Summary of the Latest Federal Income Tax Data, 2023 Update

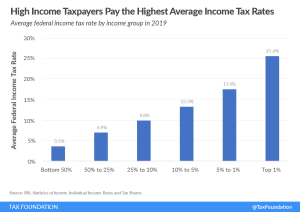

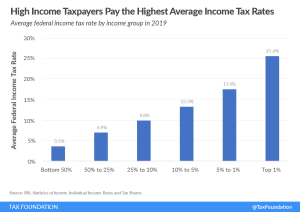

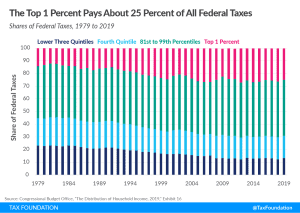

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

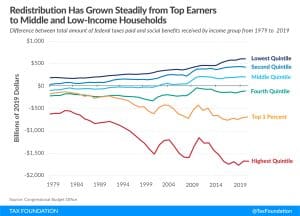

When we discuss tax policy, the conversation inevitably turns to who pays, who should pay, and how much they should pay. Unfortunately, the tax burdens debate is often missing a key point: how income transfer programs—like Social Security or Medicaid—affect households’ tax burdens.

Tax burdens rose across the country as pandemic-era economic changes caused taxable income, activities, and property values to rise faster than net national product. Tax burdens in 2020, 2021, and 2022 are all higher than in any other year since 1978.

24 min read

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

Since 2021, 43 states have provided substantial tax relief for taxpayers and businesses. But this year, a new trend has emerged in the opposite direction: a push for states to tax investment. Jared Walczak joins Jesse to discuss how wealth tax proposals to higher capital gains income taxes would affect investment, job creation, and migration between states—and why they’re happening now.

In a coordinated effort, lawmakers in seven states that collectively house about 60 percent of the nation’s wealth—California, Connecticut, Hawaii, Illinois, Maryland, New York, and Washington—are introducing wealth tax legislation on Thursday.

7 min read

Newly published data from the CBO indicates in 2019, before the onset of the pandemic, American incomes continued to rise as part of a broad economic expansion. It also shows that, contrary to common perceptions, the federal tax system is progressive.

4 min read

Most of the 2023 state tax changes represent net tax reductions, the result of an unprecedented wave of rate reductions and other tax cuts in the past two years as states respond to burgeoning revenues, greater tax competition in an era of enhanced mobility, and the impact of high inflation on residents.

20 min read

New CBO data shows that the current U.S. fiscal system—both taxes and direct federal benefits—is very progressive and very redistributive.

7 min read

Europe is facing difficult times. Governments are balancing the need for more resources with the need to maintain peace and prosperity domestically. To properly strike this balance, EU policymakers must incorporate “Fiscal Fairness” into the debate.

2 min read

On Election Day, a narrow majority of Massachusetts voters approved Question 1, also known as the Fair Share Amendment, which will transition the Commonwealth from a flat rate individual income tax to a graduated rate system.

7 min read

While supporters of the federal estate tax may be correct that only a fraction of estate tax returns eventually pays the estate tax, IRS data shows that it disproportionately impacts estates tied to successful privately owned businesses. Thus, it acts as a second or third layer of federal tax on these successful businesses over the owners’ lifetime.

9 min read

From income tax changes to cannabis legalization and taxation, here’s what voters decided on Election Day.

6 min read

When Coloradans go to the polls this November, they will be given the opportunity to permanently lower their income taxes—or to increase those tax burdens.

4 min read

The IRS recently released the new inflation adjusted 2023 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the annual exclusion for gifts.

4 min read

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

41 min read

California is no stranger to high taxes, and the state has enough going for it that its economy can withstand higher tax burdens than would be viable in other parts of the country. But there’s always a tipping point.

6 min read

President Biden proposed a 7-point hike in the corporate tax rate to 28 percent, a new minimum book tax on corporate profits, and higher taxes on international activity. We estimated these proposals would reduce the size of the economy (GDP) by 1.6 percent over the long run and eliminate 542,000 jobs.

6 min read

When NFL star wide receiver Tyreek Hill weighed offers from the New York Jets and the Miami Dolphins, no doubt there was a lot on his mind. But one consideration towered over the rest, at least according to Hill himself: signing with the Jets “was very close to happening,” but “those state taxes man. I had to make a grown-up decision.”

7 min read

While there is more we can do to encourage lower- and middle-class households to save more and build wealth, a closer, more comprehensive look at the data and trends in other countries suggests that America’s wealth gap is not as alarming as some may think.

5 min read

Massachusetts’ competitive tax advantage in New England is driven primarily by its competitive individual income tax rate and its sales and use tax structure. If the Commonwealth changes its tax code in ways that narrow the base or increase the rate, it cedes greater tax competitiveness to other states, regionally and nationally.

34 min read

If ever there was a paycheck protection program, defending people from bracket creep may be the most important one ever designed.

6 min read