useful facts. Improve your ability to counter misleading arguments about the tax code.

Joe Biden and Bernie Sanders have each proposed changes to the individual income tax, one of the largest sources of federal revenue. Our new analysis compares the economic, revenue, and distributional effects of the various proposals.

13 min read

New modeling finds that the wealth taxes proposed by Sen. Warren and Sen. Sanders would raise significantly less revenue than promised, face serious administrative and compliance challenges, and would increase foreign ownership of U.S. capital.

38 min read

A low wealth tax rate is equivalent to a high-rate income tax. The interaction between wealth taxes and the existing income taxes must be considered when analyzing a wealth tax plan.

6 min read

Deadweight loss effects demonstrate why policymakers should pursue a more efficient tax code to achieve distributional objectives, rather than pursuing high tax rates that create disproportionately high economic costs.

4 min read