Public Funding for Sports Stadiums Just Doesn’t Pay off for Taxpayers

The long-term value of these projects to the broader public remains highly debatable.

Our dedicated excise tax experts, Adam Hoffer and Jacob Macumber-Rosin, provide leading tax policy research, analysis, and commentary of the latest proposals and trends related to excise taxes. Explore the vast and changing world of excise taxation.

The long-term value of these projects to the broader public remains highly debatable.

We estimate Trump’s proposed tariffs and partial retaliation from all trading partners would together offset more than two-thirds of the long-run economic benefit of his proposed tax cuts.

12 min read

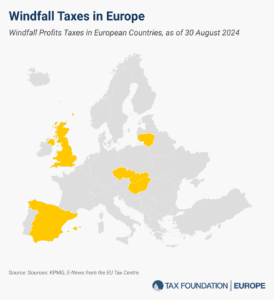

Spain’s central government is considering making its windfall taxes on energy companies and the banking sector permanent.

6 min read

While federal tax collections—especially corporate taxes—have reached historically high levels, these gains have not kept pace with escalating spending, particularly on debt interest, leading to a substantial and concerning budget deficit in FY24.

6 min read

As the geopolitical scene continues to change, policymakers in Europe should focus on lowering effective marginal tax rates to drive much-needed investment and long-term economic growth.

6 min read

The Brazilian government is poised to make the biggest change to its alcohol tax policy in recent history.

6 min read

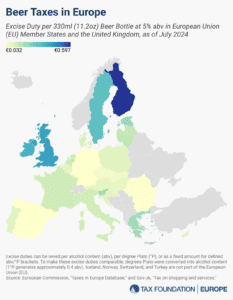

As Oktoberfest celebrations wrap up across the continent, now is a great time to examine beer taxes in the European Union. Hefty beer taxes add to the price of every drink consumed.

5 min read

Due to the peculiar design of the proposed tax increase, it’s true: the largest tax increase Oregon has ever seen would create a substantial budget shortfall.

8 min read

Especially for a state that relies so heavily on the sales tax as a source of revenue—and where most people want to keep it that way—a broad base and a low rate is crucial.

5 min read

Focusing on competitiveness, neutrality, and efficient policies to raise revenue would go a long way in increasing economic growth and stabilizing public finances over the long term.

7 min read

Sports stadium subsidies are salient political gimmicks designed to appear as if politicians are providing tangible benefits to taxpayers. The empirical evidence shows repeatedly that stadium subsidies fail to generate new tax revenue and new jobs or attract new businesses.

6 min read

Using tariff policy to reallocate investment and jobs is a costly mistake—that’s a history lesson we should not forget.

6 min read

The Department of Justice (DOJ) recently announced that it would move to reschedule marijuana. This move doesn’t do as much for legal cannabis sales as proposed federal legislation like the States 2.0 Act, but rescheduling cannabis has major ramifications for cannabis businesses.

4 min read

Estimating the economic effects of different types of taxes informs policymakers about the trade-offs of raising revenue in a given way.

5 min read

Growing levels of waste and pollution, paired with increasing burdens on taxpayers to address environmental problems, have spurned policymakers in the US and abroad to encourage producers to be responsible, either financially or operationally, for the end-life of their products.

34 min read

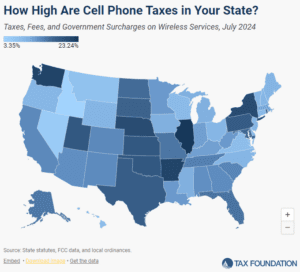

Wireless taxes and fees set a new record high in 2024.

23 min read

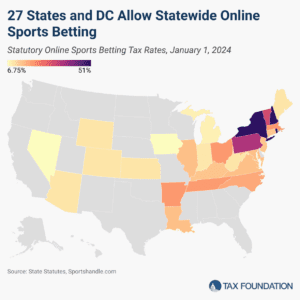

Legal sports betting has grown rapidly since the Supreme Court granted states the ability to establish online sports betting markets in Murphy vs. NCAA in 2018.

3 min read

The stakes for next year’s expiring tax provisions are quite high. If Congress does nothing, then 62 percent of households will see their taxes go up in January of 2026.

Taxes are on the ballot this November—not just in the sense that candidates at all levels are offering their visions for tax policy, but also in the literal sense that voters in some states will get to decide important questions about how their states raise revenue.

9 min read

The flawed design of these windfall profits taxes has created problems in countries that implemented them.

4 min read