Summary of the Latest Federal Income Tax Data, 2023 Update

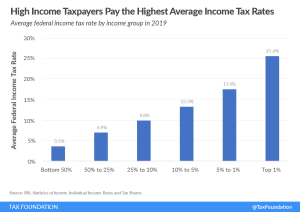

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

When we discuss tax policy, the conversation inevitably turns to who pays, who should pay, and how much they should pay. Unfortunately, the tax burdens debate is often missing a key point: how income transfer programs—like Social Security or Medicaid—affect households’ tax burdens.

Tax burdens rose across the country as pandemic-era economic changes caused taxable income, activities, and property values to rise faster than net national product. Tax burdens in 2020, 2021, and 2022 are all higher than in any other year since 1978.

24 min read

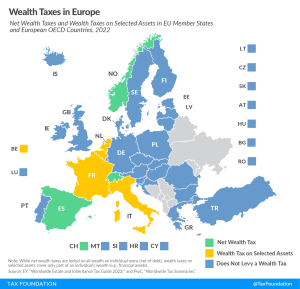

Instead of reforming and hiking the wealth tax, perhaps policymakers should consider whether the tax is serving its intended objectives, and, if not, consider repealing the tax altogether.

4 min read

If Wisconsin policymakers return some of the projected continued revenue growth to taxpayers in a structurally sound and pro-growth manner, those tax cuts will benefit businesses and individuals throughout the state, leading to more innovation, more job and wage growth, more economic opportunities, and more vibrant communities.

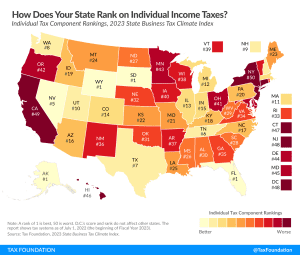

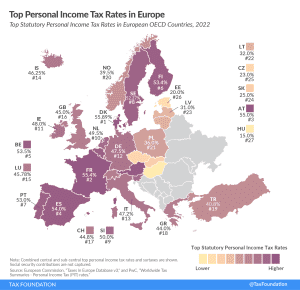

Individual income tax rates can influence location decision-making, especially in an era of enhanced mobility, where it is easier for individuals to move without jeopardizing their current job, or without limiting the scope of their search for a new one.

5 min read

As policymakers in St. Paul finalize this year’s tax bill, they should avoid policies that incentivize the diversion or relocation of capital. Importantly, states do not institute tax policy in a vacuum. The evidence from states’ experiences and the academic literature supports the conclusion that tax competitiveness matters not just to businesses but to human flourishing.

15 min read

Scandinavian countries are well known for their broad social safety net and their public funding of services such as universal health care, higher education, parental leave, and child and elderly care. So how do Scandinavian countries raise their tax revenues?

7 min read

While the IRS hopes to increase revenue collection and minimize additional burdens on taxpayers, uncertainty remains regarding its ability to deliver, particularly on the latter. Furthermore, some concerns about the original funding package are already surfacing, specifically around insufficient funding for taxpayer services.

6 min read

The Portuguese government has introduced plans to exempt “essential” food items from its value-added tax (VAT) in response to the recent inflation spike. While this may sound like a reasonable measure on the surface, it comes with numerous unintended consequences that compromise its effectiveness.

4 min read

Spain should follow the examples of Italy and the UK and enact tax reforms that have the potential to stimulate economic activity by supporting private investment while increasing its international tax competitiveness.

7 min read

When designed well, excise taxes discourage the consumption of products that create external harm and generate revenue for funding services that ameliorate social costs. The effectiveness of excise tax policy depends on the appropriate selection of the tax base and tax rate, as well as the efficient use of revenues.

83 min read

The overall U.S. tax and transfer system is overwhelmingly progressive, and understanding the extent—and source—of that progressivity is essential for lawmakers considering the trade-offs associated with each tax policy decision.

23 min read

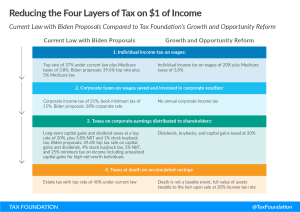

According to our analysis, President Biden’s budget would reduce long-run economic output by about 1.3 percent and eliminate 335,000 FTE jobs. See what tax policies the president is proposing.

17 min read

The White House says this budget will reduce the deficit, strengthen Medicare, and will only target the well-off. But are those claims true? Erica York, senior economist, walks through the details with Jesse. They discuss what the economic impact of this budget would be and what parts stand a chance at actually becoming law.

Adopting the sound tax reforms still pending in Santa Fe is an opportunity for New Mexico to keep up with the pack or risk falling further behind.

7 min read

The proposed reforms would be welcome changes to the Commonwealth’s tax code, but the economic principles behind the reforms also have important implications for the Bay State’s income tax system writ large.

6 min read

Tax reform should be about increasing fairness. And the way to get there is by reducing complexity and double taxation, not by doubling down on them.

6 min read

As Kansas legislators consider additional tax policy changes this legislative session, they should prioritize economic growth and a structurally sound tax code.

7 min read

President Biden’s new budget proposal outlines several major tax increases targeted at businesses and high-income individuals that would bring U.S. income tax rates far out of step with international norms.

7 min read

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

2 min read

Despite robust revenues, some state lawmakers are champing at the bit to raise taxes on higher-income households, sometimes to extraordinary levels.

7 min read